Signs of a surge

After the attempts at a rally failed yet again on Monday, Tuesday was a welcome relief for many bulls. While every up day in recent weeks has soon been squashed (and may yet again), there were some initial signs that this time is different.

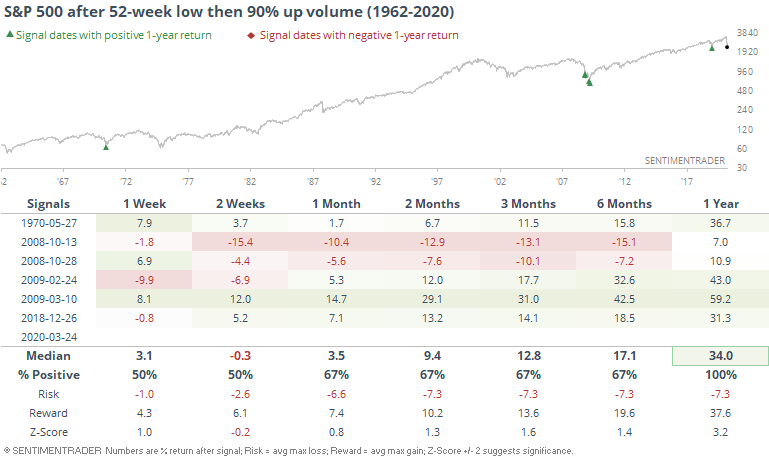

For one, the S&P 500 cycled from a multi-year low to erase at least a few days' worth of losses. The other big up days recently didn't have enough oomph to do that.

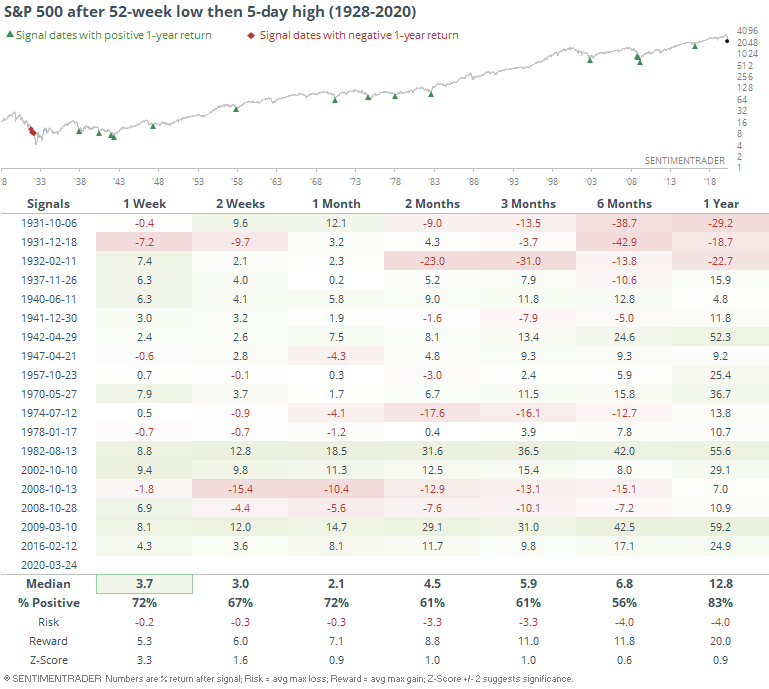

This was usually a decent sign going forward, with 1932 and 2008 being the big exceptions.

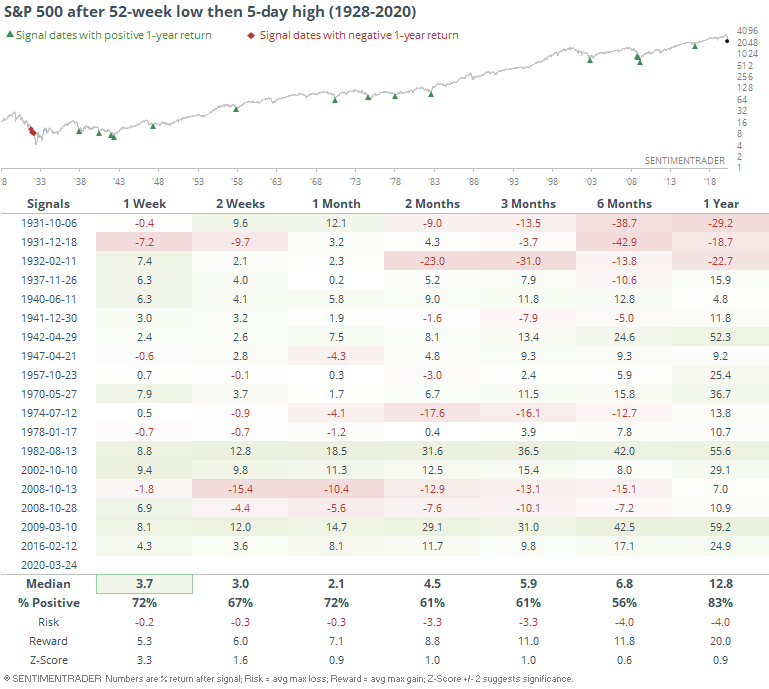

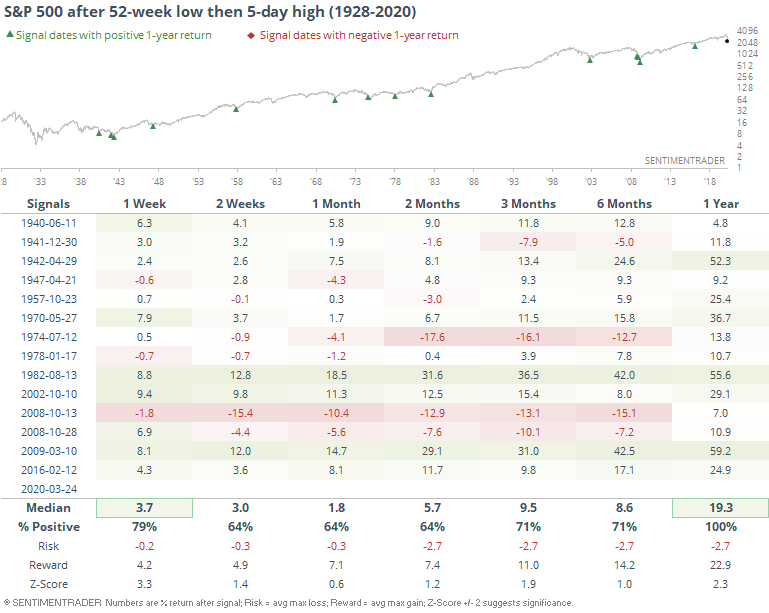

If we just take the 1930s out of the picture (a sin, I know), then the one-year returns improve dramatically, with no losses.

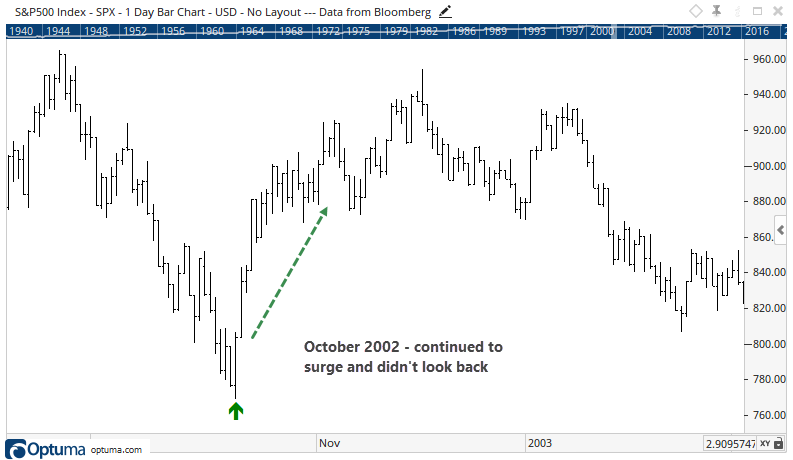

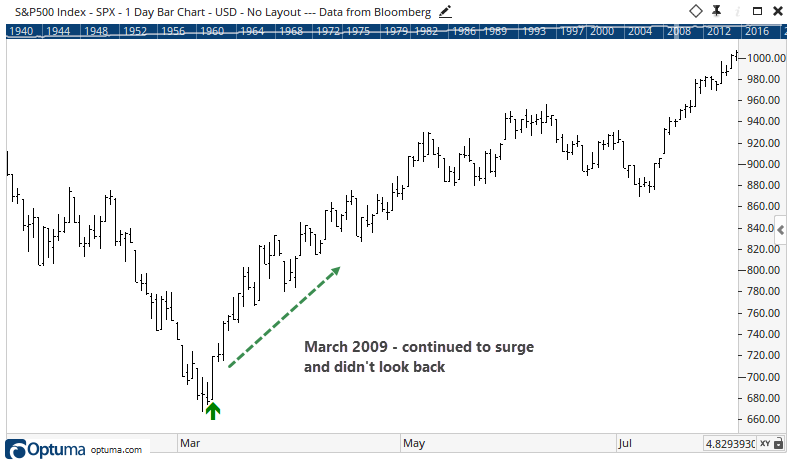

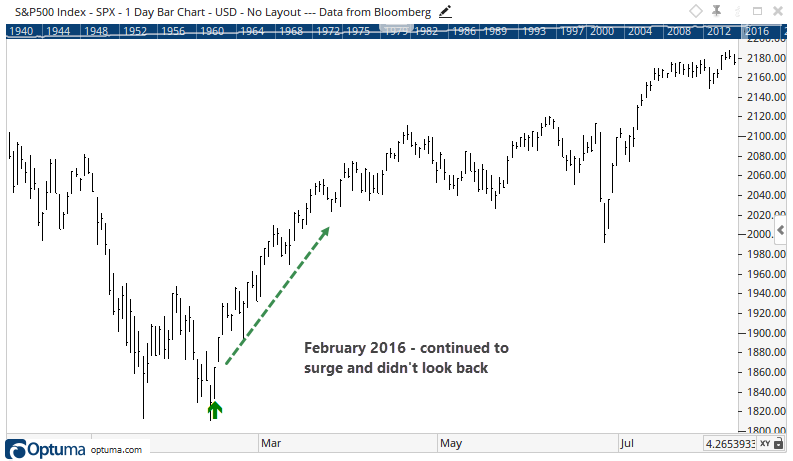

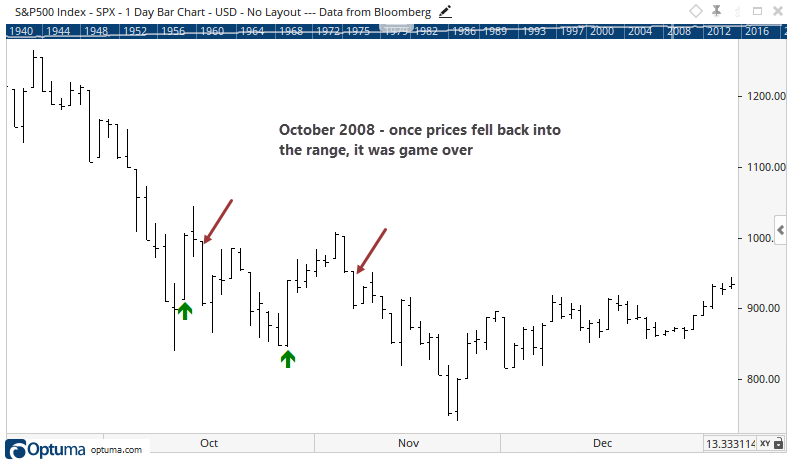

The signals over the past 20 years mostly took off and never looked back, except for those two in 2008. We'll look at those last.

Those two failures in 2008 looked a lot different. Relatively soon after the surge, prices fell back well into the range of the big up day.

Granted, we're dealing with a tiny sample size as usual lately, but it suggests that bulls do not want to see buyers give up the ghost now. If they have enough power to keep pushing higher, it bodes well.

It's also notable that activity on Tuesday was heavily skewed toward winners. For the first time in this cycle, there was a 90% up volume day after stocks had just hit a fresh low.

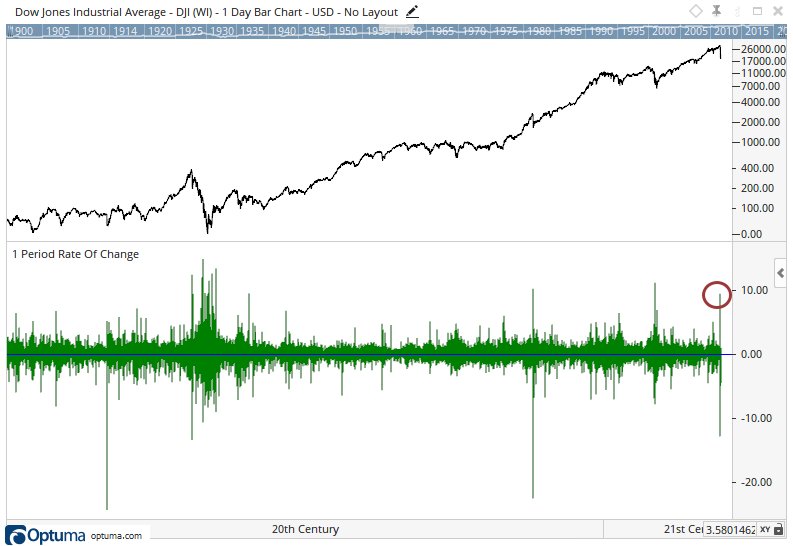

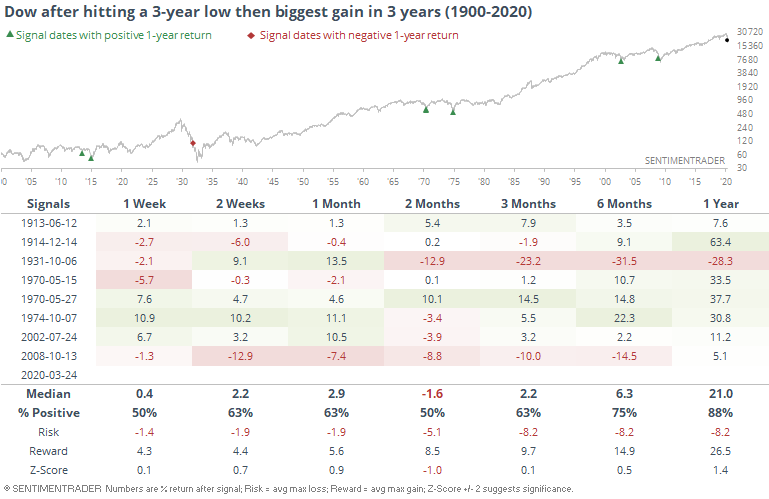

That should be the case on a day stocks make a historic jump. For the Dow Industrials, it was one of the biggest gains since 1900.

Big gains themselves were not necessarily an all-clear sign, especially short-term, for the Dow. But a year later, the index showed gains every time except for the 1930s.

Overall, the buying interest and close at the highs on Tuesday could be enough to finally change sentiment enough to string together some up days. We'd have to in order to change the pattern over the past few weeks. And if buyers can do that, historical precedents argue strongly that the worst of the selling is behind us, at least for a couple of months.