Silver's correction

Silver crashed in March and then soared as global central banks cranked up their printing presses. But nothing goes up forever, and silver has fallen sharply over the past few days:

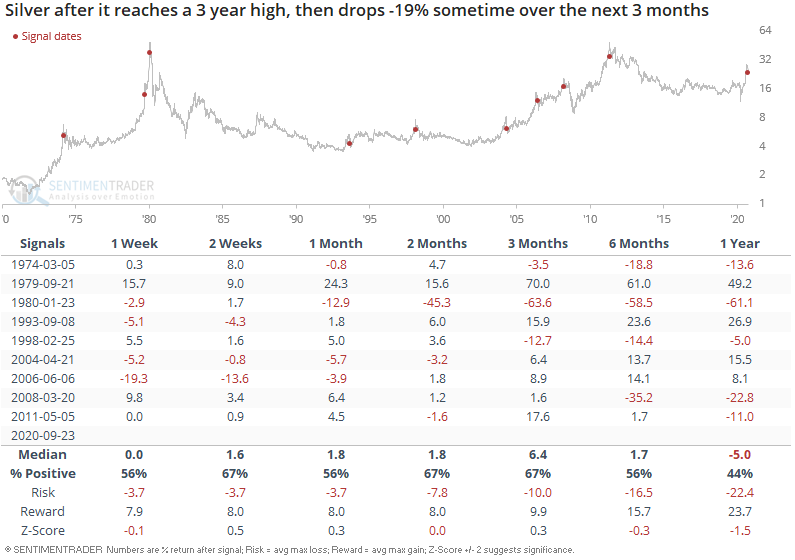

This is typical for silver's price action (surge then plunge). When silver rallied to a 3 year high in the past and then dropped -19% sometime over the next 3 months, silver's forward returns were mixed. However, volatility was extremely high. In a bull market this usually occurred after 2/3's of silver's correction was over, whereas at a bull market top this (obviously) was not a good sign:

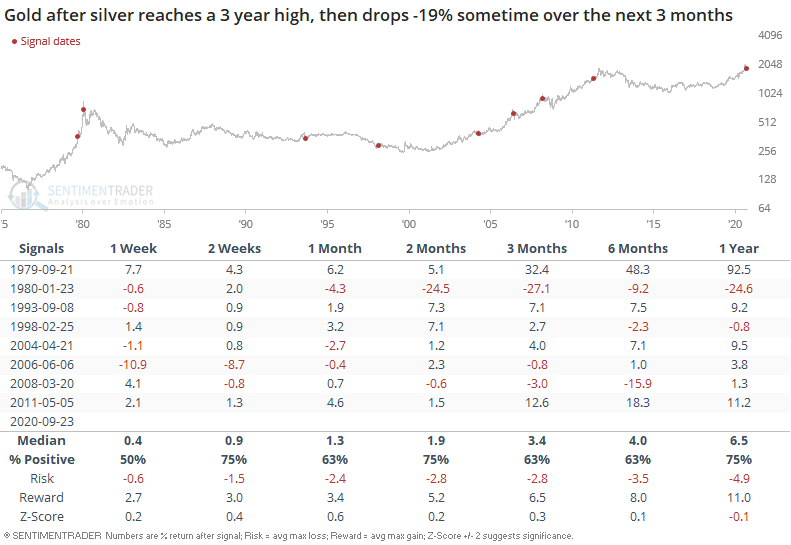

Likewise, this mostly led to mixed returns for gold: