Sentiment is extremely......

Sentiment according to AAII is popular perhaps because A) the survey has been around for a long time and B) it's one of the few free sentiment indicators out there. In my opinion this isn't the most effective of sentiment indicators for a simple reason: looking at it from 2 different angles can result in 2 different interpretations. Here's what I mean:

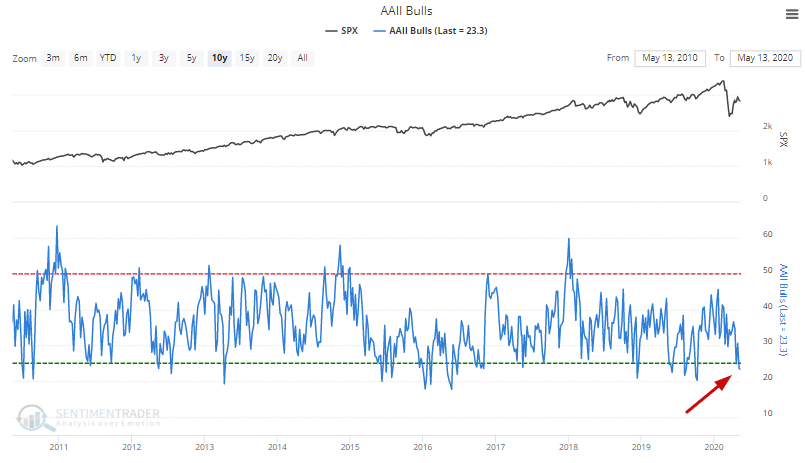

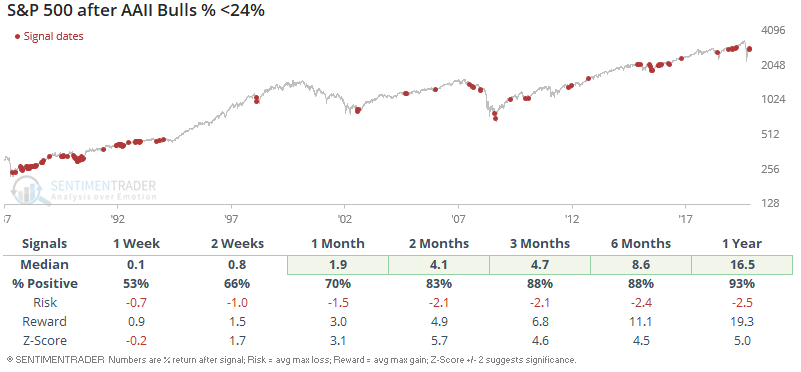

The % of bullish AAII respondents is under 24%:

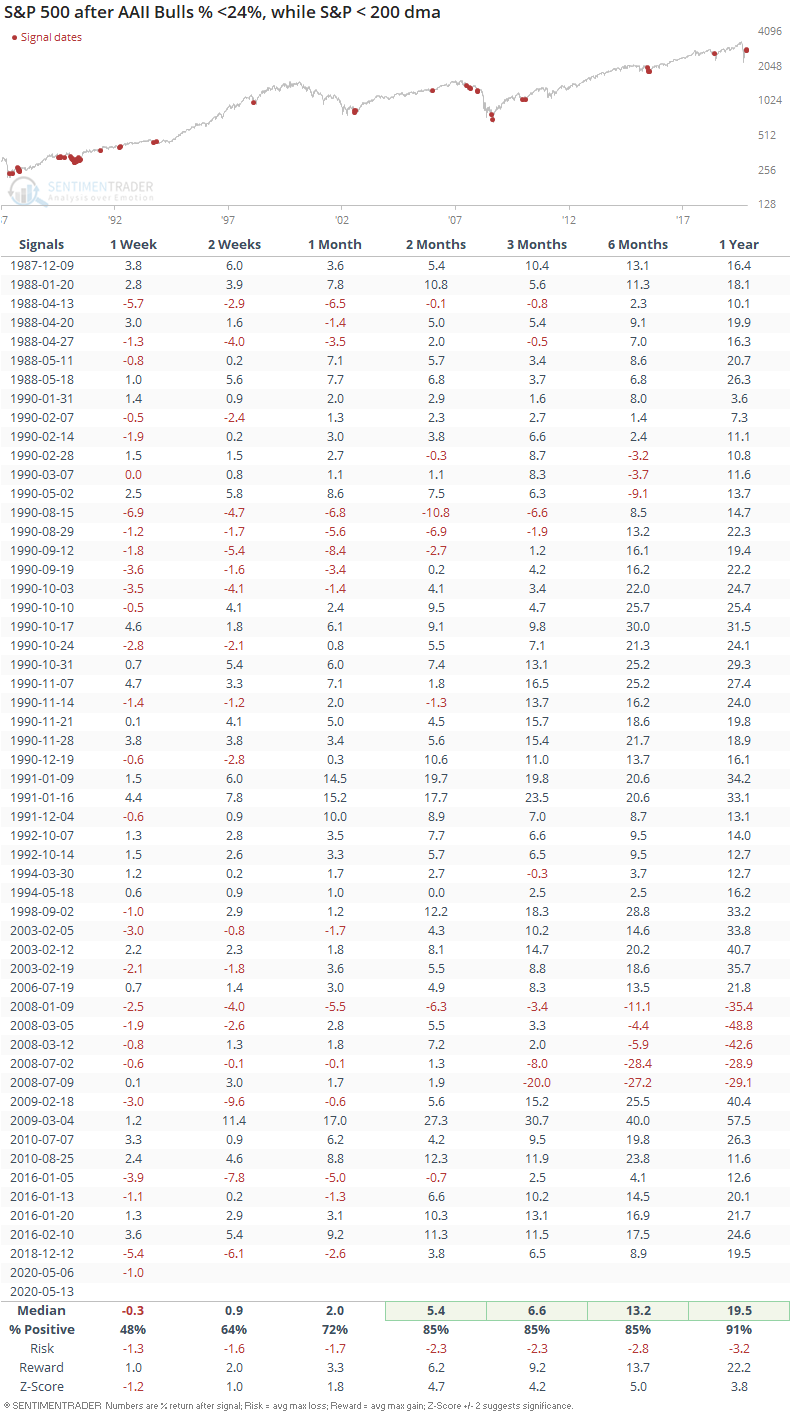

This was bullish for stocks 1+ months later in the 117 historical cases:

If we only examine the historical cases in which the S&P 500 was under its 200 dma, the S&P's returns over the next 2+ months were still extremely bullish:

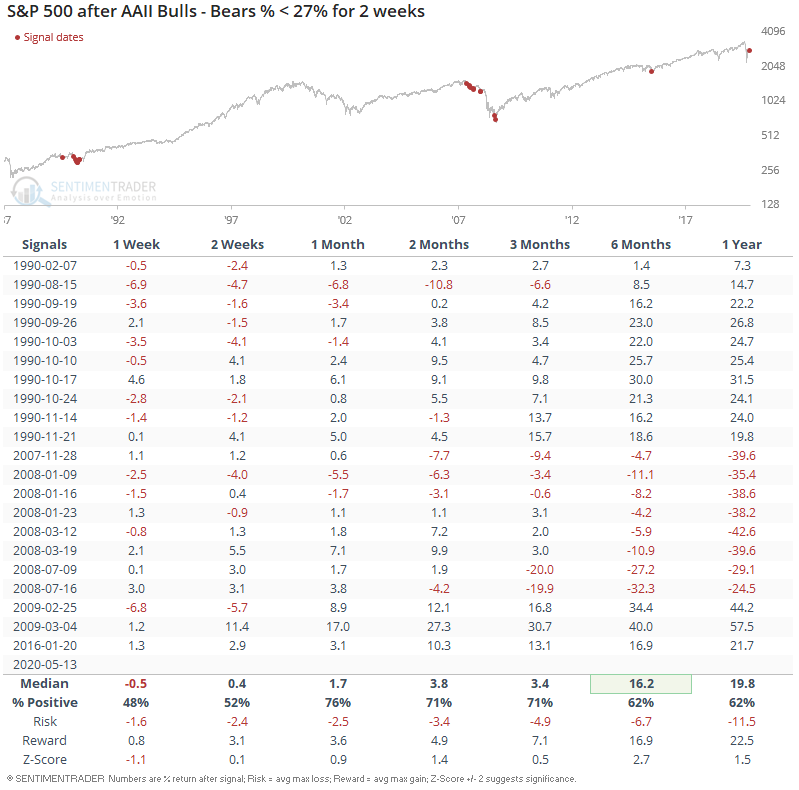

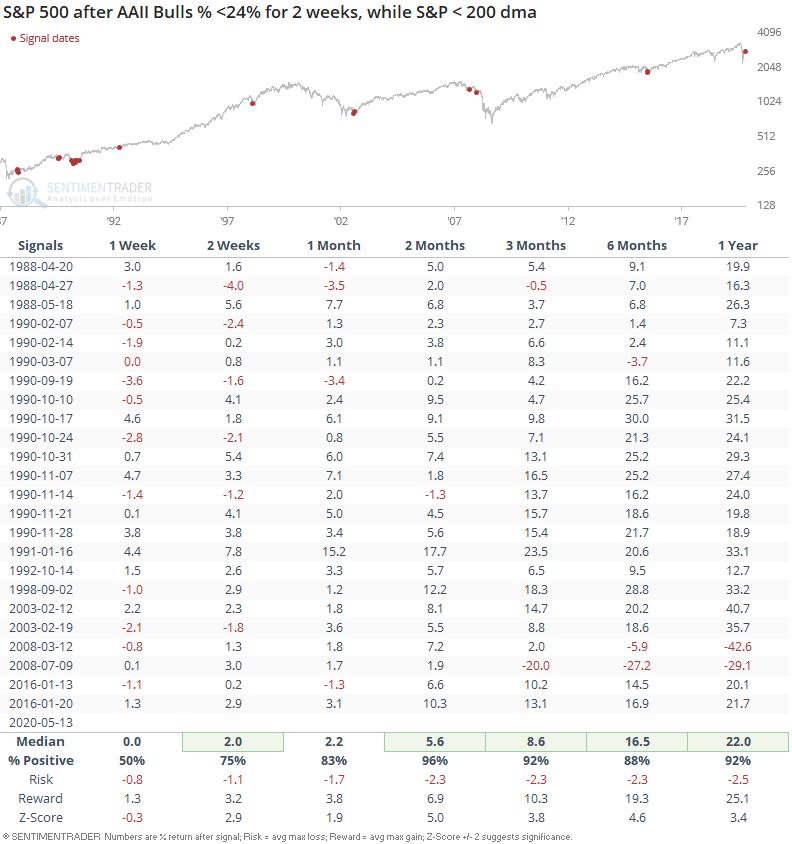

And if we only look at the cases in which AAII Bulls % was low for 2 weeks, as it is right now, the S&P's forward returns are still extremely bullish:

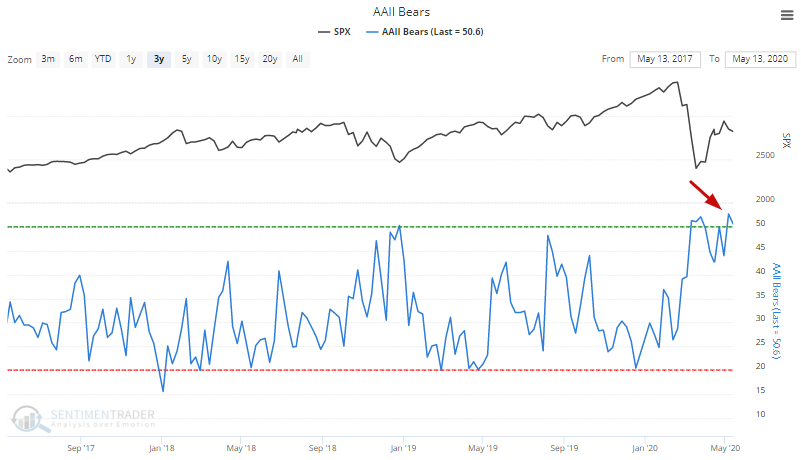

Now that we've examined the bulls, let's examine the bears. The % of respondents who are bearish is high:

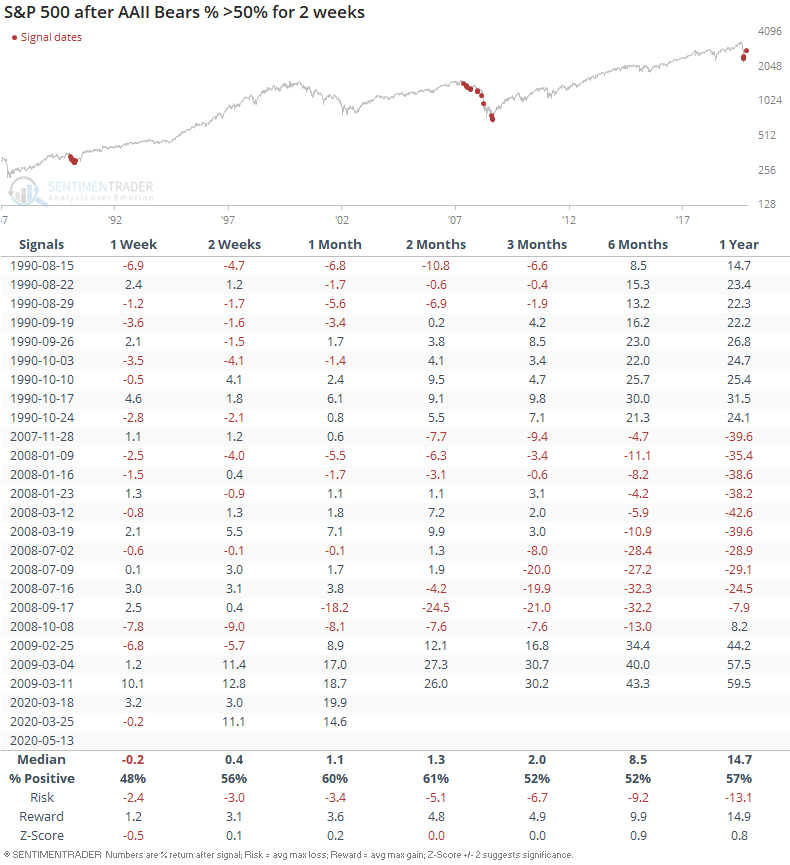

But contrary to what you might expect, this wasn't a bullish sign for stocks. Both the 1990 and 2008 cluster of cases saw stocks fall further before a long term bottom was reached:

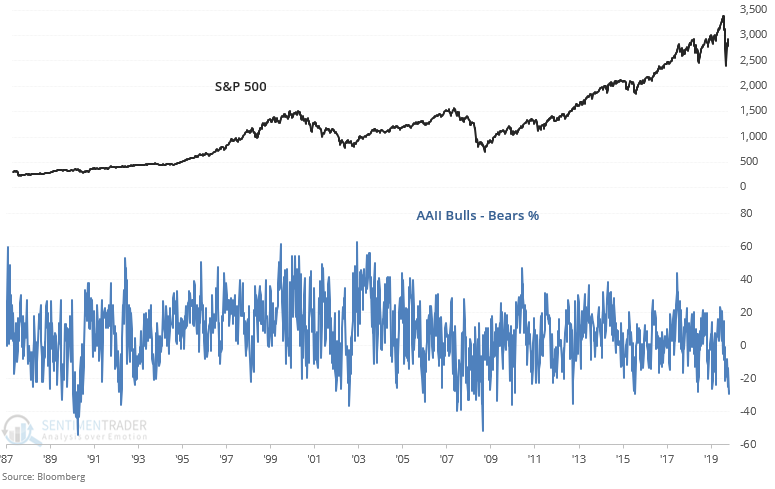

Similarly, the spread between AII Bulls and Bears is extremely low:

The 1990 and 2008 cluster of cases saw stocks further before reaching a long term bottom, whereas the 2016 case came after the bottom was in: