Sentiment cycle is "discouraging"

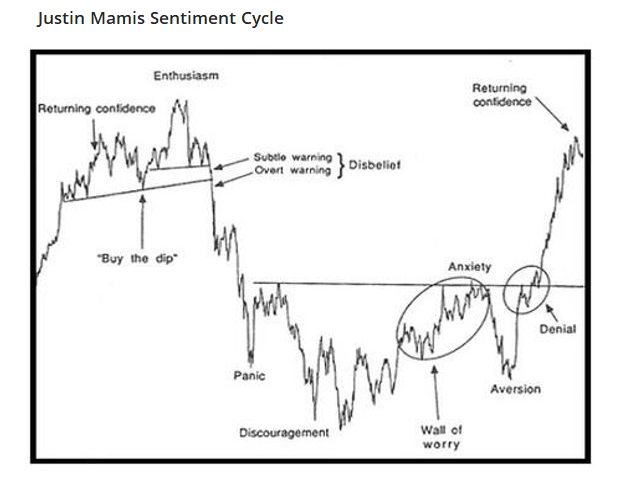

As stocks plunged then recovered at the end of 2018 and start of 2019, we reviewed the typical Sentiment Cycle as popularized by Justin Mamis decades ago.

At the time, price action was playing out about in accordance with the typical cycle, but there were good reasons to believe we were further along than the price pattern alone would suggest:

When we used to post this chart daily, the things we noted to watch to watch for when coming out of the Discouragement phase were 1) Explosive price gains over 2-3 day periods, 2) Massive thrusts in market breadth, 3) "Just another bear market rally" articles, and 4) Minimal pullbacks after short-term overbought readings. We can check all 4 of those boxes now, suggesting we’re further along the timeline than price alone would suggest.

That was from early January 2019, and it turns out that we were much further along than price action alone would suggest. There was never any testing of the panic low during what was supposed to be the "discouragement" part of the cycle.

This is notable because we can check most of those boxes now.

1. Explosive price gains over 2-3 day periods? Yes.

2. Massive thrusts in market breadth? Most definitely - by some metrics, the best we've ever seen.

3. "Just another bear market rally" articles? Yes.

4. Minimal pullbacks after short-term overbought readings? Questionable - as Troy mentioned in a premium note, many of our short-term Optix readings for major ETFs are now at extremely high levels.

That last point is debatable, depending on the indicator used. One could make the argument that on very short-term time frames, stocks have already been overbought and yet stocks continued higher until Tuesday, but it's not conclusive. Major bottoms tend to see buyers roll right over any hints of overbought readings.

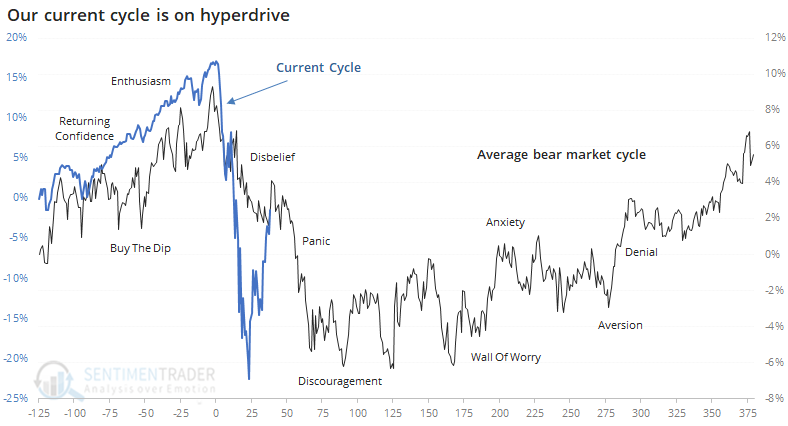

If we overlay the S&P 500's current path against the typical Sentiment Cycle again, then we get the following. Our current market has been so extreme in just about every regard that we've had to use a secondary scale.

Everything about the past two months has been on a super compressed time frame. What usually takes months or even years to play out has happened in days or weeks, even the slowest-moving aspects of fiscal and monetary responses.

Based on a very general pattern, we should be in the post-panic, discouragement phase of the Cycle. While it doesn't necessarily mean a lower low than the initial panic, it does often mean months of volatile swings that make everyone doubt their outlook.

The biggest problem with this idea is the same as in January 2019. We've already seen the kind of thrusts and behavior that we see during the latter part of the Sentiment Cycle, not the beginning, so we'd place less weight on the idea of a typical cycle than normal. If anything, given behavior over the past two weeks, the current juncture is more like "anxiety" than "discouragement."