Sentiment vs. breadth

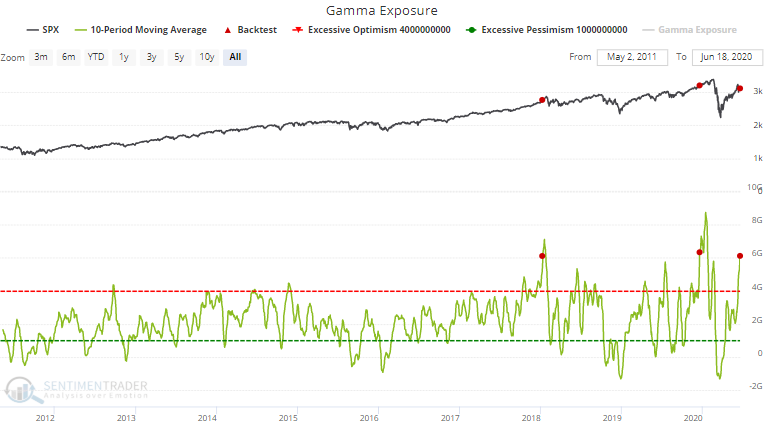

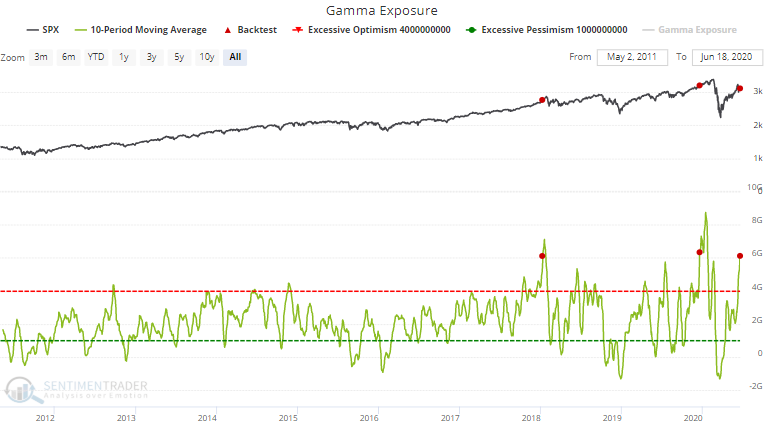

The weight of the evidence is short-medium term bearish for stocks, and longer term bullish. I looked at incredibly high Gamma Exposure more than a week ago, and after the market's plunge on June 11, Gamma Exposure is coming right back up. On a slightly longer term basis, this means that the 10 day average for Gamma Exposure is historically high (and rising).

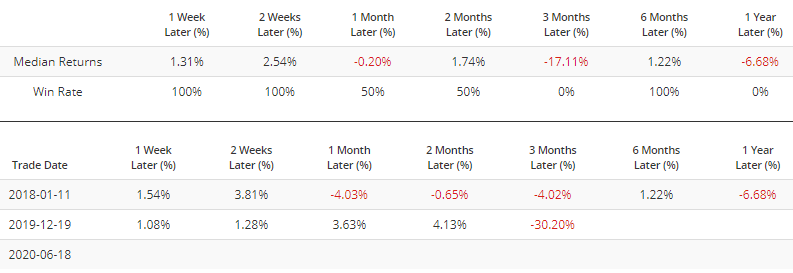

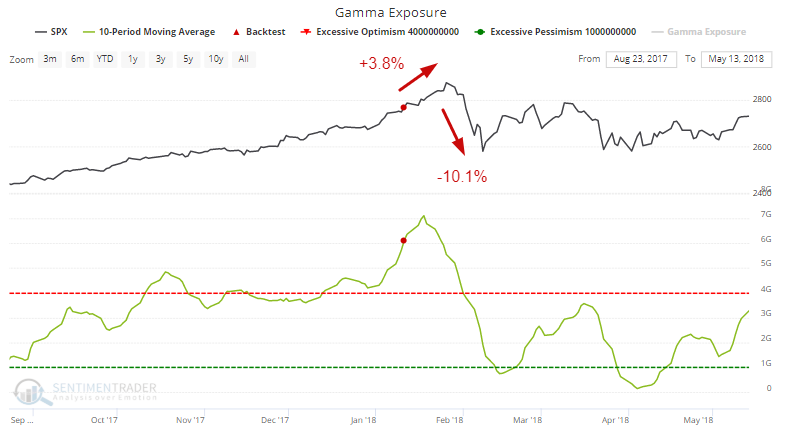

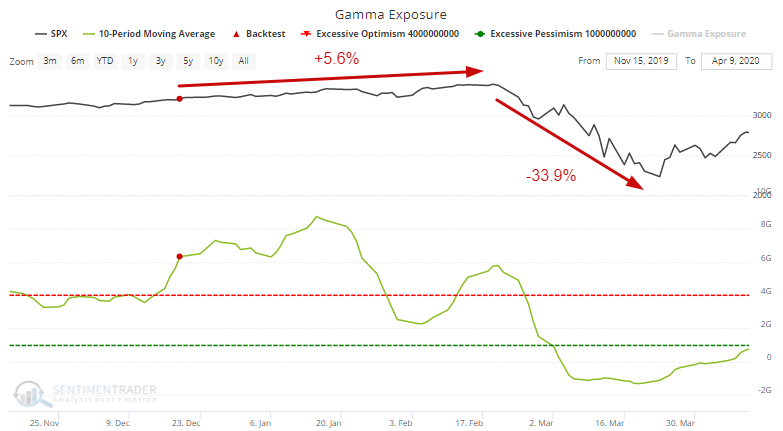

Gamma Exposure's 10 day average has only been this high 2 other times in almost 10 years: in January 2018 (before Volmageddon) and December 2019 (2 months before the March 2020 market crash).

In January 2018, the S&P rallied another 3.8% before it tanked -10.1% in a matter of days:

In December 2019, the S&P rallied another 5.6% before one of the worst crashes in market history:

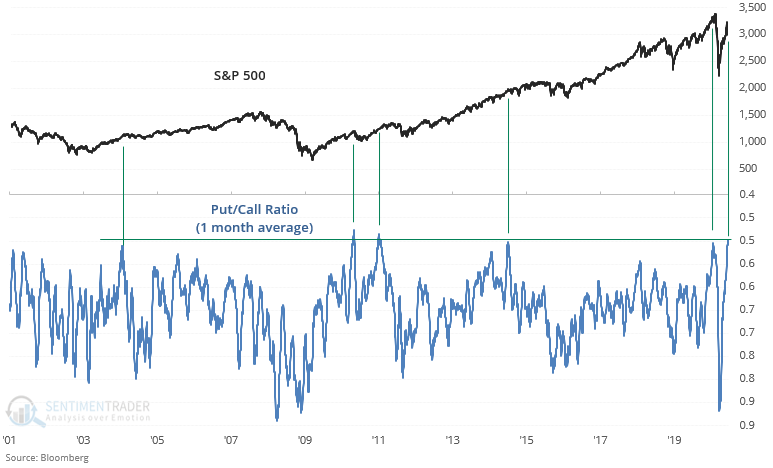

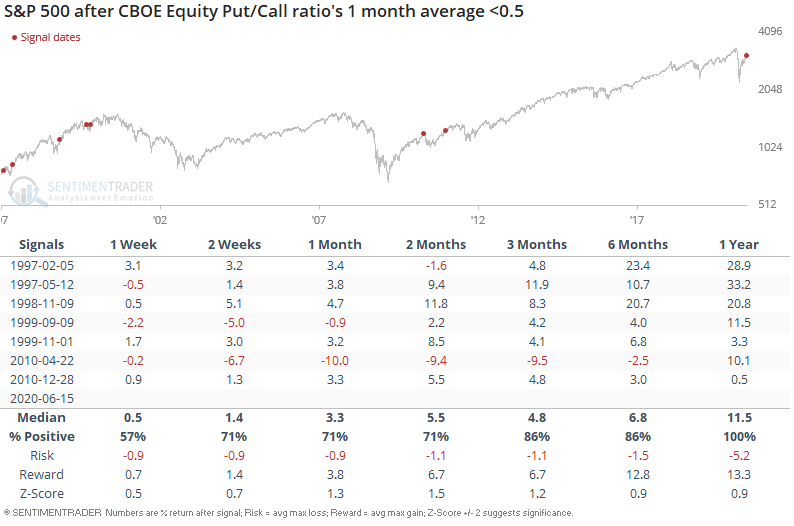

In the meantime, the Equity Put/Call ratio's 1 month average is at the 19th most overbought day in 20 years. Few days ever reached such an extreme level. This is even more extreme than at the stock market's top in February 2020. In some ways, this is an important risk for equities - monitor carefully.

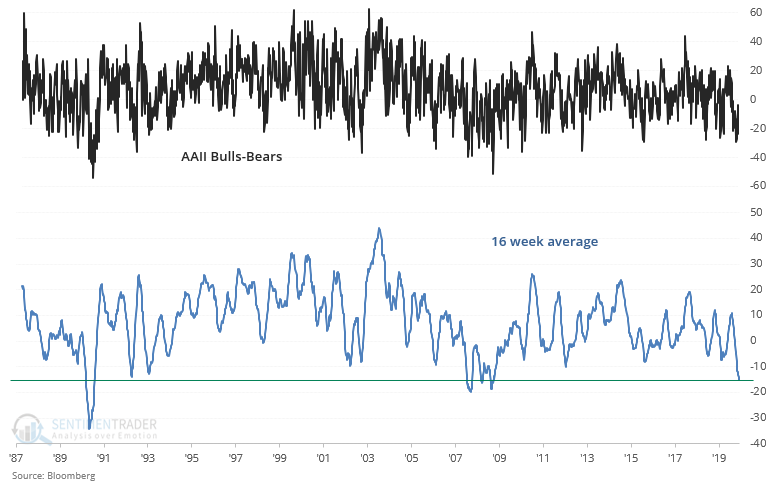

One of the few sentiment indicators not confirming the "investors are optimistic" theme is AAII. The spread between AAII Bulls and Bears is still quite low, pushing the spread's 16 week average to the lowest reading in over a decade:

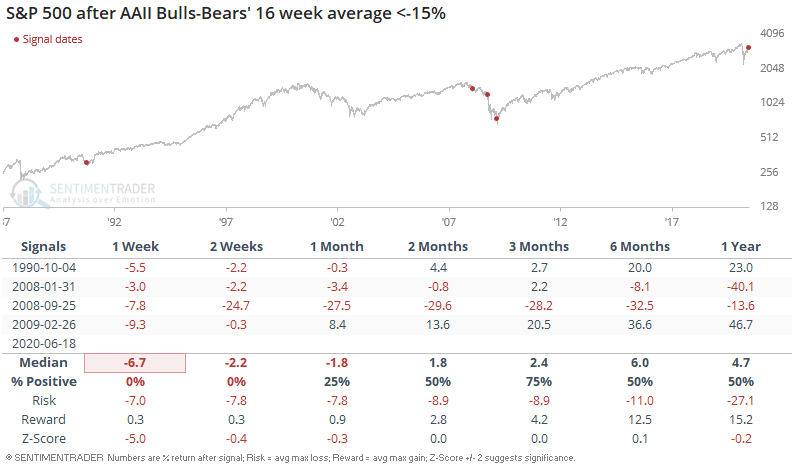

Such low "sentiment" (at least according to AAII) historically has not been a good reason to be bullish on stocks. On the contrary, this consistently led to a short term pullback in the S&P 500:

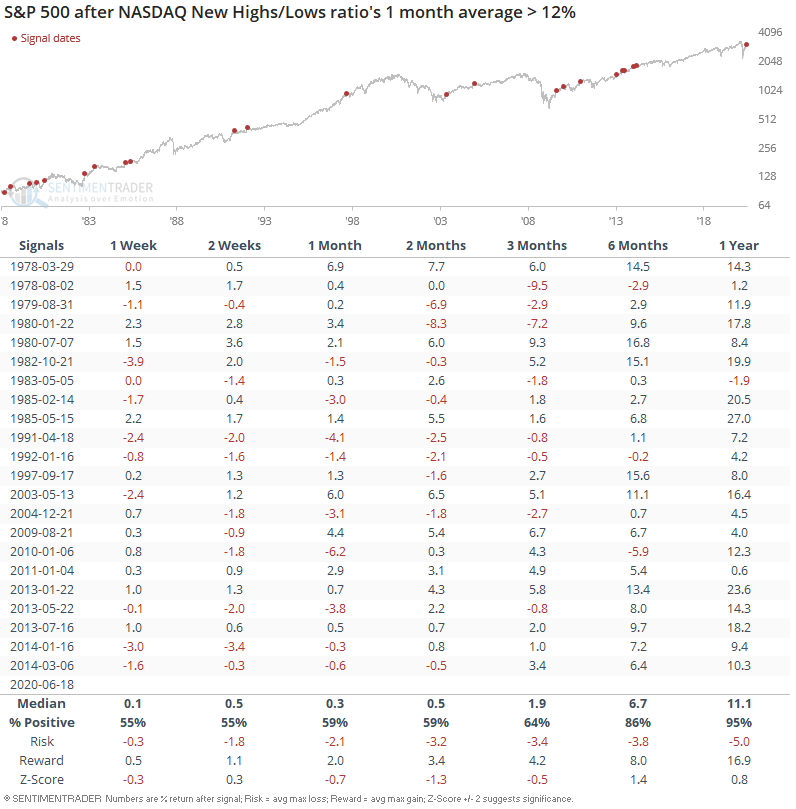

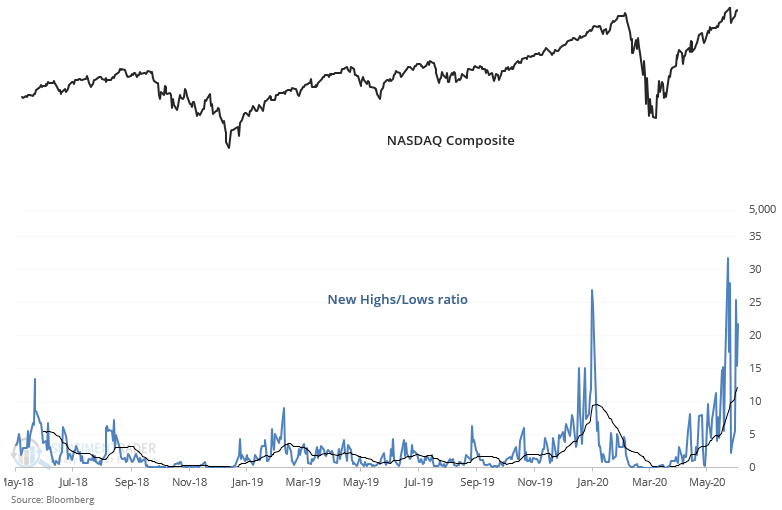

While sentiment is telling a short term bearish theme, breadth is supporting the long term bullish theme. Tech stocks' relentless surge has pushed the NASDAQ Composite's New Highs/Lows ratio higher and higher. The ratio's 1 month average is at its highest level in more than half a decade:

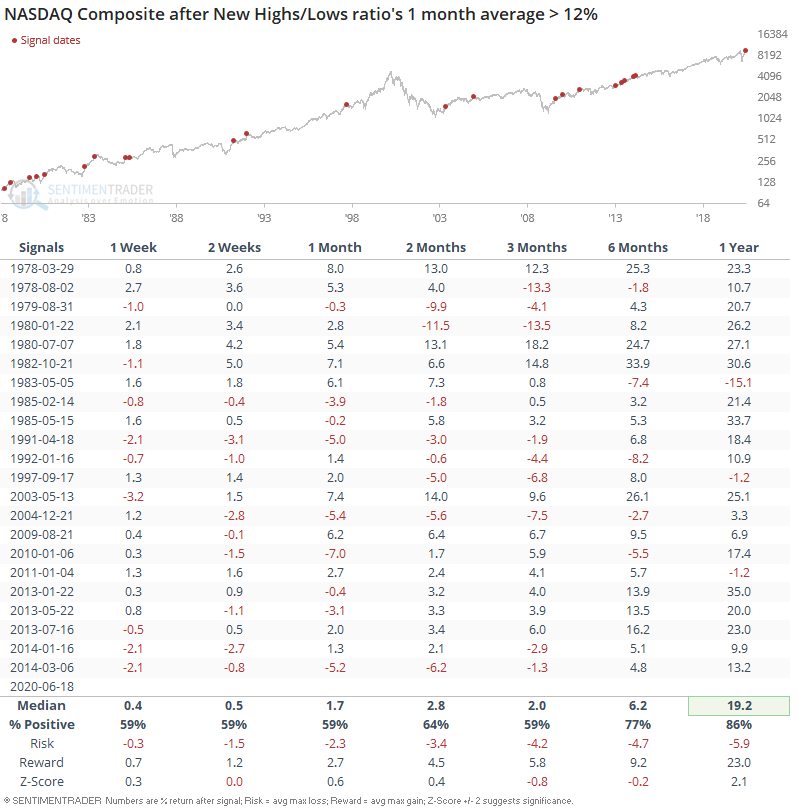

When the NASDAQ's breadth was this strong in the past, it could make a short term pullback (although it's hard to pinpoint exactly where). But on a longer term basis (1 year forward), this mostly led to more gains.

This had the same effect on the S&P 500 (since the NASDAQ and S&P tend to move together).