Short-Term Risk Levels signal a potential opportunity

Key Points

- The Short-Term Risk Levels indicator fell to a reading of 1 (suggesting low risk)

- Stock market returns following previous readings of 1 have generally been favorable

- This reading is not intended to imply that there is NO risk for stock traders

Short-Term Risk Levels

Our Short-Term Risk Level indicator can fluctuate from 0 to 10. In essence, the lower the reading, the less perceived risk in the stock market and vice versa.

One way to look at it is in terms of cash. If one were to rely solely on this indicator to allocate capital (not recommended), then a Risk Level of 0 would suggest keeping 0% of one's portfolio in cash (i.e., fully invested). A Risk Level of 10 suggests keeping 100% of one's portfolio in cash (i.e., no exposure to stocks).

Using short-term risk for longer-term returns

Even though the Short-Term Risk Level is meant for, well, shorter-term movements, a very low level doesn't happen very often, so let's take a look at longer-term returns. Our test runs from the end of 2003 through last Friday, using the S&P 500 index. The trading methodology is as follows:

- Each time Short-Term Risk Levels falls from above 1 to a value of 1 or lower, we will buy and hold the S&P 500 Index for six months

- If a new signal occurs within six months of a previous signal, we will extend the holding period for an additional six months

A holding period can extend indefinitely if new signals continue to occur frequently. You can run this test in the Backtest Engine.

The results show a mostly positive bias

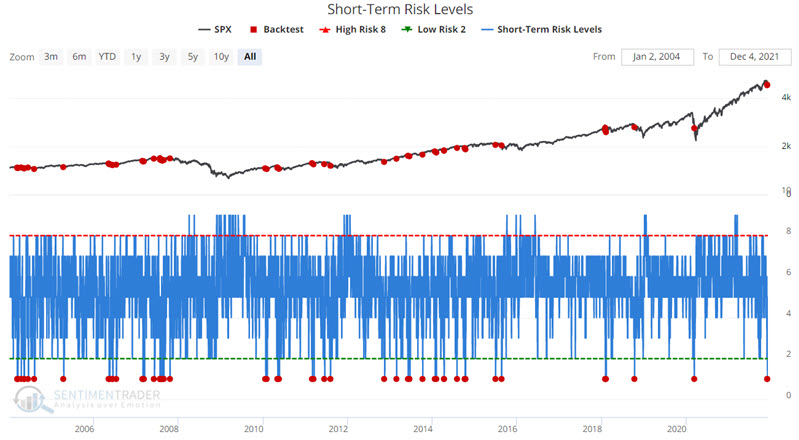

In the chart below, the red dots highlight previous Short-Term Risk Levels readings of 1.

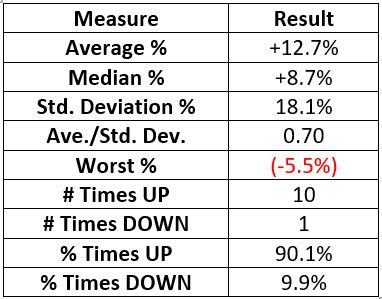

The table below displays a summary of trading performance after all signals (including overlapping signals).

The chart below shows the growth of $1 invested in the S&P 500 Index using the rules described above, with $1 growing to nearly $3.50. There were some drawdowns and periods of inactivity when risk never declined to the threshold level.

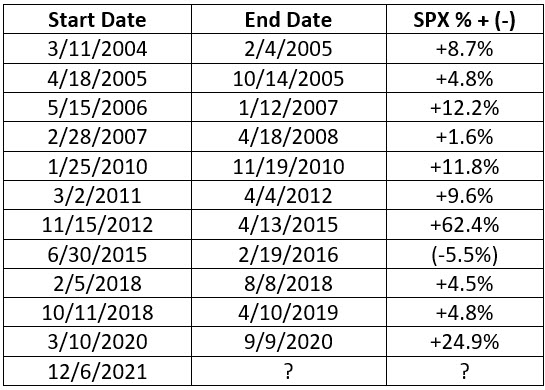

The table below displays the holding periods and S&P returns, including those that extend beyond six months if new signals occur within six months of an original signal.

The summary stats show that 10 out of 11 signals were winners, with an average return of nearly 13%.

What the research tells us…

When the Short-Term Risk Level fell to 1, 10 out of 11 signals showed a positive return over the next 6 months. From a real-world trading perspective, traders need to note in the equity chart above that returns - though positive - are by no means a straight line advance. Interim drawdowns have exceeded -15% on four occasions, with a maximum drawdown of -22.3%, so "low risk" should not be confused with "no risk."