Small traders are buying call options and selling futures contracts

During the week ended May 15, the smallest of options traders opened a new record of net bullish positions.

The positive market further encouraged them. For the week ended May 22, they used more than 45% of their total volume on buying speculative call options, on par with the highest levels of aggressive betting in 15 years.

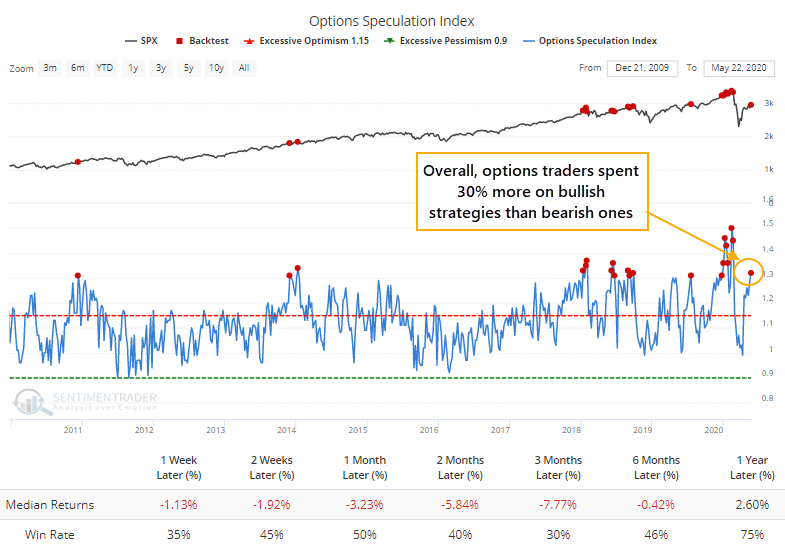

They're not the only ones placing heavy bets on a continued rally. Call buying and put selling was so popular across all traders that it pushed our Options Speculation Index above 1.3, meaning that traders opened 30% more bullish contracts than bearish ones. The Backtest Engine shows this has not worked out well.

The curious thing is that at the same time small traders are aggressively buying speculative call options, they're shorting the major equity index futures.

The contrary record of their call buying activity is much better than their futures positioning, and we'd give that a lot more weight. Even the couple of times they were buying a lot of calls that weren't confirmed by their futures positions led (at some point) to a decline.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A more in-depth look at options traders' position versus futures traders'

- Consumers are feeling less positive about now and more positive about the future...again

- The S&P 500 is playing with its 200-day moving average

- A look at domestic and overseas indexes and the number of stocks rising above their 50-day averages