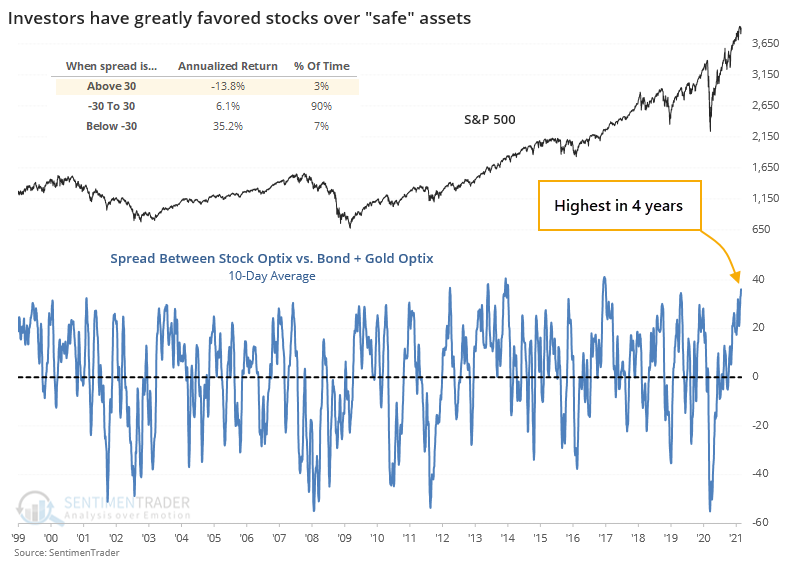

Sentiment on stocks nears record vs bonds and gold

If you ever look at the Market Overview on the Dashboard, then one thing may stick out in recent days - sentiment on stocks has stayed stubbornly high while it has soured markedly on bonds and gold.

At various times over the years, we've looked at similar bouts of relative sentiment extremes between stocks and supposed safe havens like bonds and gold. This one sticks out as being among the most severe.

Over the past 10 days, the Medium-Term Optimism Index (Optix) for stocks has been more than 35 points above the average Optix for bonds and gold. This is the widest spread in 4 years.

We can see from the chart that when the spread has been above +30 points, the S&P's annualized return was -13.8%, versus +35.2% when the spread was below -30.

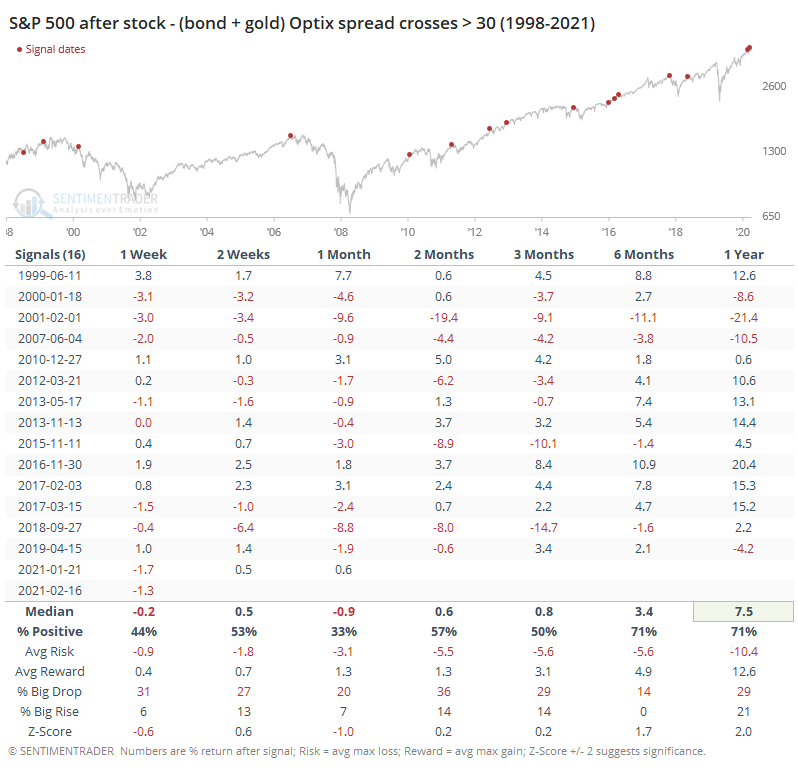

If we take a signal-based approach and buy the S&P when the spread first crosses above +30 for the first time in a couple of weeks, then we get the following forward returns.

The S&P tended to struggle over the next month or so. Even up to 3 months later, its returns were middling, with more risk than reward. It wasn't until 6-12 months later that it showed decent returns.

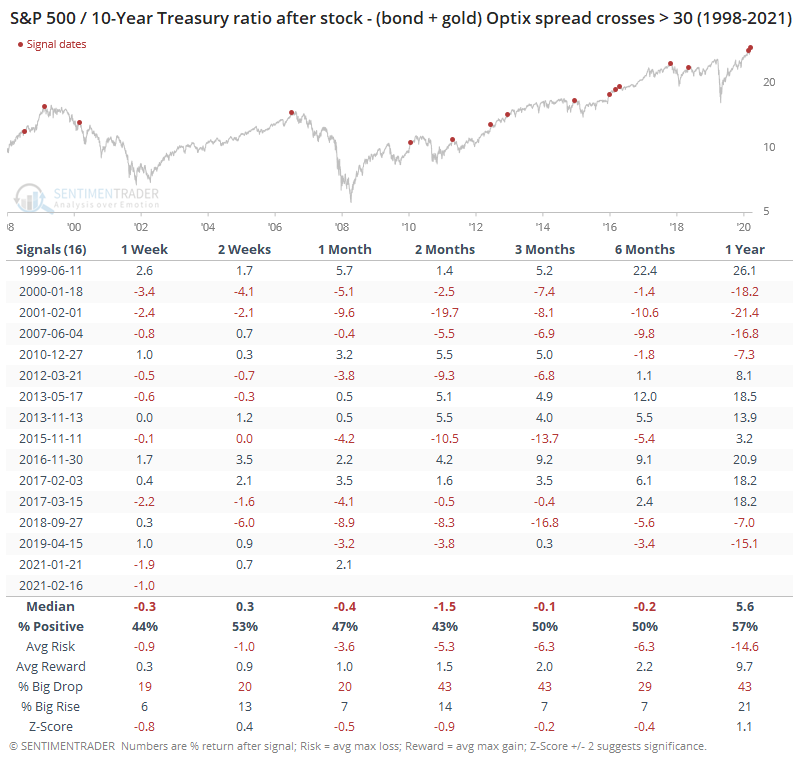

In terms of relative performance, the table below shows performance in the ratio of the S&P 500 to 10-year Treasury note futures.

Here, we can see fairly consistent weakness in stocks vs. bonds, with a very poor risk/reward ratio even up to 6 months later. There was a much higher chance to see a big drop in the ratio than a big rise.

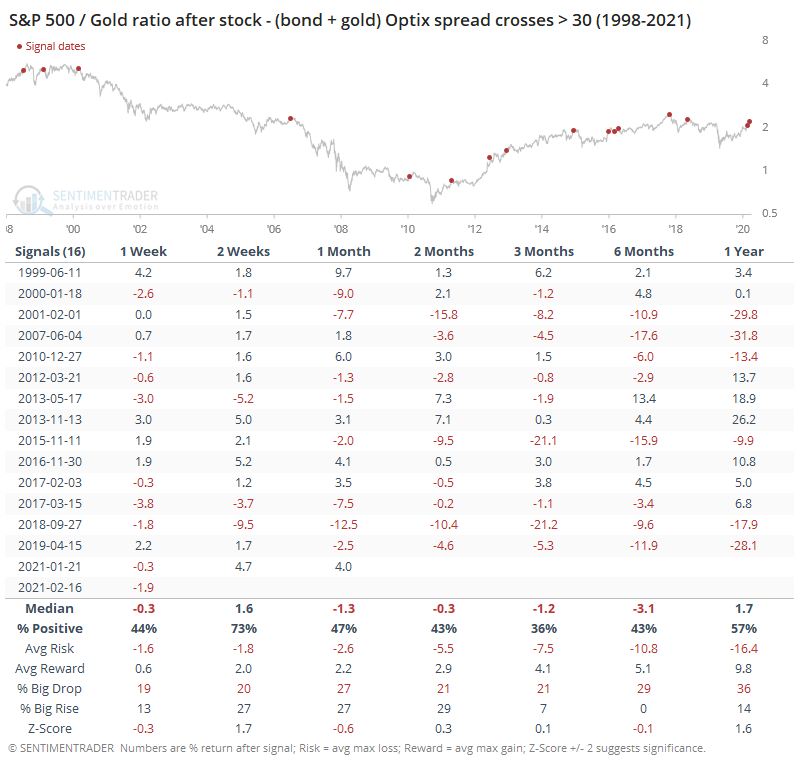

The S&P's performance against gold showed similar characteristics.

This was even more consistent than the ratio of stocks to bonds. Against gold, the S&P declined more consistently over the medium-term.

All markets are a tradeoff against another as investors decide where their money will be treated more fairly. When sentiment has swung toward one asset in a way that's out of whack with history, investors tend to swing in the other direction. That should be a headwind for stocks and tailwind for bonds and gold from here.