Small Options Traders Get Aggressive As Soybeans Fall

This is an abridged version of our Daily Report.

Small traders become aggressive

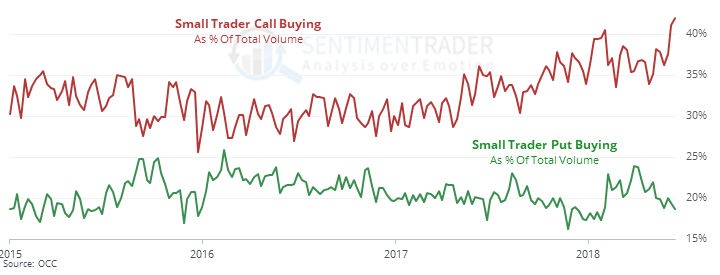

The smallest of options traders have become remarkably aggressive in betting on a market rally.

Their volume of opening call purchases is nearing record highs, last seen in 2000 and 2007. They are spending more than 42% of their volume on buying calls, the most in more than a decade.

A bad few weeks for beans

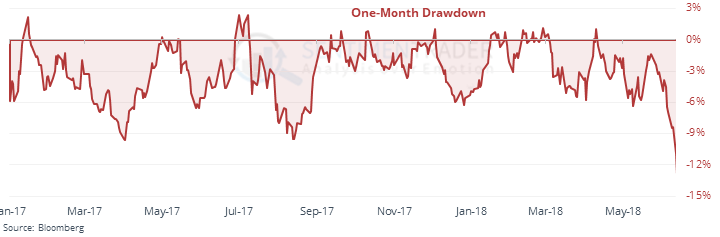

Soybeans have lost more than 13% in a few weeks and closed at the lowest level since 2013.

That’s one of the largest losses since 1970, which has led to multi-week rebounds. Longer-term returns were mixed, and there are other headwinds like seasonality.

All in, and then some

Last week, active investment managers went to a leveraged long position in stocks. Sounds bad, but the Backtest Engine shows that over the next month, the S&P 500 rose 82% of the time after the other times managers were this aggressively long.

A week of small losses

The Dow Industrials have lost ground for the last 5 sessions, but no more than 0.5% each day. That has triggered 18 times since 1929.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |