Should we buy the dip in Gold

Key points:

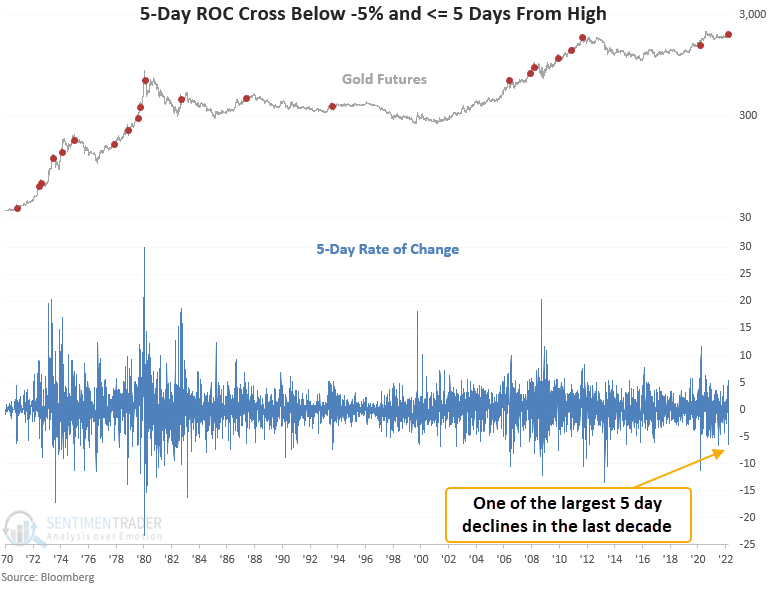

- A short-term gauge of momentum shows a sharp contraction in the price of gold futures

- The 5-day rate of change for gold declined by more than 6%, with the commodity <= 5 days from a 252-day high

- Similar price momentum signals near a high show favorable results across all time frames

What happens when short-term price momentum accelerates to the downside near a high

Let's conduct a study to assess the outlook for gold futures when the 5-day rate of change declines by more than 5% as the commodity remains 5 days or less from a 252-day high.

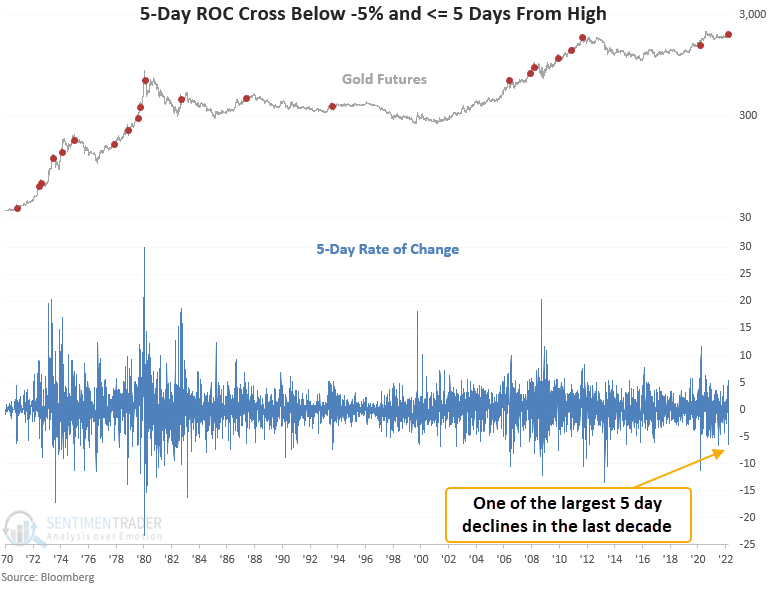

Similar episodes of negative momentum suggest we buy the dip

This signal triggered 21 other times over the past 52 years. After the others, gold futures show positive returns and favorable win rates across all time frames. While the win rates may not catch your eye, they look significantly better than the study period averages. The 1-year return looks compelling except for the 1975 and 1980 signals.

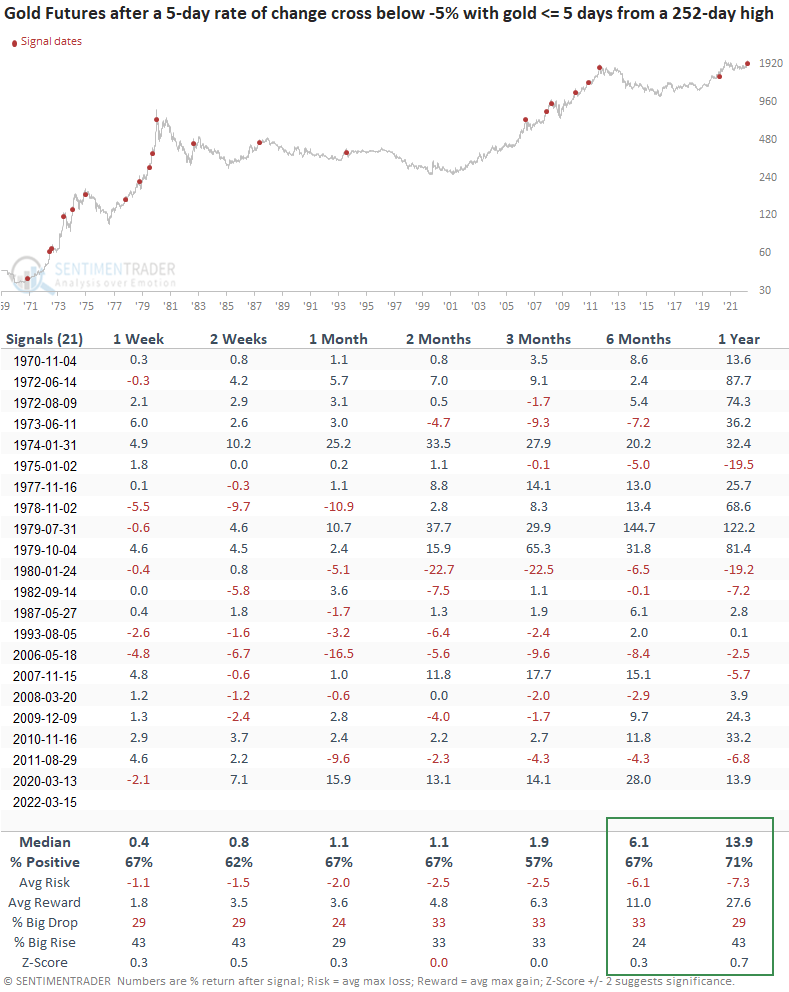

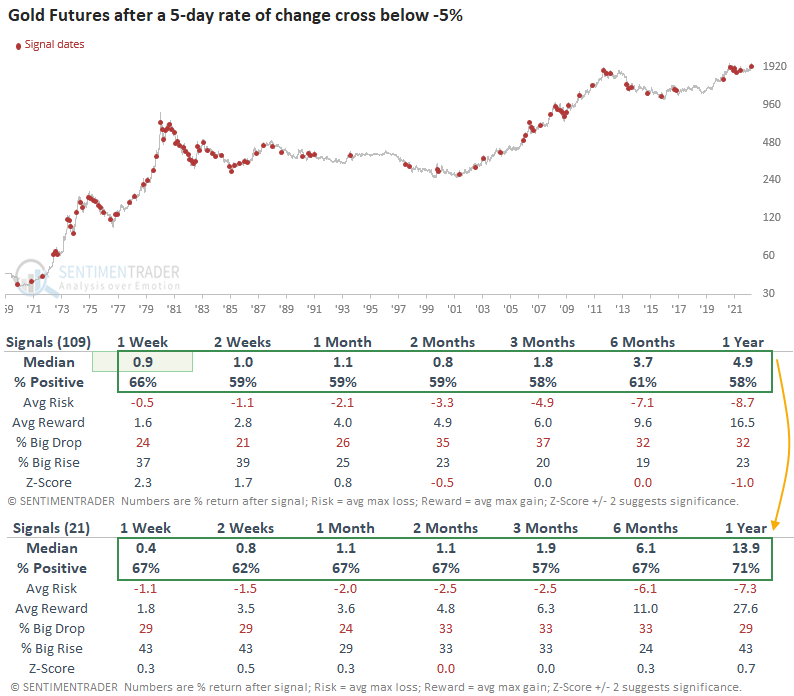

A comparison of the 5-day ROC near a high versus all 5-Day ROC signals

The first table shows all instances when the 5-day rate of change crossed below -5%. I used a reset on the rate of change and a minimum holding period to filter out repeats. Interestingly, the all signals version shows solid returns, win rates and risk/reward profiles in the 1 & 2-week time frames. Comparing the two types of signals shows better win rates for the instances near a high. i.e., an established uptrend helps. The 6 and 12-month results look even more compelling for the signals near a high.

What the research tells us...

When price momentum for gold futures accelerates to the downside, the adverse price action can provide a potential near-term mean reversion edge regardless of the current market environment. Suppose the short-term panic occurs near a high. In that case, the results look solid across all time frames, especially the 1-year window. i.e., we should buy the dip in an uptrend-one thing to consider concerning gold and several other commodities. The Russia/Ukraine conflict put an additional bid in an already frothy backdrop. So, the spike and subsequent reversal may take longer to revert to the primary uptrend.