Small Caps Shine As Financial Conditions Tighten And VIX Drops

This is an abridged version of our Daily Report.

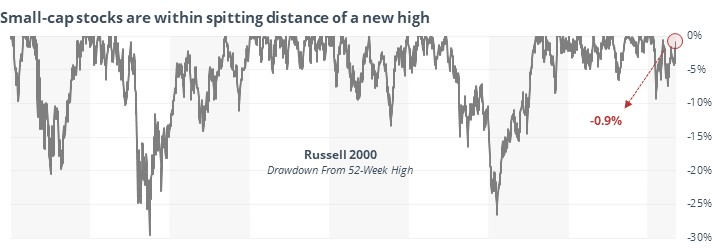

Small caps trying to drag us higher

The small-cap Russell 2000 is within 1% of an all-time high, while the S&P 500 is still more than 5% below.

That’s usually taken as a universally good sign for stocks in general. It hasn’t been that easy, especially for the Russell, which was negative a year later every time it triggered

It was good while it lasted

Financial conditions were at a 28-year best in January just as stocks were peaking. Since then, they have tightened by 1%, suggesting a reversal to a more restrictive trend. That hasn’t been a terrible sign for stocks, though defensive sectors did better going forward.

Welcome back, volatility sellers

The VIX has dropped back to a below-average level for the first time in months. Other times it did so, stocks struggled a bit in the shorter-term, while the VIX rebounded almost every time .

Concern for high-yield

The Cumulative Advance/Decline Line for high-yield bonds just sunk to its lowest level since July 2016. That suggests there has been a persistent trend of fewer and fewer bonds supporting funds like HYG or JNK.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |