Silver is shinier than gold

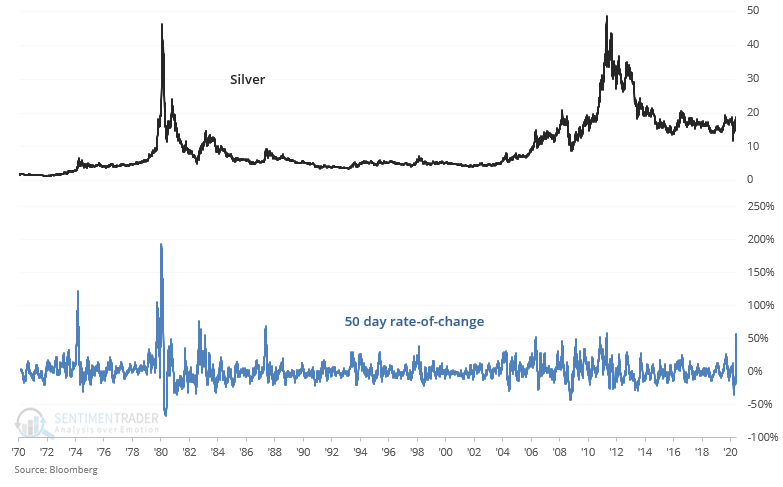

After crashing in March, silver has surged 55% over the past 50 days:

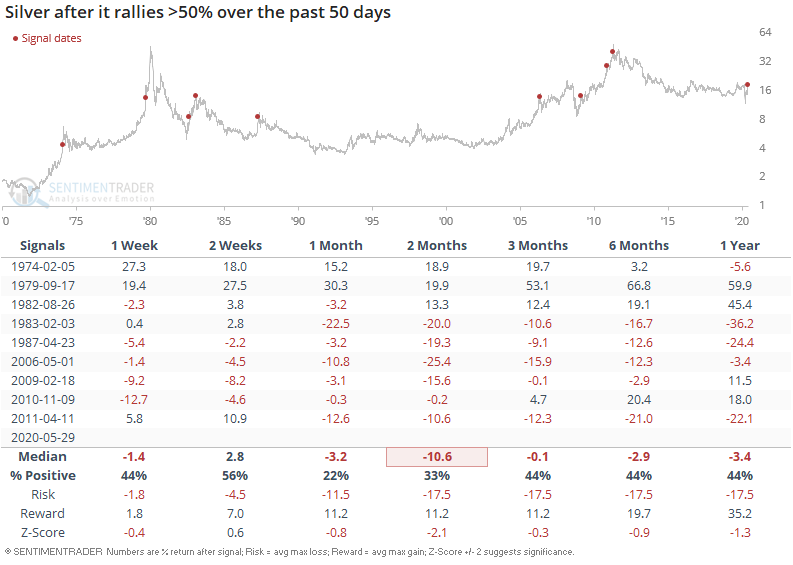

Such extreme short term rallies were bearish for silver over the next month, particularly over the past 40 years (1980-present). Silver fell over the next month by a median of -3.2%:

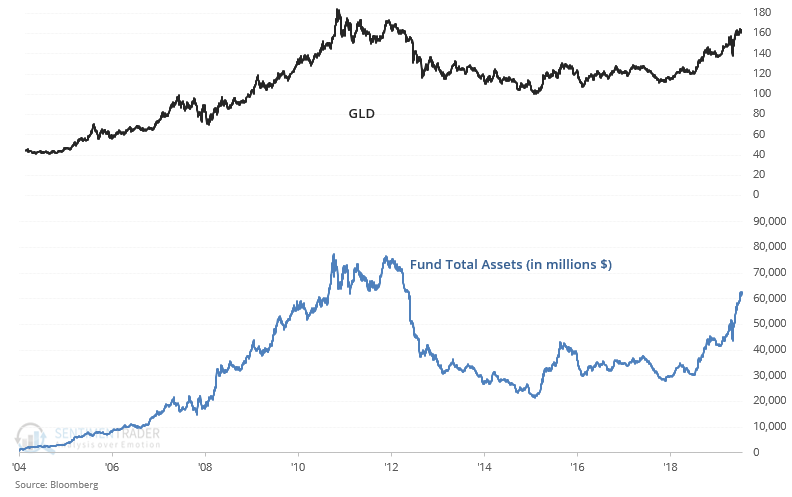

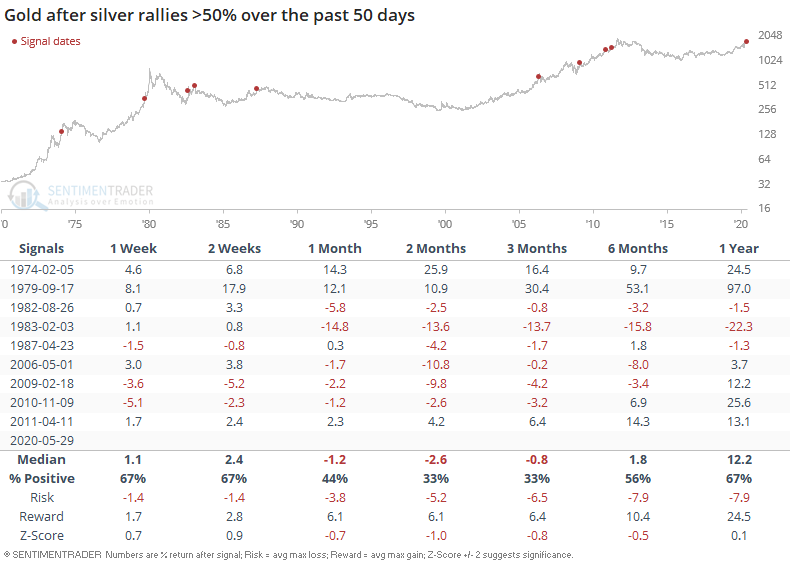

Since gold and silver tend to move in the same direction, this was bearish for gold as well over the next 1-3 months:

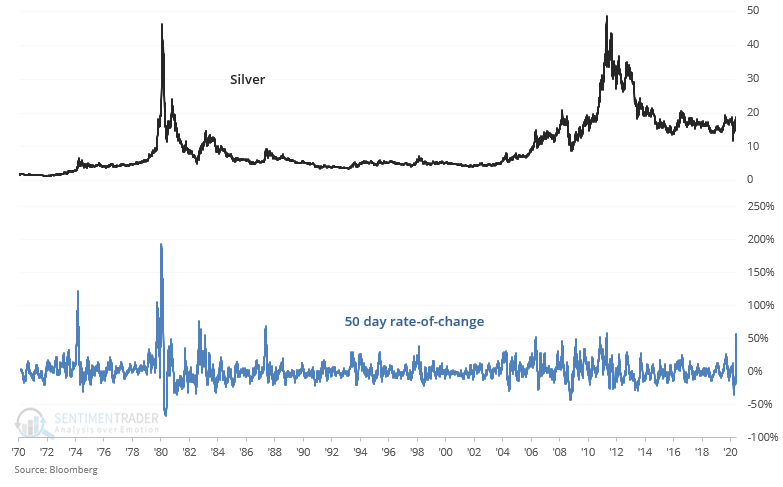

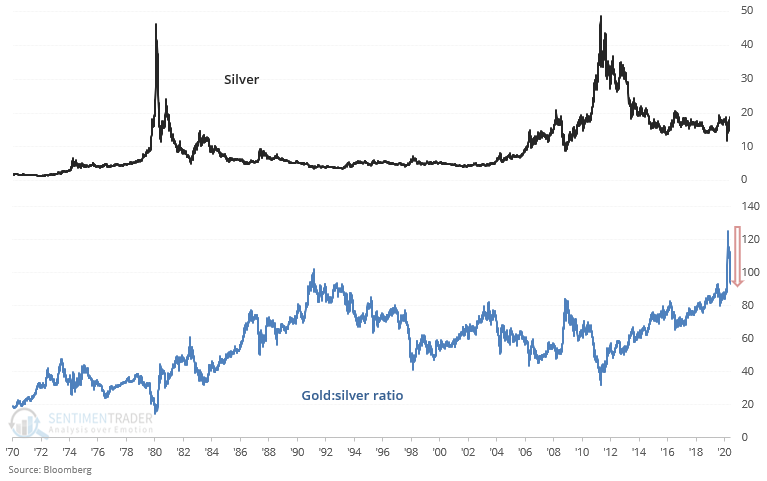

The gold silver ratio surged in March as silver crashed. But now that silver is rallying while gold is consolidating, the gold:silver ratio has crashed more than -24% over the past 50 days:

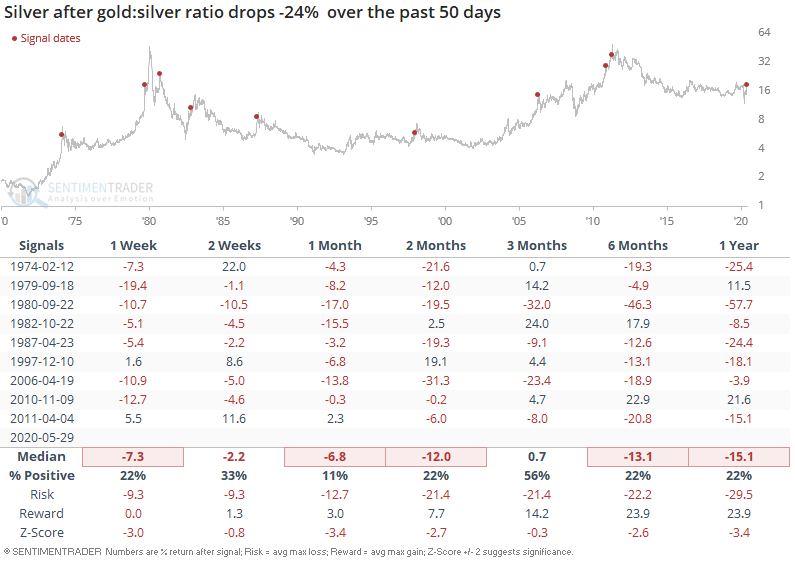

Such extreme drops in the gold:silver ratio are common during precious metals rallies since silver, which is more volatile than gold, rallies more than gold. When this happened in the past, silver always fell over the next 1-2 months:

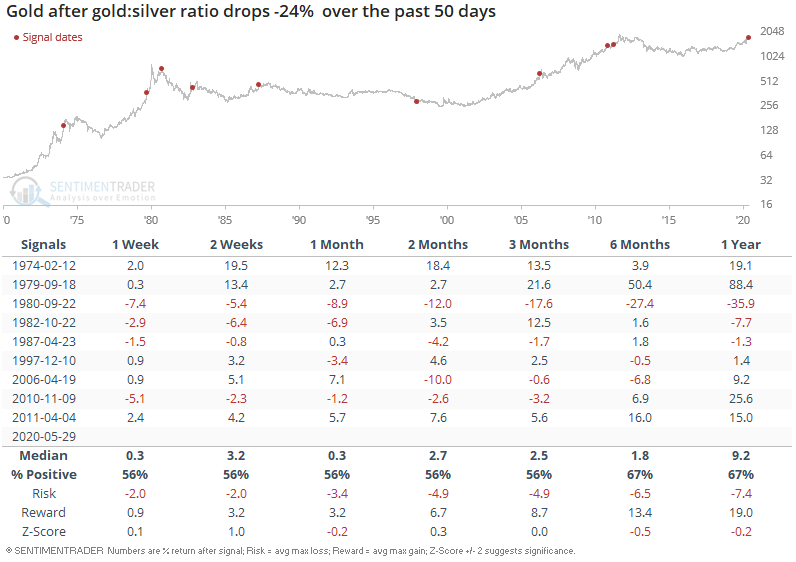

As for gold, this wasn't a clear bearish sign on any time frame:

And for what it's worth, the total amount of money invested in GLD has surged over the past year along with gold's rally.