Small Caps Make a Big Move

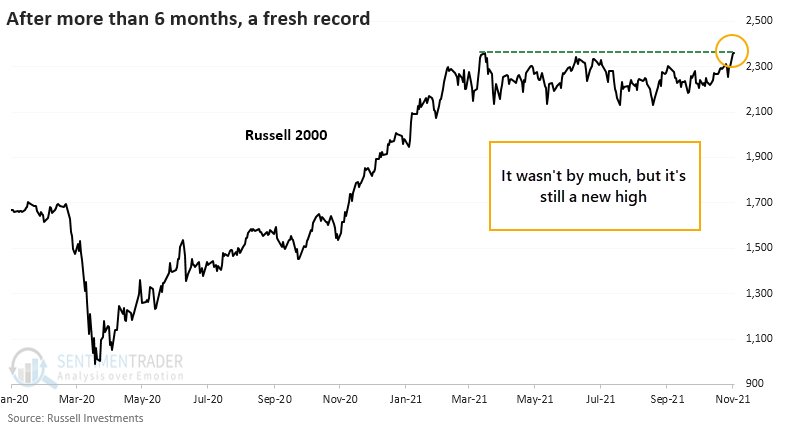

In a year when headline indexes like the S&P 500 have set record after record, it seems like it has taken the small-cap Russell 2000 forever to break out. It finally did, by the tiniest of margins.

After more than six months of consolidating in a tight range, the Russell managed to push over the hurdle and close at a record high on Tuesday. That ended more than 160 days without one.

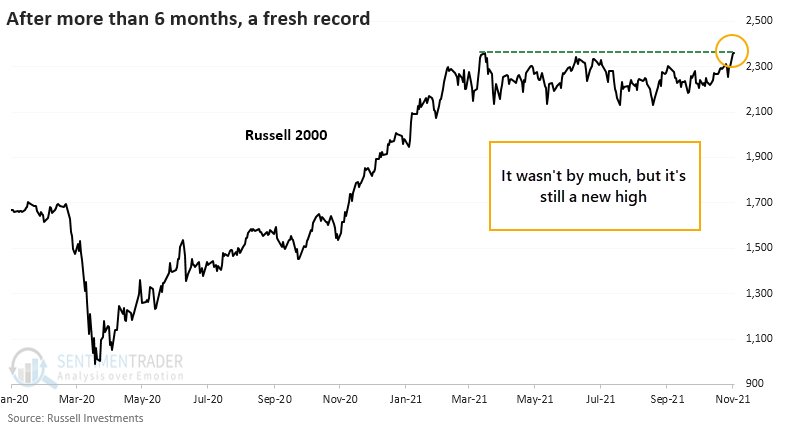

The index has gone far longer without setting a multi-year high, but this one seems overly long because other indexes have been rising without it. And with rare exceptions, it's been an excellent sign for those patient enough to stick with it.

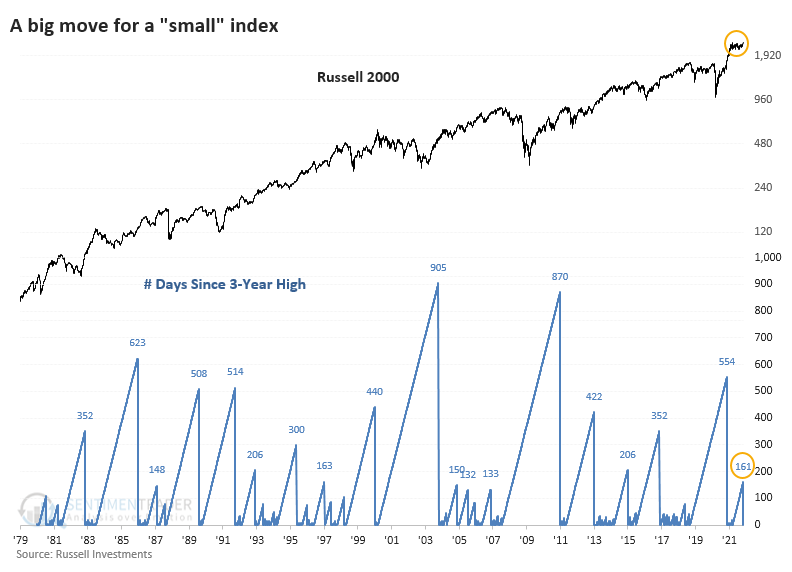

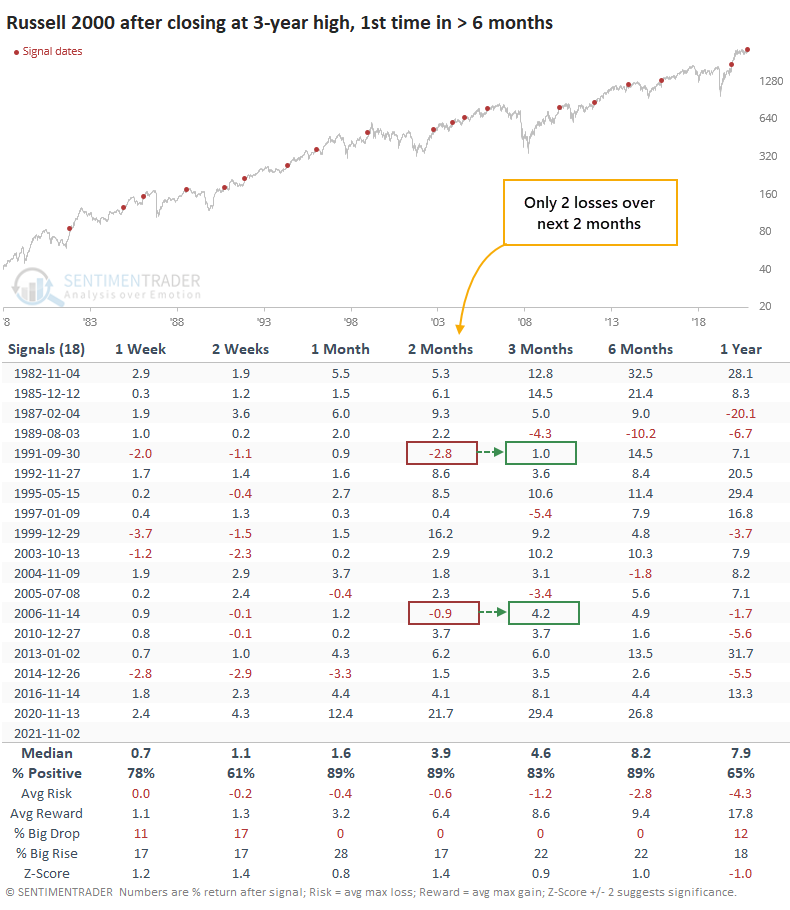

GOOD SIGN FOR FUTURE RETURNS

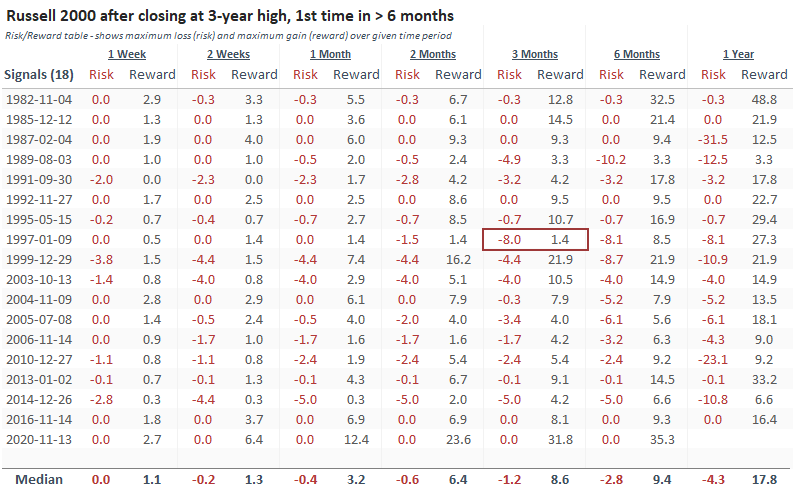

Once the Russell broke out to a new high for the first time in more than six months, it fell back only twice over the following two months, and both were minor losses that were quickly recouped.

Looking at the Risk/Reward Table for the Russell, there was only a single loss of more than -5% at any point within the next three months.

Just as remarkably, 15 out of 18 signals showed more reward than risk over the next three months, 16/18 did so over the next six months, and 17/18 over the next year.

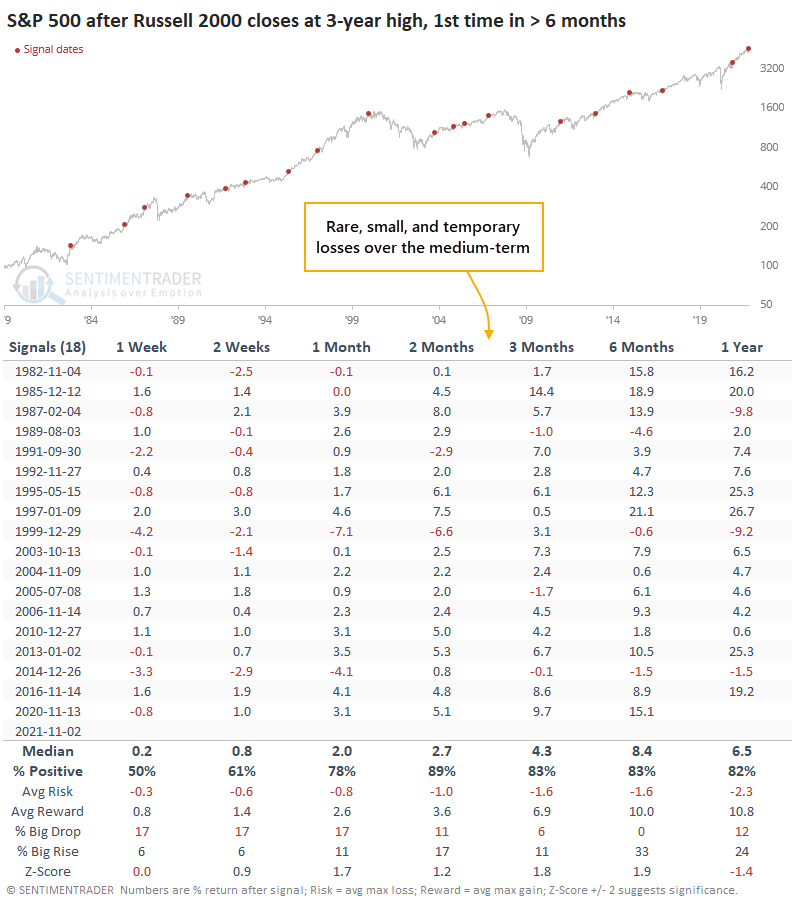

EVEN FOR THE S&P 500, A GOOD SIGN

Breakouts in small-cap stocks tend to be a decent sign for the major indexes, and indeed, the S&P 500 showed good returns after these signals. Over the next two to three months, the S&P suffered only a few minor losses, none leading to imminent cascades.

The recent spike in speculative activity is a bit of a worry over the short-term, but a return of risk-on behavior after a reset tends to lead to higher prices. The fact that small-cap stocks have now broken out to new highs, on the heels of broader advance/decline lines, is more evidence that an imminent correction seems like a low probability.