Skeptical traders push Nasdaq short interest near record levels

Somebody, somewhere, still wants to bet against this market.

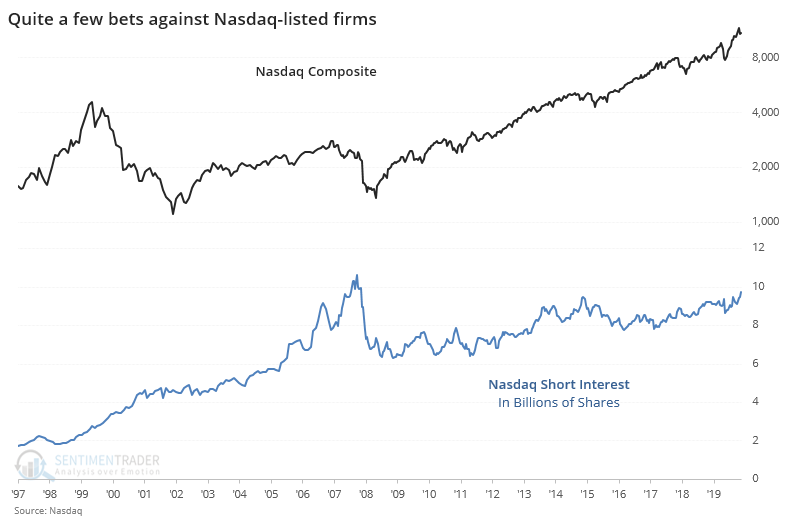

Short interest on stocks trading on the Nasdaq exchange rose in the last two weeks of September and is at the highest level in a decade, totaling nearly 9.7 billion shares.

According to Investopedia:

"Short selling is the opposite of buying stocks. It's the selling of a security that the seller does not own, done in the hope that the price will fall. If you feel a particular security's price, let's say the stock of a struggling company, will fall, then you can borrow the stock from your broker-dealer, sell it and get the proceeds from the sale.

Short interest is the total number of shares of a particular stock that have been sold short by investors but have not yet been covered or closed out. This can be expressed as a number or as a percentage."

We can see below that it's nearing its highest level ever.

The typical interpretation of short interest is that it's a contrary indicator. The more bets there are against stocks, the more potential buying demand there is when those short-sellers cover their bets, and the more bullish it is for stocks.

This is one of those tropes that sounds good but fails in practice. It just doesn't work very well, especially when using aggregates, like across an entire exchange. On an individual stock basis, there is likely more utility to it, but as a non-contrary indicator.

In a 2009 Journal of Financial Economics paper, Boehmer and Huszar found that:

"Stocks with relatively high short interest subsequently experience negative abnormal returns, but the effect can be transient and of debatable economic significance. In contrast, relatively heavily traded stocks with low short interest experience both statistically and economically significant positive abnormal returns."

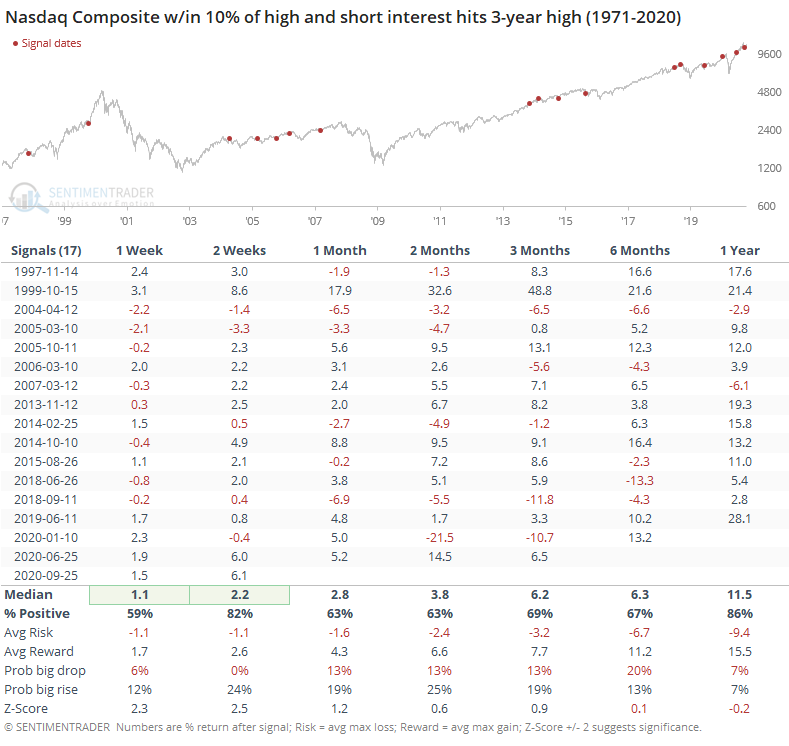

Let's see if high short interest has helped the Nasdaq's future returns. When short interest is at a multi-year high while the Composite was less than 10% from its own multi-year high, forward returns were actually quite good.

We wouldn't put much weight on the short-term numbers since this data is released with a delay and it wouldn't be usable. Over the medium- to long-term, a more appropriate time frame, returns were mostly positive. When we look at the risk/reward ratio and probability of a big gain or loss, though, it's not very impressive, about in line with random.

We sometimes get asked why bother showing any studies that don't have a solid edge. We do it because these short interest figures get tossed out frequently, and if we see this and assume it's a buy signal, because that's what we're taught to believe, then we're fooling ourselves. There are reasons to be optimistic here; this ain't one.