Signs of smart money buying in futures, sectors

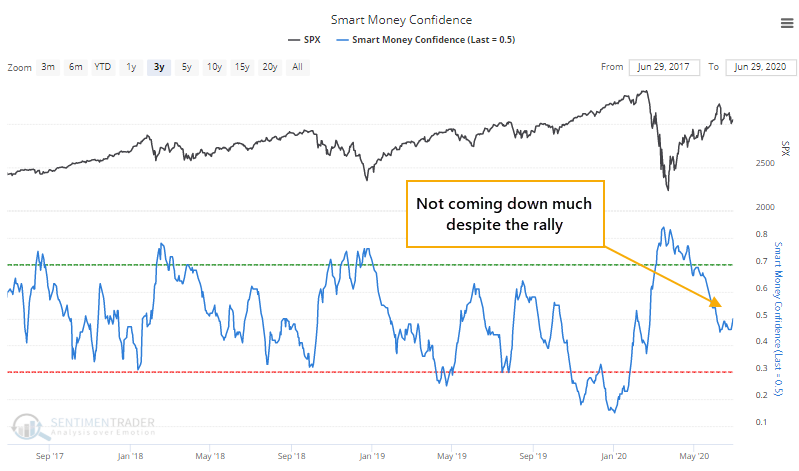

By mid-March, Dumb Money Confidence was nearing record lows, and Smart Money Confidence a 5-year high. While the former has rebounded along with prices, the latter hasn't come down by much, which is surprising.

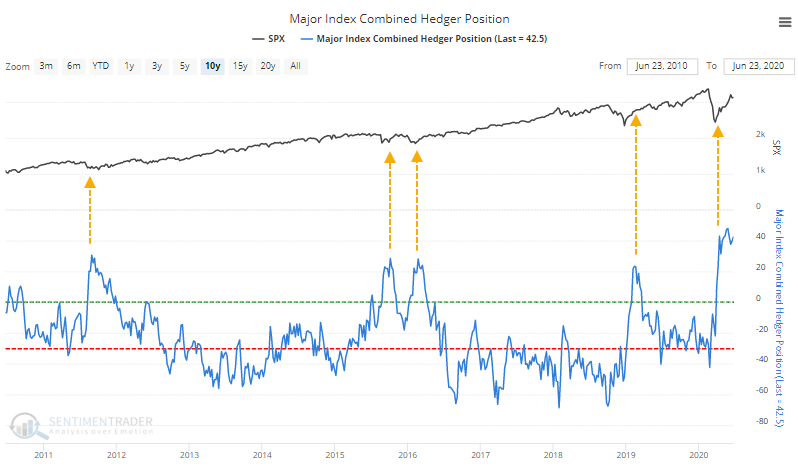

We've noted the main reasons why a couple of times - hedgers are still holding a large net long position in equity index futures, and corporate insiders have been buying up shares. That still hasn't changed much.

Like they did in 2019, hedgers bought the decline in prices aggressively then held on even as stocks rallied. They're doing the same thing this time, but are not only holding on, they're buying more. This is extremely unusual.

We don't like unusual. It's better when investors behave as they have in the past because that gives us more confidence that prices will react in the same way. So this is a bit of a worry, but so far it's unfounded - stocks are still rallying.

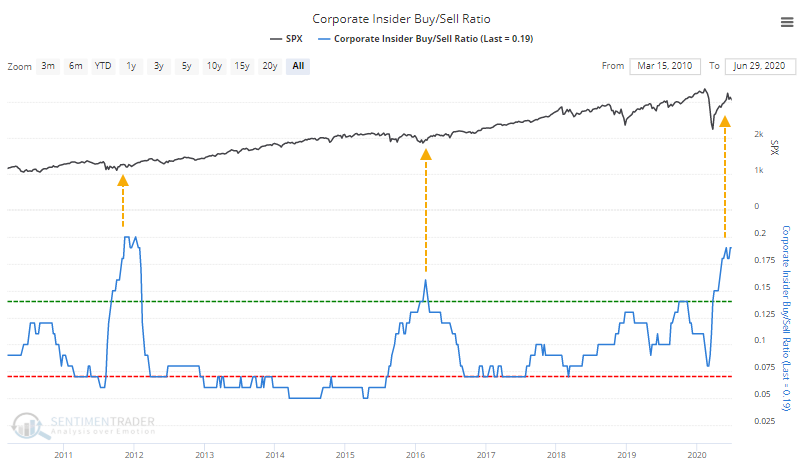

Along with hedgers, corporate insiders not only stepped up in March, but they've kept at it. The ratio of open market buys to sells in S&P 500 companies over the past six months is the highest since late 2011.

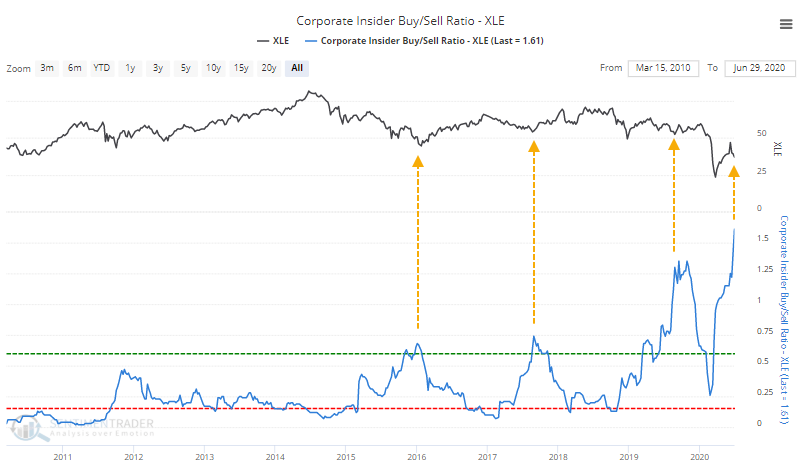

Thanks can be given to a couple of sectors in particular. Even though energy companies have been busy filing bankruptcy, there has been a pickup in the number of corporate insiders buying shares in the sector.

There was a jump in buying last summer, too, and while energy stocks tried to rally, they obviously took a big hit this spring, so that was a failure.

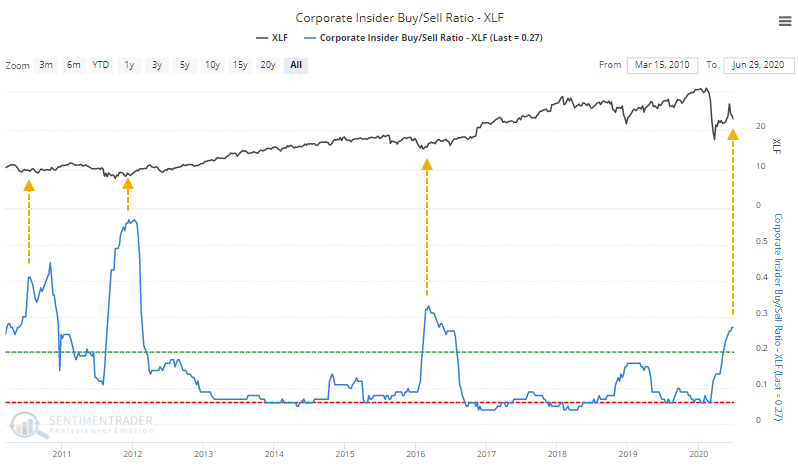

The beaten-down financial sector has seen an increase in buying relative to selling, too.

It's not as aggressive as it has been a few other times over the past decade, but is better than it's been in several years, and is clearly more positive than it was to start the year.

Smart money types of indicators tend to be longer-term as opposed to dumb money ones that are mostly shorter-term. The high level of Dumb Money Confidence is a shorter-term worry, while signs of persistent smart money buying are more comforting longer-term.