Short bets fall to 6-year low

As stocks have enjoyed a relentless rally, those who sell stocks short hoping to buy them back later at a lower price have fled.

According to Business Insider, investors haven't been this bullish on the stock market in at least 15 years.

"In a note published on Thursday, Goldman Sachs highlighted that short interest in the S&P 500 has fallen to its lowest level in at least 15 years of its 16-year data history. The decline in short interest comes as stocks cruise to record highs after recovering from the fastest bear market on record...The median stock within the S&P 500 had outstanding short interest equating to just 1.8% of its market cap, Goldman said."

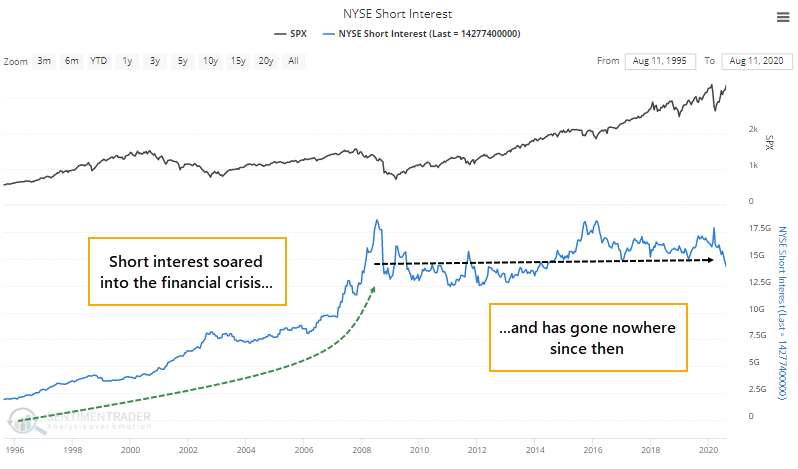

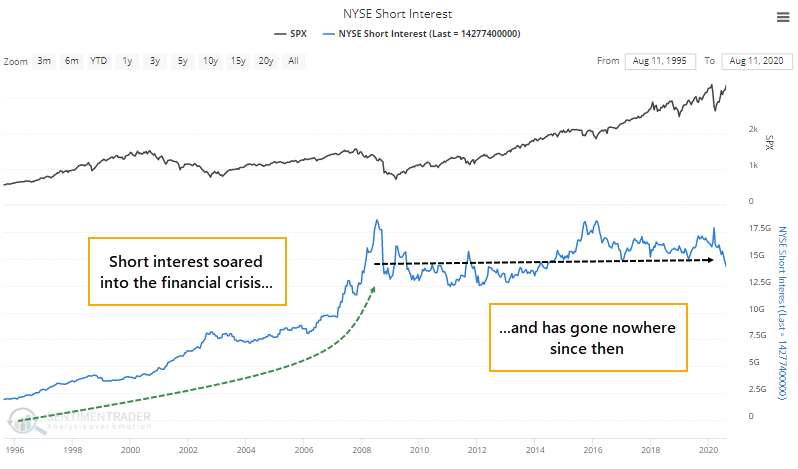

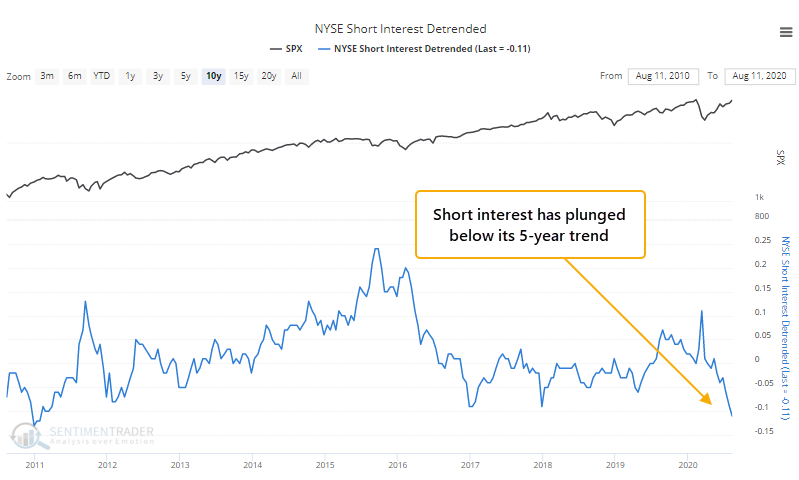

As a result, short interest among all NYSE securities has plunged. Short interest reflects the number of shares currently held short, needing to be bought back at a later date. After many years of rising short interest leading into the financial crisis, overall short interest levels have held relatively steady during the past decade.

Because short interest can be "trendy" over time, we de-trend it. This is simply each month's figure divided by its average over the past 5 years. We can see below how it has plunged from being 10% above average in March to more than 10% below average in August.

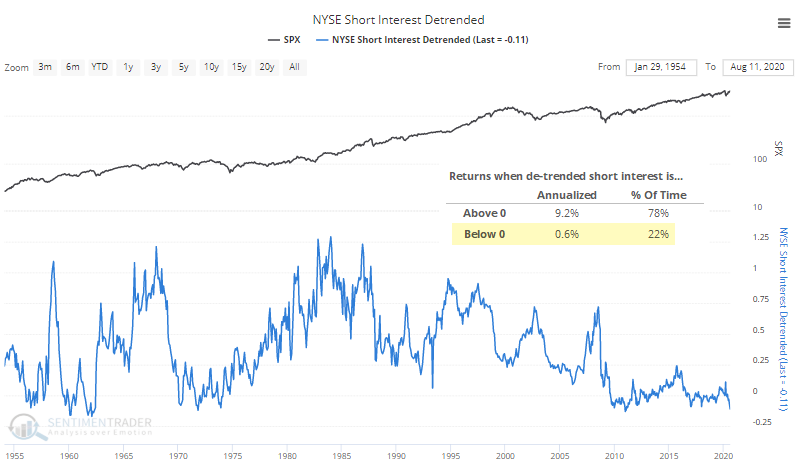

A longer-term view shows that this is unusually low. The S&P 500's annualized return when short interest is above trend is +9.2%. When short interest is below trend, that falls to +0.6%.

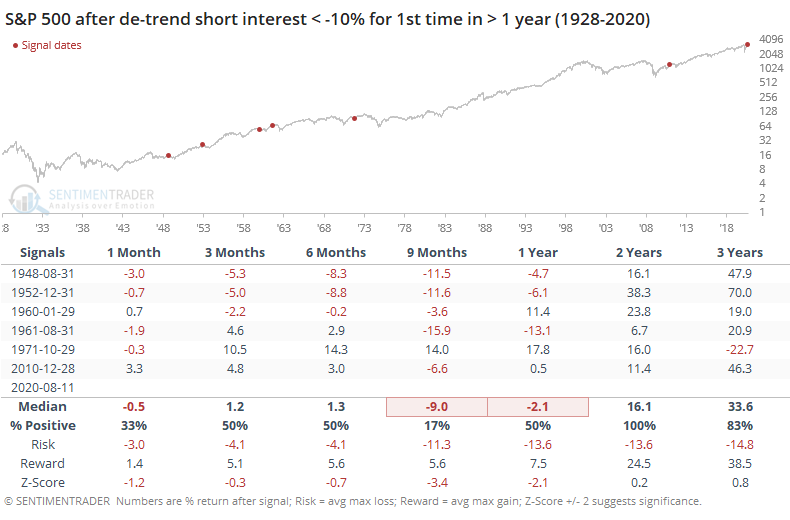

When short interest falls more than 10% below average, forward returns in the S&P were subpar over the next 9-12 months. Two years later, all of the signals showed a positive return.

Over the next 9 months, there was only a single winner out of 6 signals. That's too small of a sample size, with too big of an outlier, to be confident that this is a solid downside edge. We don't put a lot of weight on short interest anyway, so this would be at most a mild warning that some potential buying demand has been depleted.

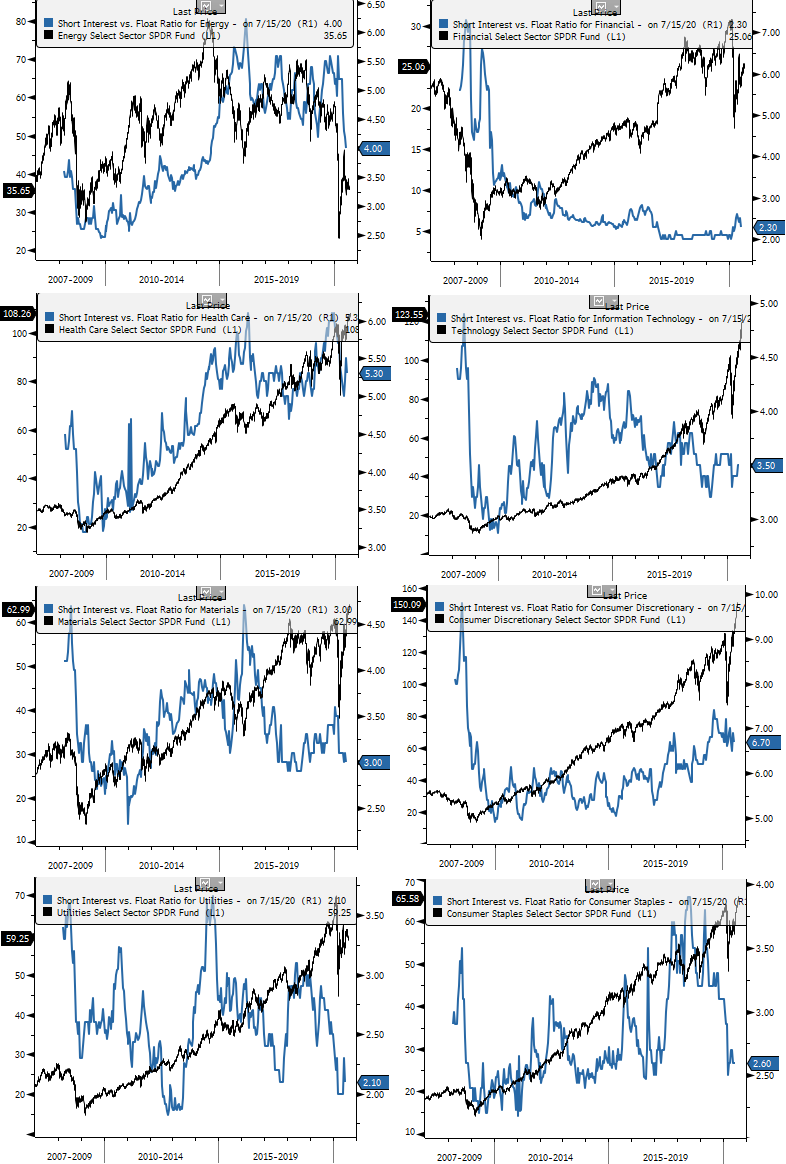

Among major sectors, only energy and health care are seeing short interest as percentage of float on the upper ends of their ranges, according to Bloomberg calculations. Most of the others near the low ends of their ranges, particularly materials, staples, and utilities.

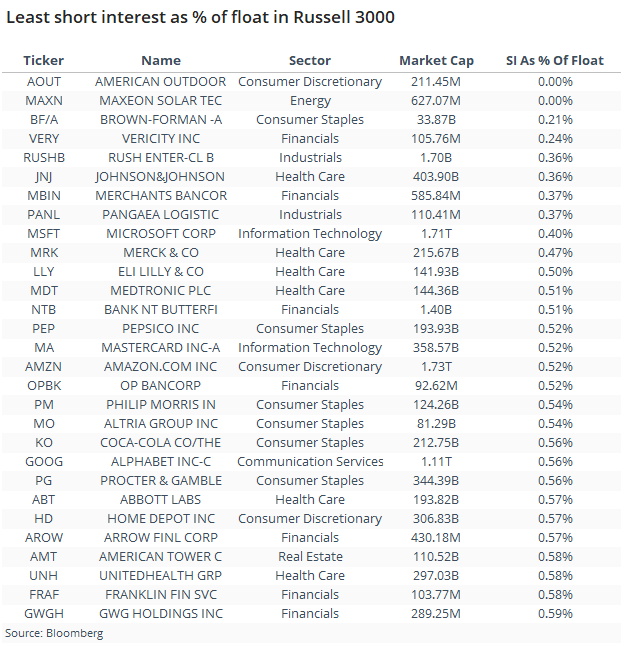

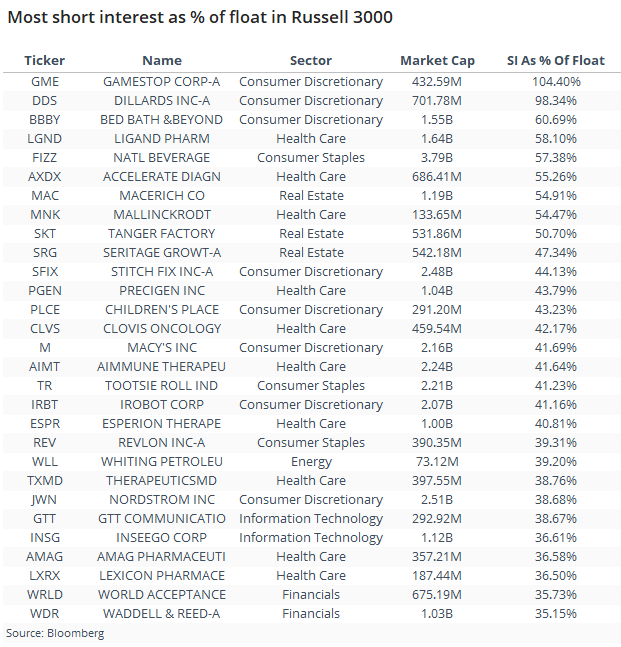

Within the Russell 3000, the tables below show the stocks with the least and most short interest outstanding as a percentage of float.