Small Caps have suffered a fast correction, the first in a year

Key points:

- The Russell 2000 just suffered one of its quickest corrections ever following a new high

- It also ended one of its longest streaks without a correction

- Both behaviors typically led to more selling pressure over the short- to medium-term

One of the quickest-ever corrections

Earlier this month, the small-cap Russell 2000 broke out of a long consolidation. When it's done that before, it had a strong tendency to keep going. While short-term returns were modestly positive, the index showed a positive return 2 months later 16 out of 18 times.

After its latest attempt, it promptly failed. And failed hard.

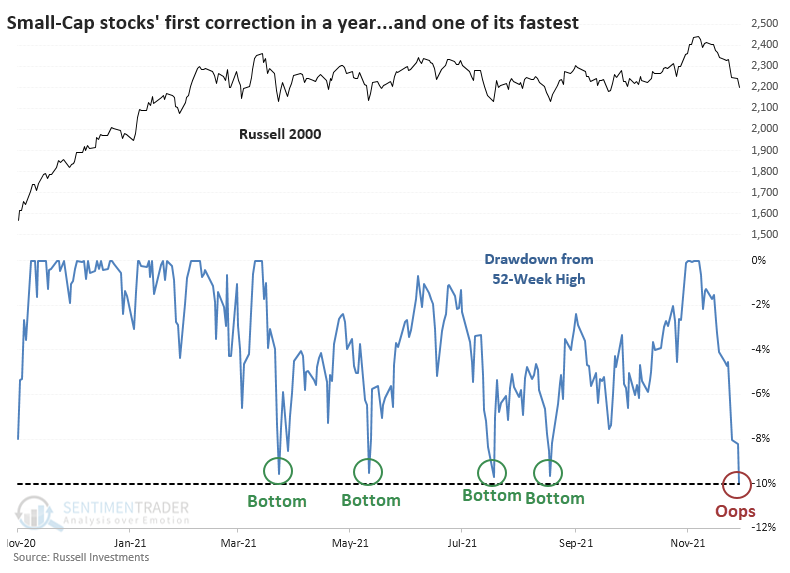

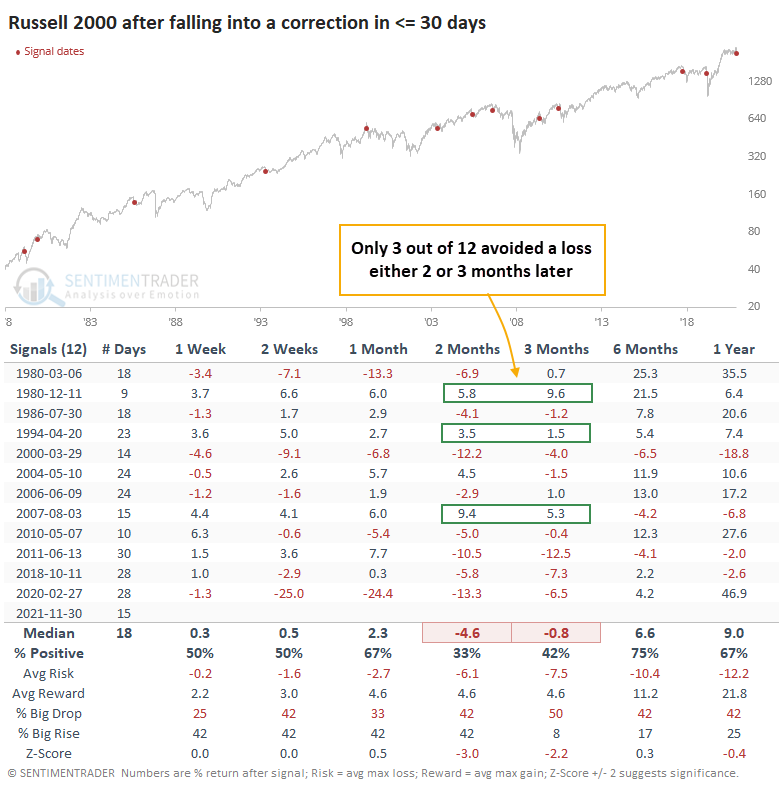

Within only a few weeks of trading at an all-time high, the Russell is already back into correction territory. This is its first drawdown of more than 10% (rounded) in more than a year.

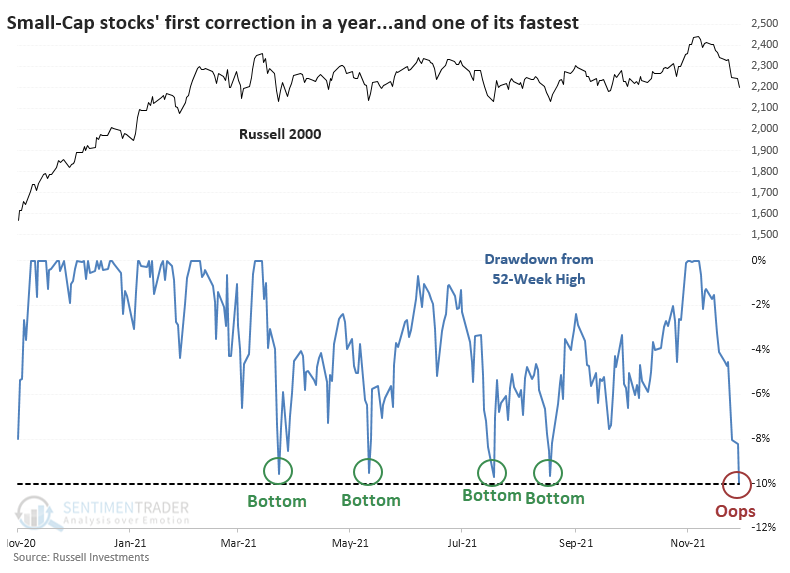

At only 15 days removed from a 52-week high, this is the Russell 2000's 4th-fastest correction.

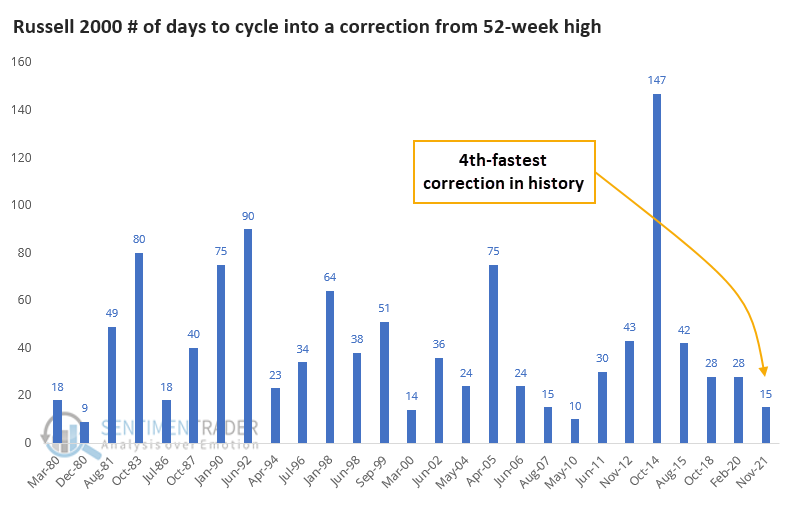

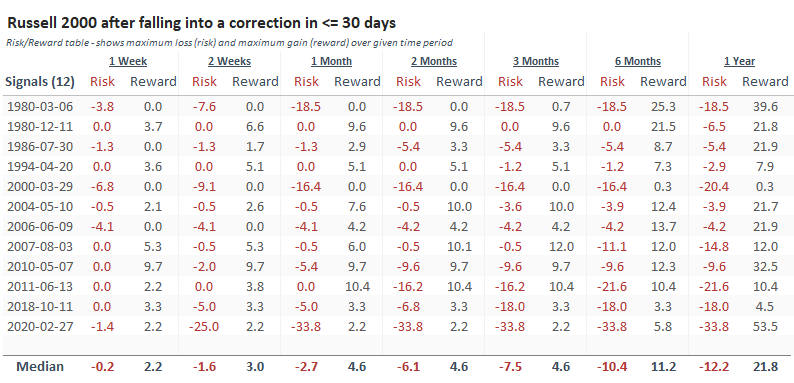

Since the Russell's breakout failed (so far) to follow through on its historical tendencies, maybe we can't rely on its failure either. But for the most part, fast corrections equaled negative future returns for the small-cap index. Quick failures were not a good sign for these stocks, with 9 out of the 12 signals leading to a negative return either 2 or 3 months later. A few of them bounced in the short-term then crapped out.

The Risk/Reward Tables shows just how poor the Russell tended to perform. Out of the 12 signals, 8 of them showed (almost) more risk than reward during the next 3 months.

The first correction in more than a year

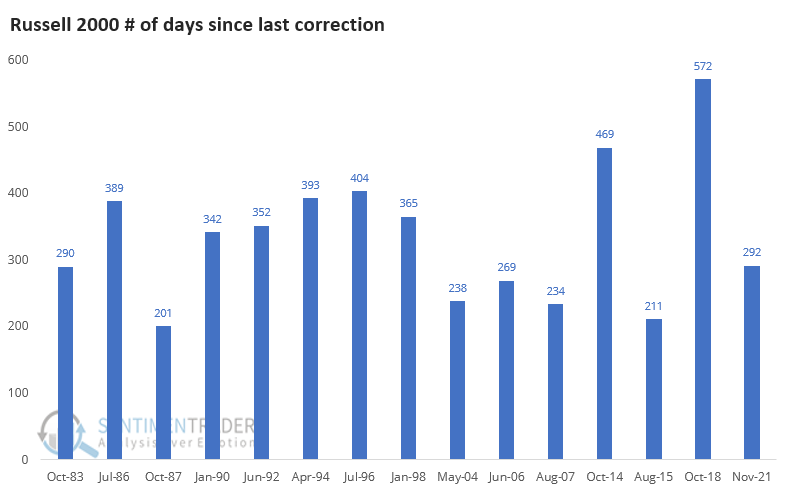

This quick correction is also the Russell's first substantial pullback in a long time. It ends a streak of nearly 300 trading days since it last traded more than 10% below a 52-week high.

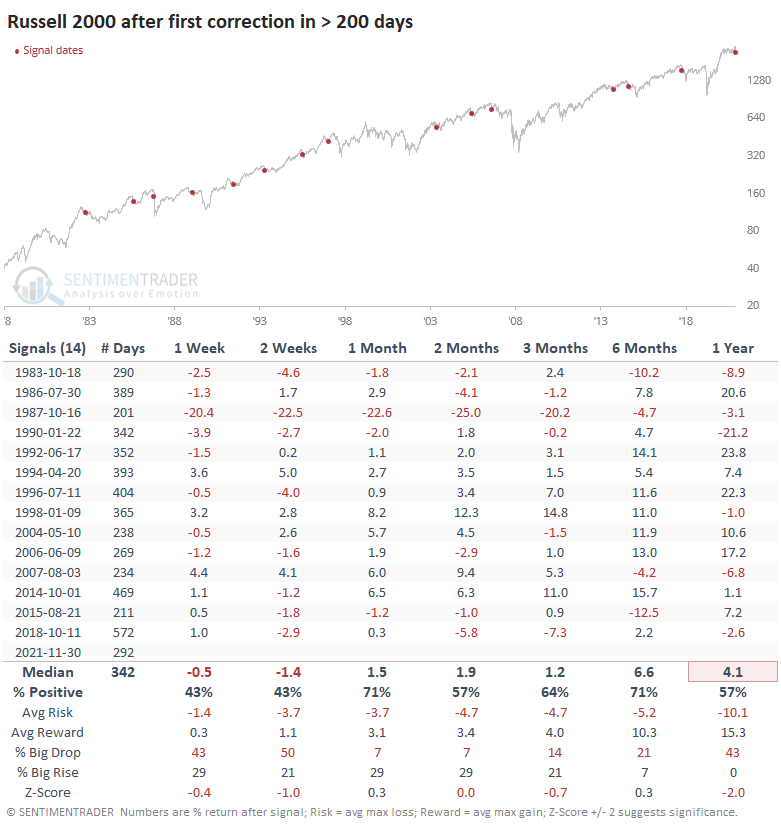

The first correction in more than 200 days tended to precede weak short-term returns and below-average medium-term ones. Out of the 14 other signals, only 2 managed to see large and sustained gains in the months ahead (June 1992 and July 1996). Most of the others either saw weak medium-term returns, or strong ones that ended up being given back over the next 6-12 months.

What the research tells us...

When a market breaks out and everyone gets excited, it tends to keep going. Quick and forceful failures after a breakout are relatively unusual, but the small-cap Russell 2000 just suffered one. The history of the index shows that investors tend to sell after fast failures, with consistently weak returns over the next 2-3 months.