Small traders keep up their record speculative buying binge

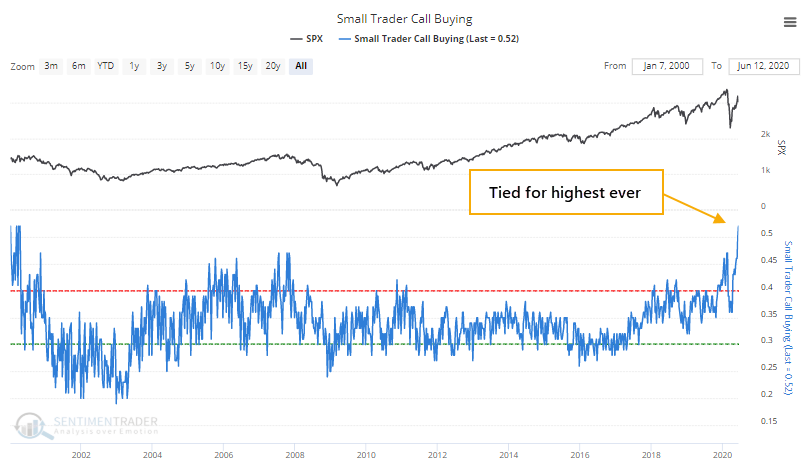

Over the past few weeks, we've looked at the high and increasing amount of speculative activity among options traders, particularly the smallest of them that transact 10 contracts or less.

As stocks rose 3% or more each week, it was kinda-sorta understandable. But last week, stocks suffered high volatility and a big decline on Thursday, coupled with a mostly-failed rally attempt on Friday. That did not put off speculative traders - in fact, it emboldened them.

Using relative percentages, small traders spent 52% of their volume on buying call options to open. This is a record high, tied with the most extreme weeks in 2000.

Speculation wasn't rampant only among the smallest of traders. Even the largest of them, trading 50 or more contracts at a time, focused to a near-record degree on speculative calls.

Maybe the legions of new traders have spawned some kind of perverse front-running scheme among hedge funds, which are breaking their trades into tiny pieces and skewing this data. That's doubtful. More likely, it's a hoard of new traders stuck at home who have seen stocks only go up for months on end. This has never ended well and remains a large risk over the short- to medium-term.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A more in-depth look at options trader behavior, especially among the smallest of traders

- The S&P 500 suffered a negative outside reversal week...and also a positive intraday reversal on Monday

- What happens to stocks, volatility, the dollar, and gold after economic surprises show a positive surge

- Optimism on tech stocks is sky high

- Our AIM Model has moved back to neutral territory

- S&P 500 and Nasdaq 100 stocks are seeing a record number of MACD sell signals