Shanghai Composite - Consolidation Setup

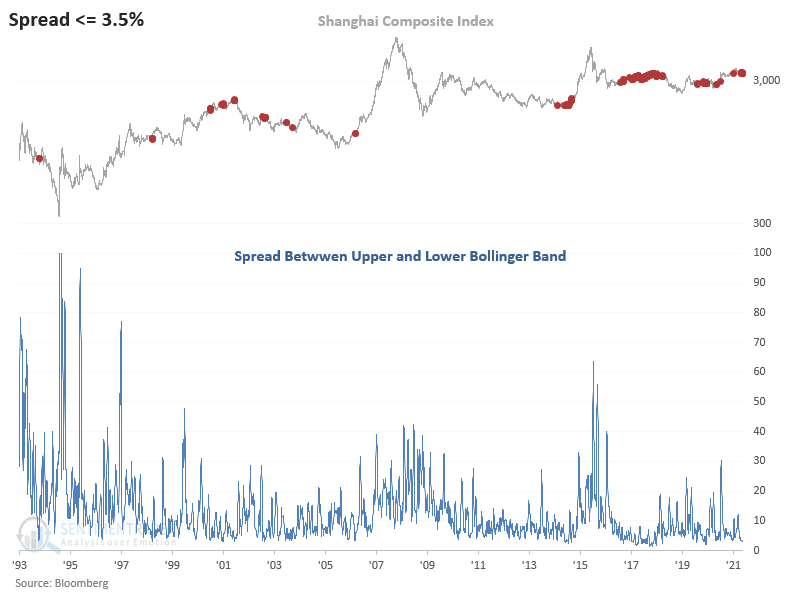

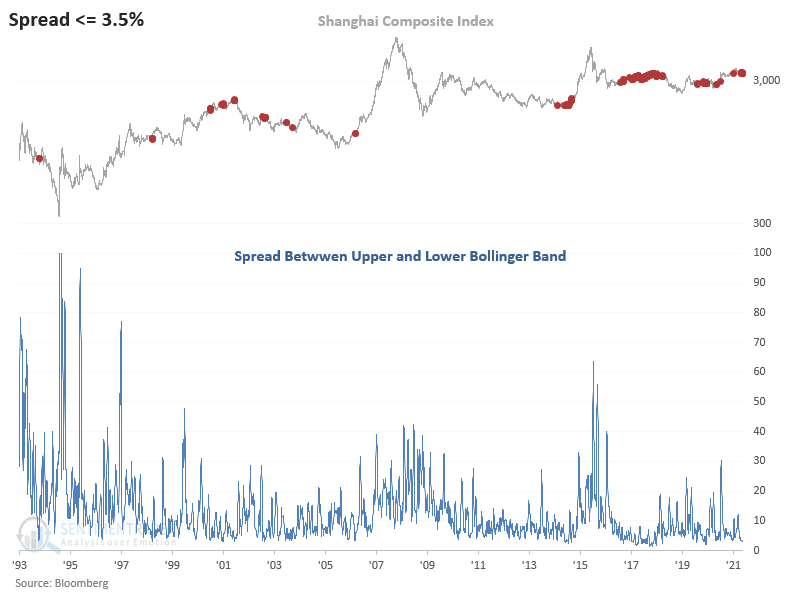

The Shanghai Composite (SHCOMP) has entered a low volatility consolidation phase that would suggest a future breakout swing trade opportunity.

Let's review a Bollinger Band breakout system that is universal across securities of all types.

THE CONCEPT

The Bollinger Band Breakout system seeks to identify a low volatility consolidation phase that sets up a future breakout swing trade.

INDICATOR

Bollinger Bands (standard indicator settings)

CALCULATION

Spread = ((UpperBand/LowerBand)-1)*100

CONDITIONS FOR A BOLLINGER BAND BREAKOUT

- Spread <= 3.5%

- If the spread is <= 3.5%, start days since true count.

- If the days since true count <= 10 and the security closes above the upper Bollinger Band, buy.

- If the days since true count <= 10 and the security closes below the lower Bollinger Band, short.

Let's take a look at some charts and signal performance.

HISTORICAL CHART

CURRENT DAY CHART

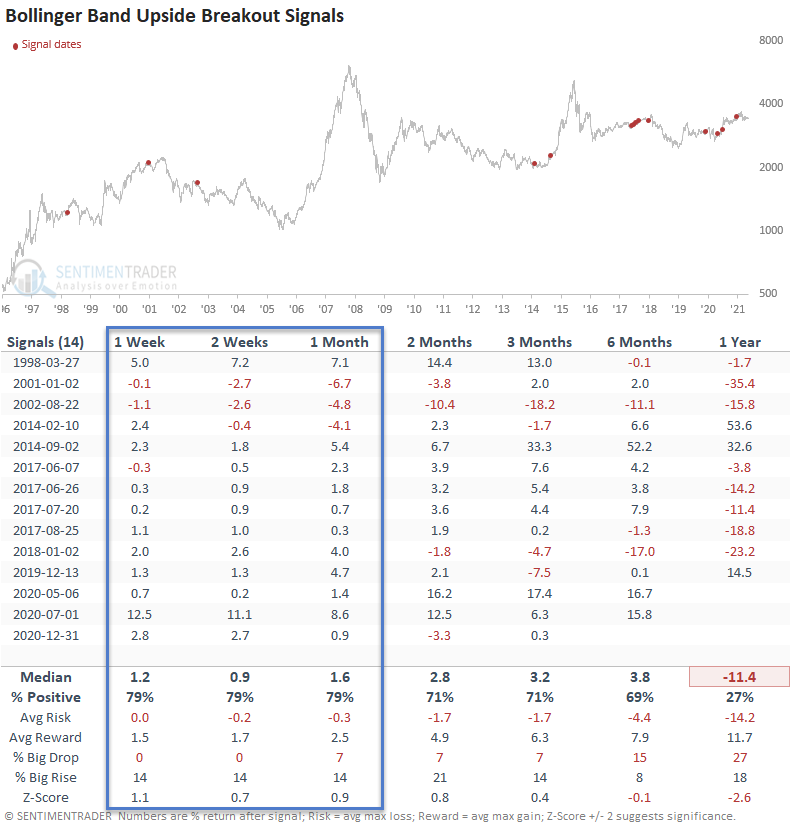

HOW THE SIGNALS PERFORMED

Performance looks robust in the 1-4 week timeframe. I would also add that the two and four-week periods show ten consecutive winners starting in 2014. The 1-year timeframe is interesting and highlights the problematic nature of a buy and hold strategy for the Chinese market.

HOW THE SIGNALS PERFORMED

The performance results in the table below reflect a Shanghai Composite short signal. The results in the 1-2 week timeframe would suggest a small window of opportunity.

Swing trading breakout systems are excellent tools for identifying low-risk trading opportunities with easily defined rules. I like the method as a systematic approach helps to remove the subjective side of trading.