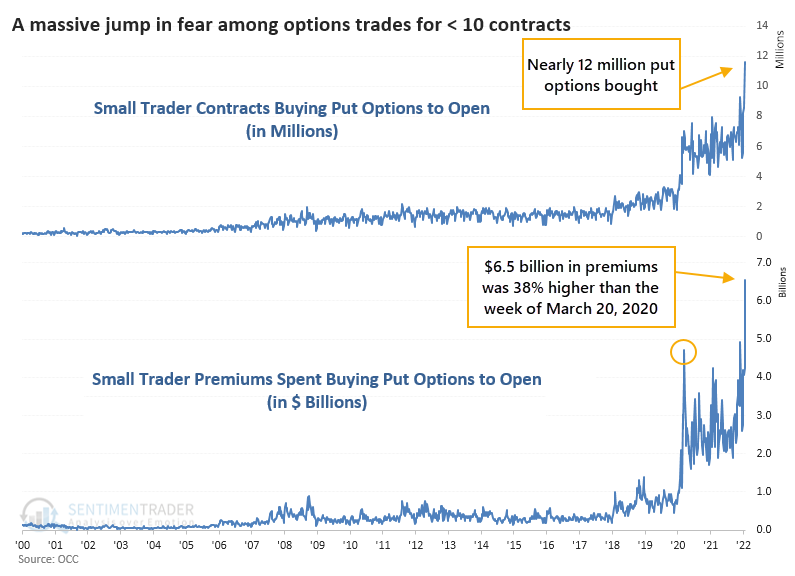

Small traders are panicking to a record degree

Small traders are showing record levels of panic

Last week saw some of the most volatile price action in 2 years, a barrage of nasty headlines, and a cutting in half of a near-majority of stocks on the Nasdaq.

It was enough to trigger panic among the most leveraged traders in the market.

Small options traders bought to open nearly 12 million put options last week, spending $6.5 billion for the privilege of protecting their portfolios. That's a remarkable jump in trades meant to hedge against further losses. It's 40% higher than even the worst week during the March 2020 meltdown.

Of course, this only shows one side. If they also bought a tremendous number of speculative call options or sold a bunch of put options betting that declines would be limited, then it doesn't mean a whole lot.

As a percentage of all opening option trades, small traders spent 29% of their volume on buying put options. When we look at the amount of money small traders spent on put options relative to calls, it's now the highest since April 2020.

| Stat box Traders pulled more than $6.5 billion from the SPY S&P 500 fund on Monday, the 8th-largest outflow of the last decade. After the 7 other largest outflows, SPY rallied over the next 2 weeks 6 times. |

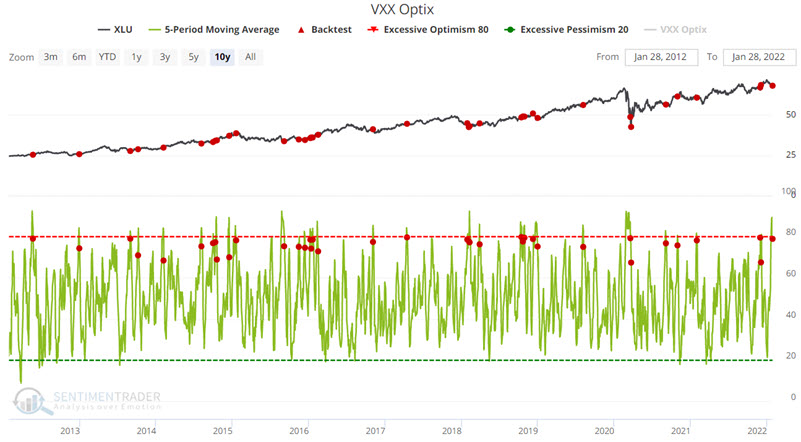

Using Utilities as an anti-VIX proxy

Jay noted that VXX (iPath S&P 500 VIX Short-Term Futures ETN ) is an exchange-traded note designed to track the performance of short-term VIX futures. Because of its construction, its price ultimately trends towards zero (which makes it an odd trading vehicle), except during those brief periods when the VIX Index spikes to sharply higher levels.

Of course, human nature being what it is, when volatility does spike, higher investor sentiment regarding the expectation of even higher volatility also tends to spike. And then, just as inevitably, it tends to reverse quickly.

But instead of trying to trade a VIX product, an alternative would be a defensive sector like Utilities. The chart below displays ticker XLU and those days when the 5-day average for our VXX Optimism Index dropped below 80.

Of particular interest is the 81% Win Rate 1 month later. In a nutshell, the idea is that instead of shorting highly volatile shares of VXX - or selling options - a trader might consider buying shares of XLU instead.