Sentiment Cycle Shows High Confidence for The Past 6 Months

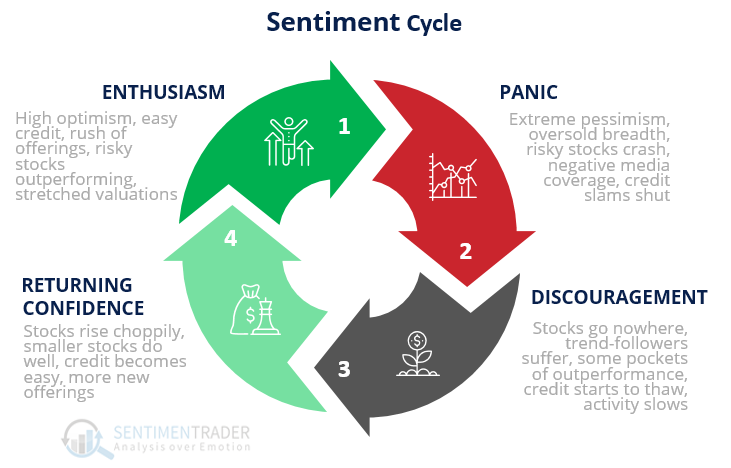

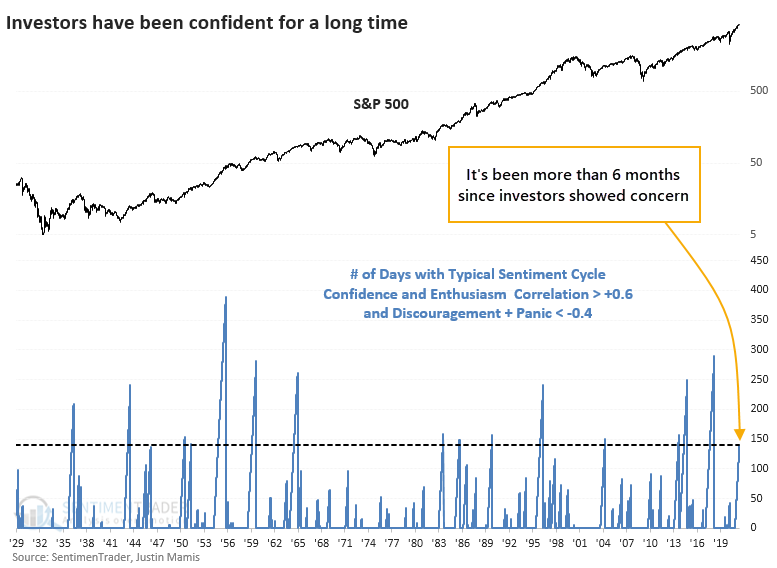

For more than six months, investors have had shown at least Returning Confidence and even Enthusiasm. That's according to the latest correlations to a Typical Sentiment Cycle.

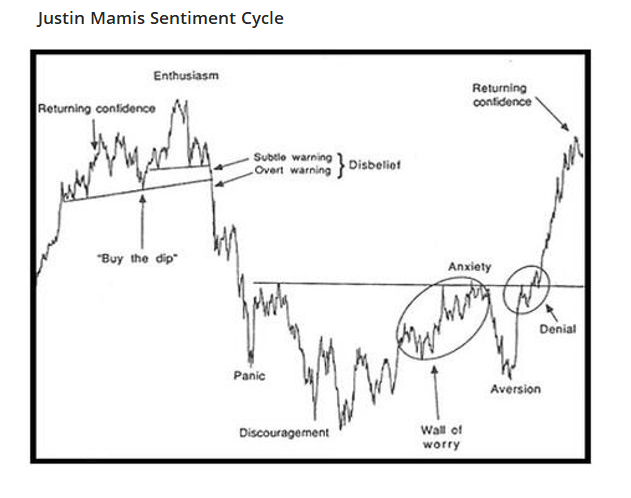

The idea of a repeatable pattern of investor behavior is questionable because the environment and inputs are always different. Human behavior is relatively constant, though, so many use some version of the Cycle popularized by Justin Mamis in his 1999 book, The Nature of Risk.

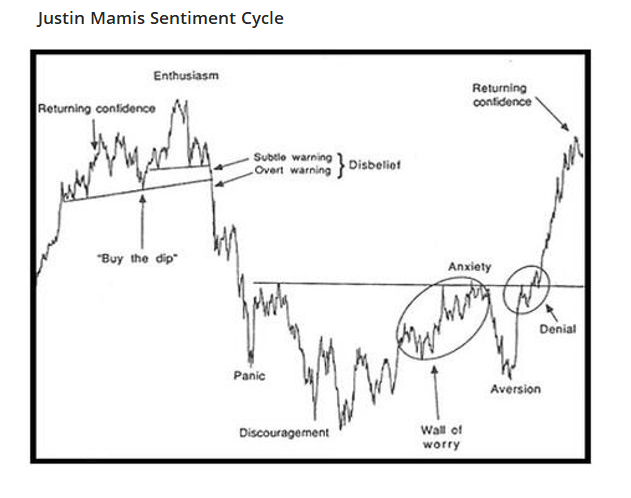

There are essentially 4 major parts to the cycle:

WHERE WE ARE NOW

If we go back to 1928 and compare all periods to that 1990-1991 period, we can see the correlation we have to each part of the Cycle. When we do that, we get the following estimates for where we are in the Cycle:

- Enthusiasm: +0.93

- Returning Confidence: +0.77

- Discouragement: -0.69

- Panic: -0.80

The correlations range from -1.0 (perfect opposite) to +1.0 (perfect symmetry). Based on that, there is a strong probability that we're in the Enthusiasm phase. Last September, the correlations suggested we were moving into the Returning Confidence phase, a good sign. It stayed there for a while, then moved into Enthusiasm near the end of last year.

So, it has been more than six months, 140 days to be exact, that the price pattern of the S&P 500 has had at least a +0.60 correlation to both Returning Confidence and Enthusiasm, while also showing at least a -0.40 correlation to Discouragement and Panic.

That has moved us into the top 15 stretches of time with this kind of confidence among investors.

LONG BOUTS OF ENTHUSIASM HAVE BEEN OKAY

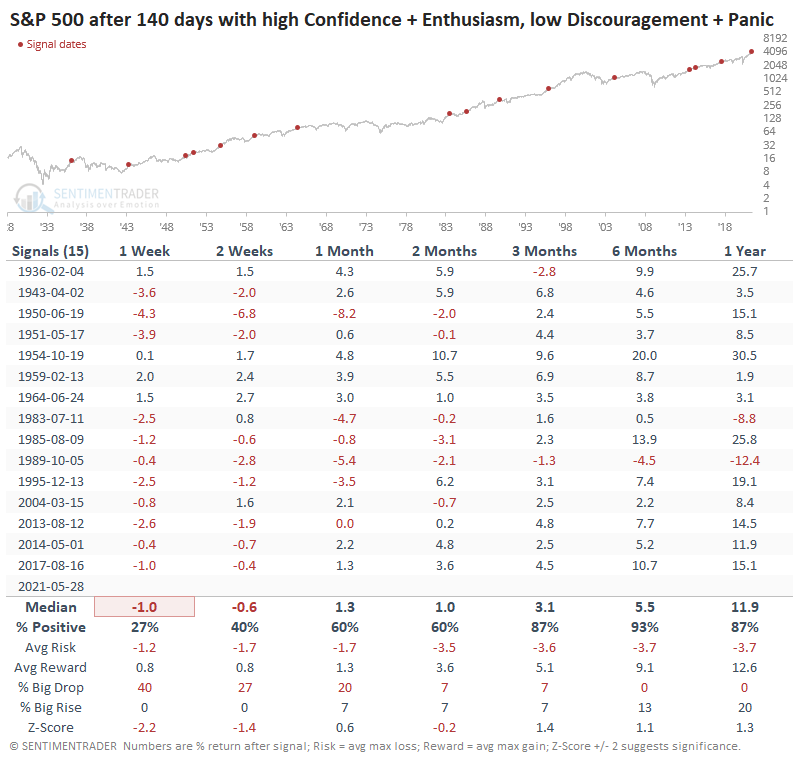

We wouldn't put a lot of weight on short-term returns following similar stretches, but those short-term returns were poor after the precedents for what it's worth.

Longer-term, the S&P showed more resilience. Over the next 3-12 months, there were few losses, and the risk/reward was quite positive.

The biggest risk is that some trouble spots like valuation and inflation take hold, and investors' confidence starts to ebb. That could help trigger a very rocky short- to medium-term environment. The biggest positive we can see right now is that momentum has been so strong that it tends to persist, and so far, we're still not seeing many internal warning signs of deterioration.