Sentiment Is Curling

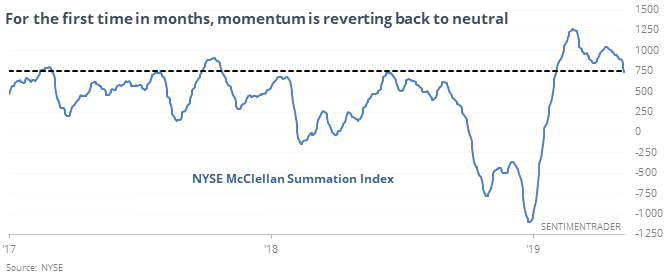

Summation finally weakens

We’ve discussed the McClellan Oscillator and Summation Indexes a lot in recent months, because they have been showing notable readings of momentum. That’s starting to ease with the long-term Summation Index, which dropped below 750 for the first time in months, ending its 2nd-longest streak above that level in 57 years.

Like most other displays of extreme momentum, these didn’t roll over often, and when they did, the losses tended to be muted.

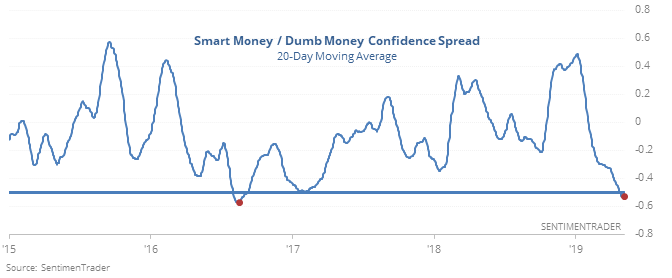

Sentiment is curling

The spread between Smart and Dumb Money Confidence reached an extreme months ago and has stayed there. Only now it is beginning to curl back in the other direction, with the 20-day average moving up from an extreme level.

That has preceded weak short-term returns when it triggered in the past.

The latest Commitments of Traders report as released, covering positions through Tuesday

The 3-Year Min/Max Screen shows only one new extreme from “smart money” hedgers, a multi-year short in Eurodollars. They mostly slightly reversed prior extremes. They do continue to add to exposure in agriculture contracts, though, now to the 2nd-highest level on record.

Reversal

The S&P 500 fund, SPY, lost more than 1.25% intraday, then reversed to close in positive territory. It’s trading above its 200-day average. There have been 14 similar signals in its history, 13 of which went on to gain over the next two weeks. The sole failure was in September 2000.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.