Short term headwinds

The S&P 500's 27% rally (close $) from its bottom in March has pushed many of our Optix indicators to excessive short term optimism territory. This is typically a short term bearish factor for stocks, but over the longer term isn't really a concern.

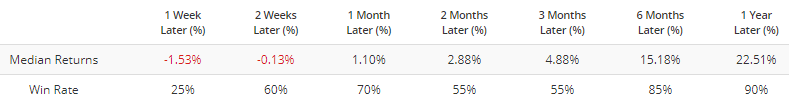

For example, SPY Optix is at 98:

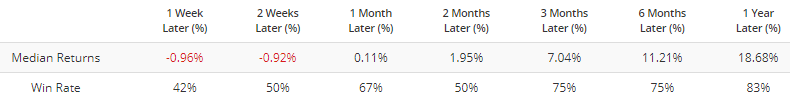

When this happened in the past, SPY faced mild weakness over the next 1-2 weeks, even though this wasn't bearish after that.

If we isolate for historical cases that occurred while the S&P 500 was under its 200 dma (i.e. still in a long term downtrend), SPY's 1 week forward returns were more bearish:

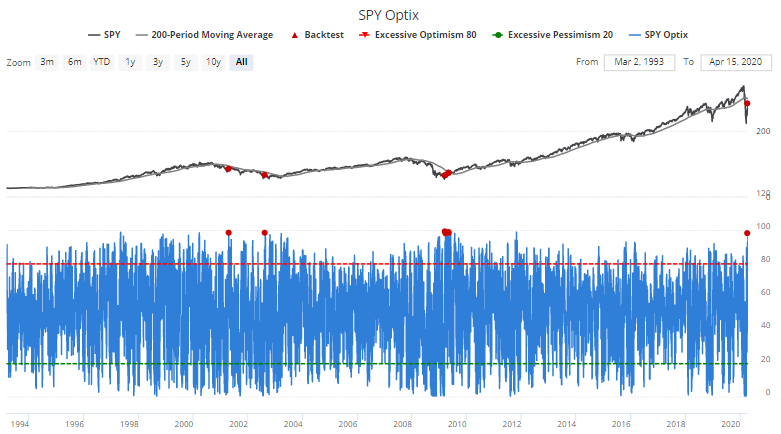

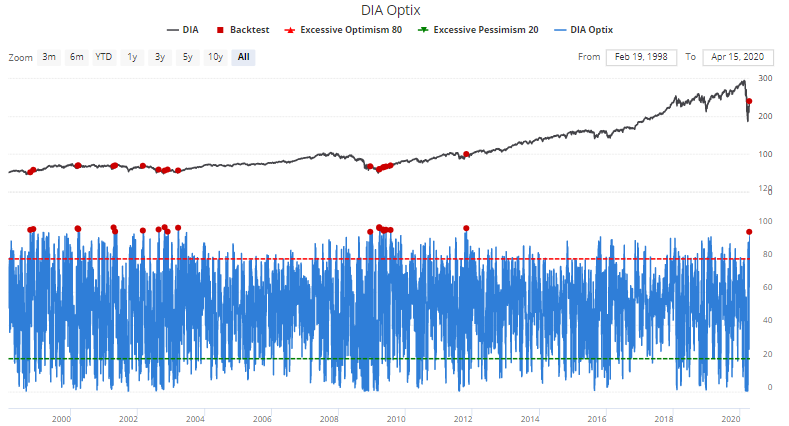

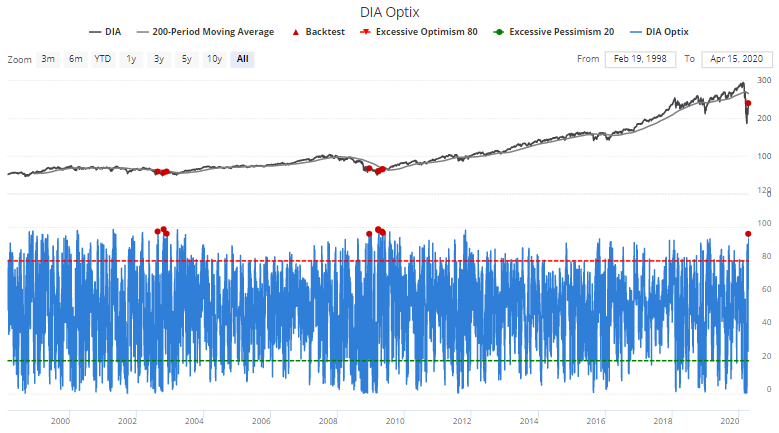

Similarly, DIA Optix is at its highest level in years (96):

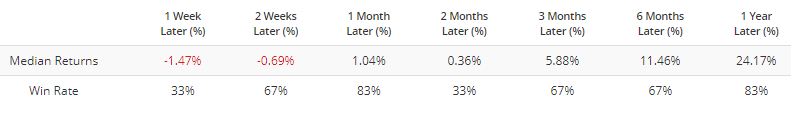

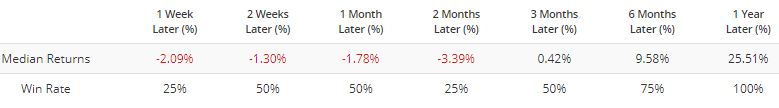

This was slightly bearish for DIA over the next 2 months:

And cases that occurred while DIA was under its 200 dma were more bearish in the short term, but bullish long term:

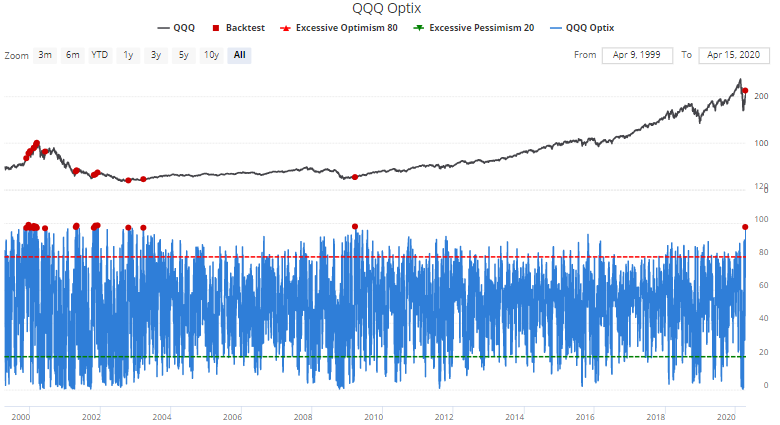

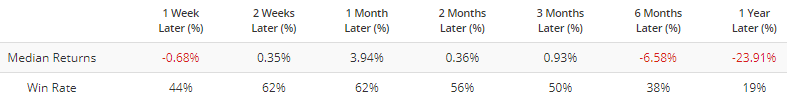

QQQ Optix is at 97, the highest level in a decade:

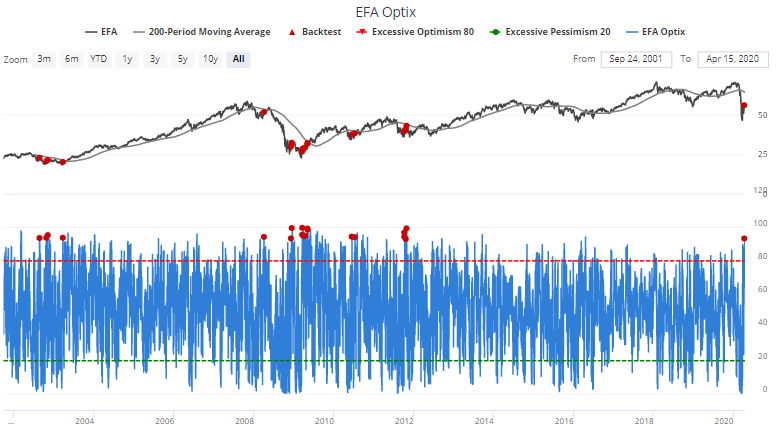

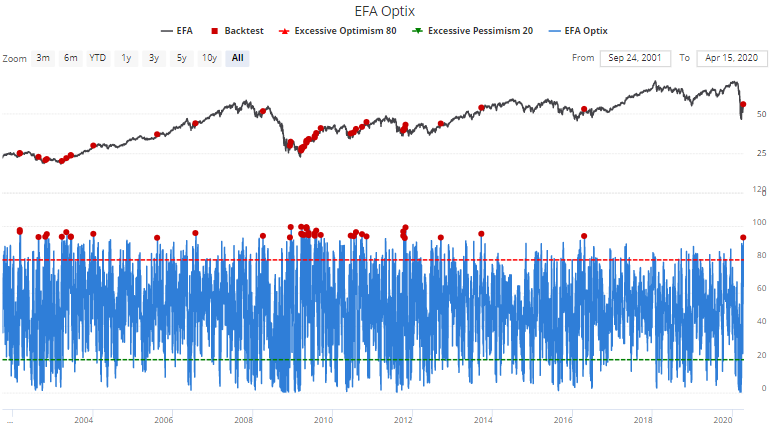

It's not just U.S. equities that are demonstrating excessive short term optimism. EFA Optix is at 93:

*EFA = etf for developed markets, excluding U.S. and Canada

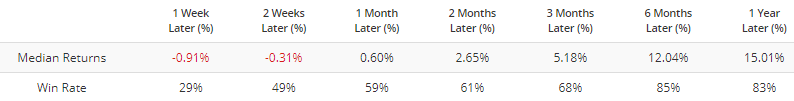

When short term optimism was this high, EFA usually suffered over the next week:

Historical cases when EFA was under its 200 dma were slightly more short term bearish and more long term bullish: