Small traders are buying call options...and puts, too

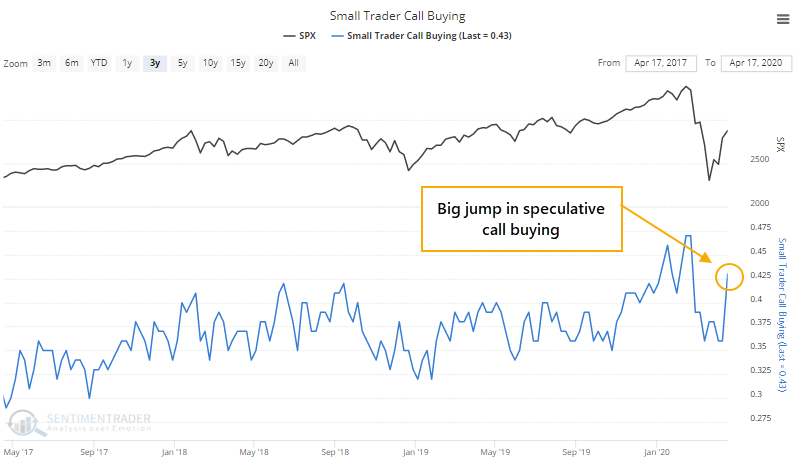

Last week, the smallest of options traders appeared to get a lot more optimistic than they've been in weeks. After paring down their speculative call buying in March, they ramped it back up again last week, spending more than 42% of their total volume on buying call options to open. That's among the most in years.

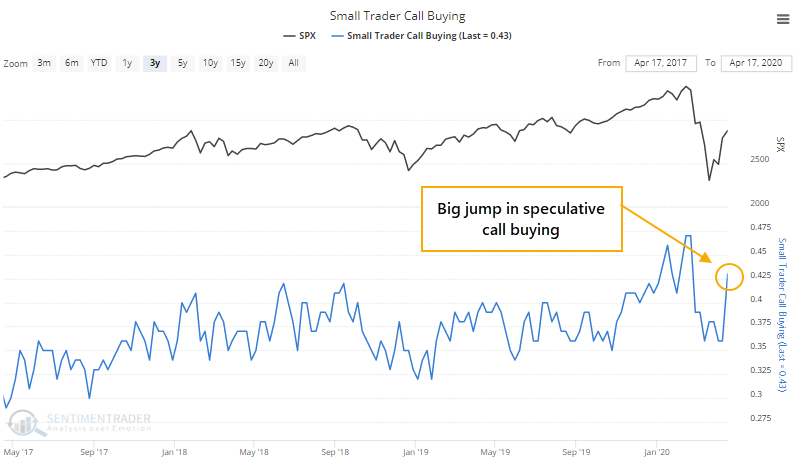

If we zoom out and look at the past 15 years, then we can see that it's still among the most aggressive weeks.

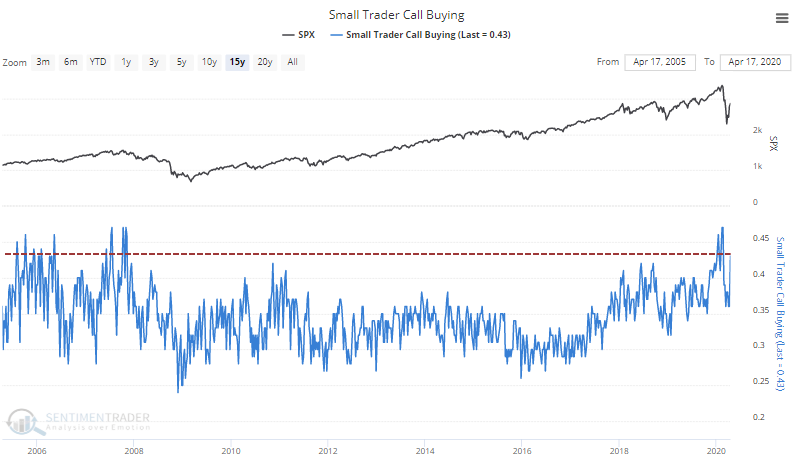

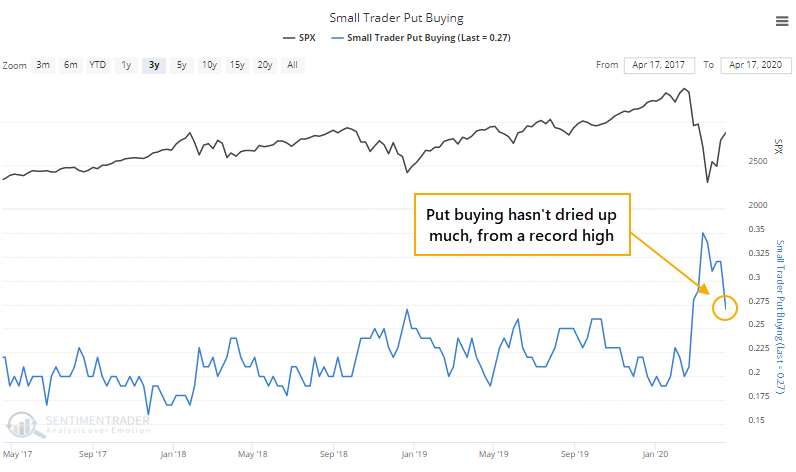

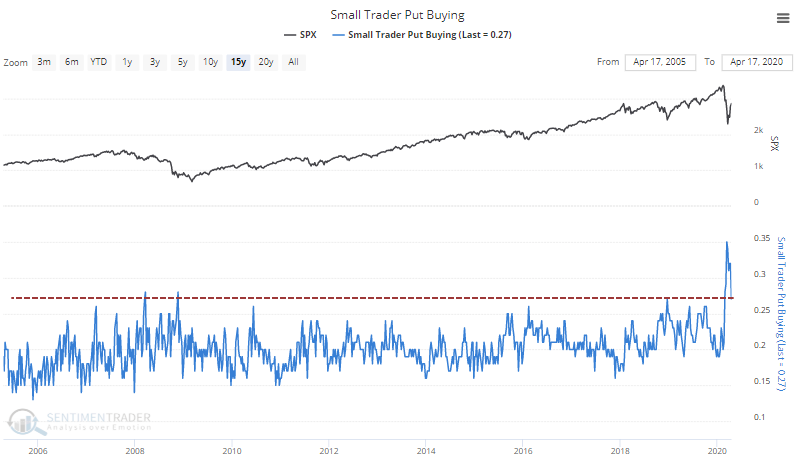

The odd thing is that they're buying a lot of protective put options, too. They spent more than 35% of their volume on buying puts near the bottom, a record amount, and have since pulled back on that strategy, but not as much as we might expect.

Zooming out over the past 15 years, we can see that the current pace of put buying is still above some of the biggest weeks ever.

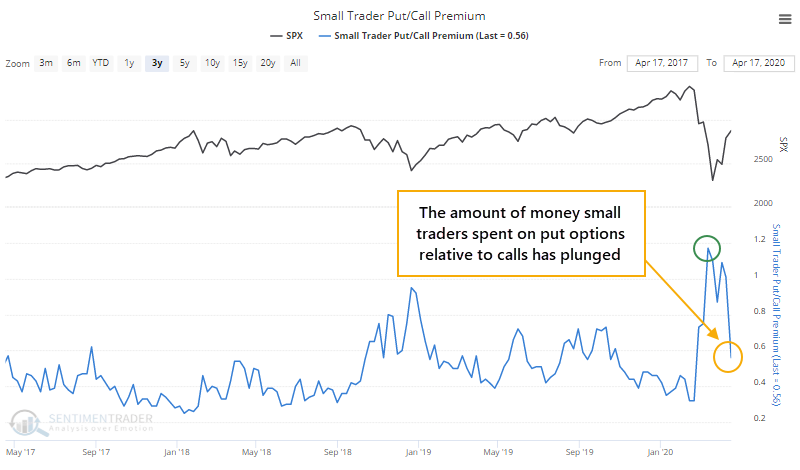

That sends a mixed message - small traders are buying a lot of calls and puts at the same time. That means they're spending less on selling options to open, which is a trend that's been in place for a decade.

If we look at the amount of money these traders are spending on their put and call premiums, then we can see that it spiked as they panicked in March, and has since receded to a neutral level.

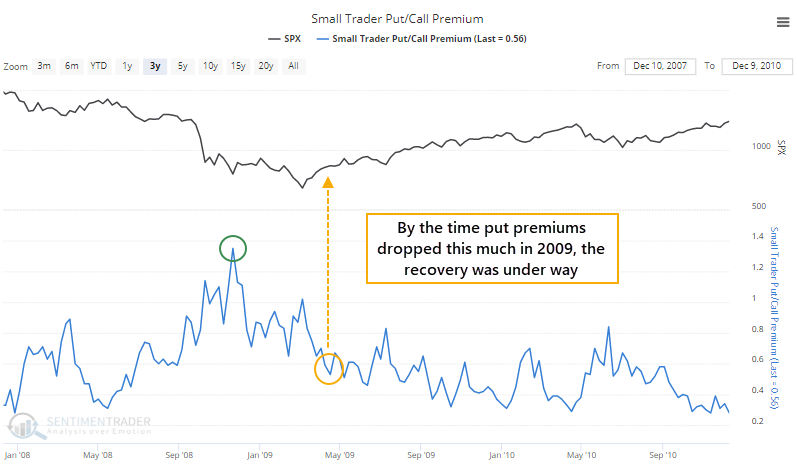

By the time we saw something similar in 2008, the real recovery was underway.

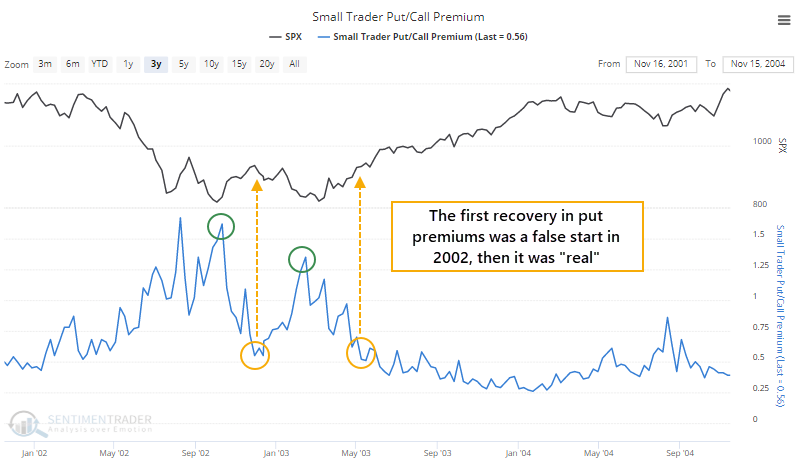

In 2002, these traders jumped the gun in the fall of 2002, assuming the worst was behind them. It was, but they still scrambled for puts again when the S&P went back down to test the lows.

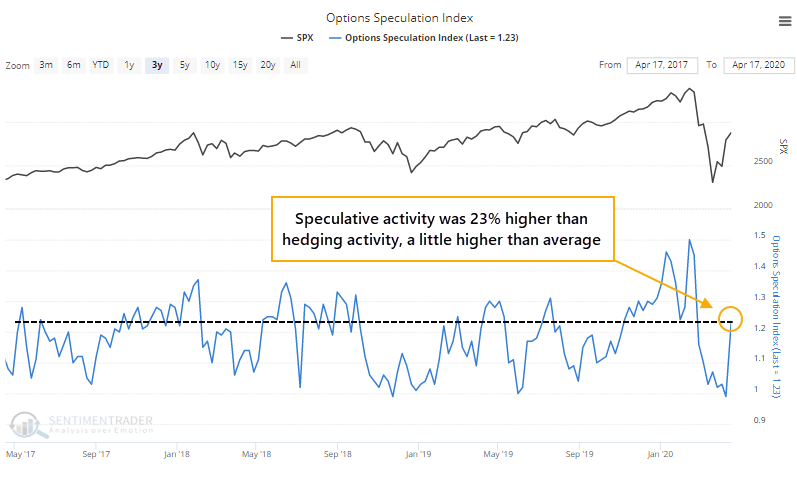

A more comprehensive look at options trader behavior, the Options Speculation Index, shows a jump in speculative activity, but not to the extremes seen over the past few years.

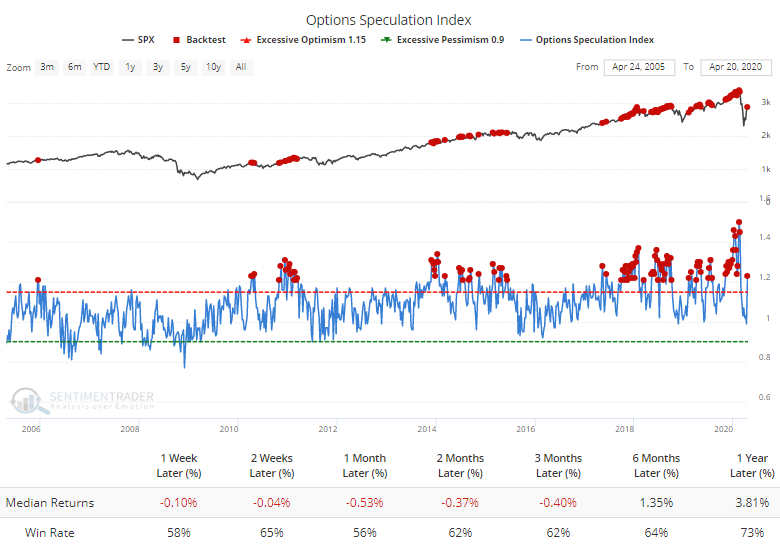

The Backtest Engine shows that when traders spent at least 20% more volume on bullish strategies than bearish ones, the S&P 500 typically rose in the weeks and months ahead, but returns weren't great, with a negative median up to three months later.

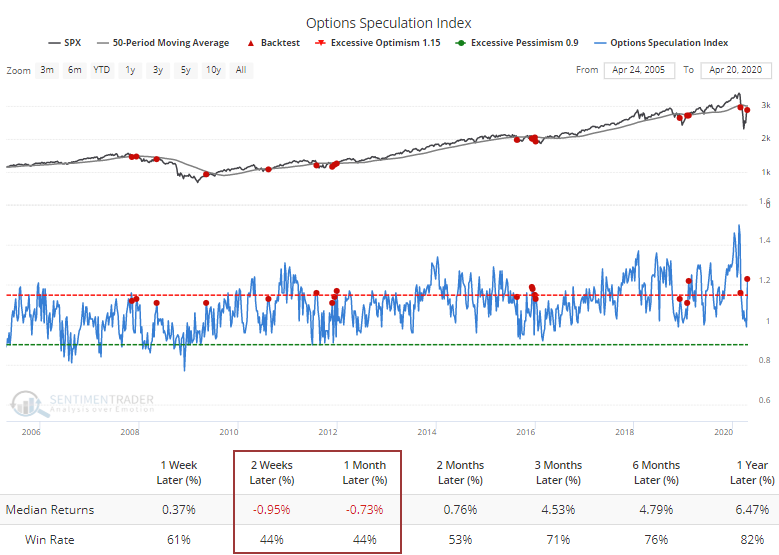

It's rare to see this much speculation during a downtrending market, though. If we test for lesser extremes, 10% more volume in bullish than bearish strategies, while the S&P is below its 50-week moving average, then returns over the next 2-4 weeks were poor.

The overall suggestion from this behavior of options traders is that the jump in speculative activity is a modest, shorter-term worry. They're still buying a lot of protective puts, but that rise in speculative call buying is a definite worry, especially during a downtrending market. The panic in March might be (should be) enough to equate to a major bottom, but that doesn't mean there can't be weeks or even months of digestion.