Small Business Has Never Been Better As Hong Kong Slides Into A Bear

This is an abridged version of our Daily Report.

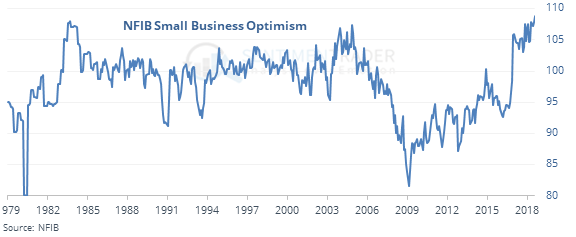

Never better

Small business owner optimism is at record highs, surpassing two other periods since 1979.

Despite worries about labor, owners have exceptionally high confidence about future conditions. It is backward-looking for stocks, though, and forward returns after these periods were subdued for small-cap and tech shares.

Another bear market

More and more markets are falling 20% from their highs, from commodities to emerging markets. The latest to fall into bear territory is Hong Kong, for the first time since ’15. When those shares first fall 20%, they have tended to keep going down.

More warnings

Due to a continued high number of 52-week lows, another day of Hindenburg Omens was triggered on both the NYSE and Nasdaq exchanges. As noted in the September 10 report, that has negative implications going forward when clustered together like this. That’s a combined 8 Omens in 6 days, matched only three times in history.

Not shiny

Optimism on silver has dropped below 17 for only the 2nd time in the past 17 years. According to the Backtest Engine, the other instance was early November 2014 which preceded a 10% rally over the next several months.

NOTE

The Bear Market Probability Model discussed in the September 5 report is now live on the site here. We’ll be updating it monthly.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |