Selling Off After We're Already Oversold

Whenever stocks are oversold and start to sell off even more, then it is a truism that we'll hear the cliche:

Markets crash when they're oversold

It happened on Black Monday in 1987, so...sure, it happens. Anything can and does happen in the markets. But is it a good bet?

Selling short a market that is already oversold, betting on a catastrophe, can pay remarkably, especially if using put options to speculate on the crash. The put buyer gets the double-bonus of the put getting more and more in the money, along with the super-charched addition of higher implied volatility.

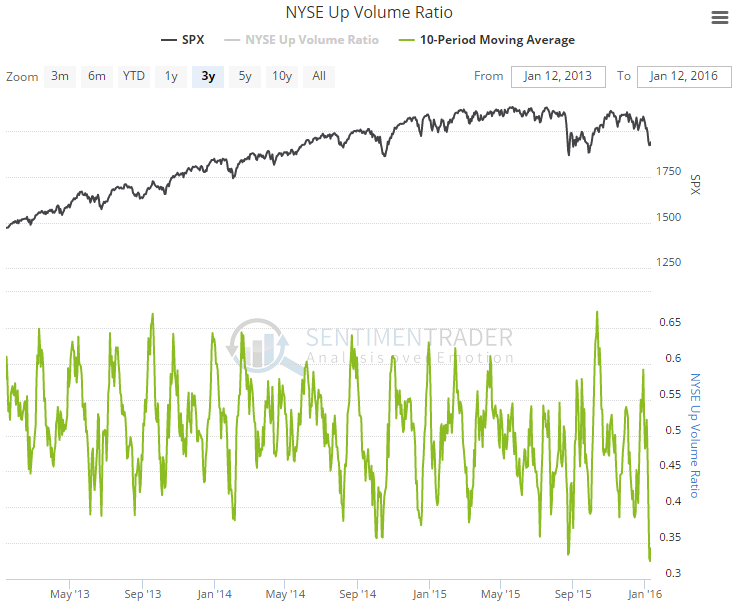

Defining "oversold" is open to opinion, so let's go back to what we almost always do in this case - the 10-day average of the NYSE Up Volume Ratio. As of Tuesday, it closed at 34%, already deeply oversold.

Now we'll look for any date since 1940 that the ratio was below 35% and then the S&P 500 sold off 2% in one day (it's just below that currently). Surely this is a pre-crash setup if ever there was one. After all, it occurred in October 1987 the day before the big crash.

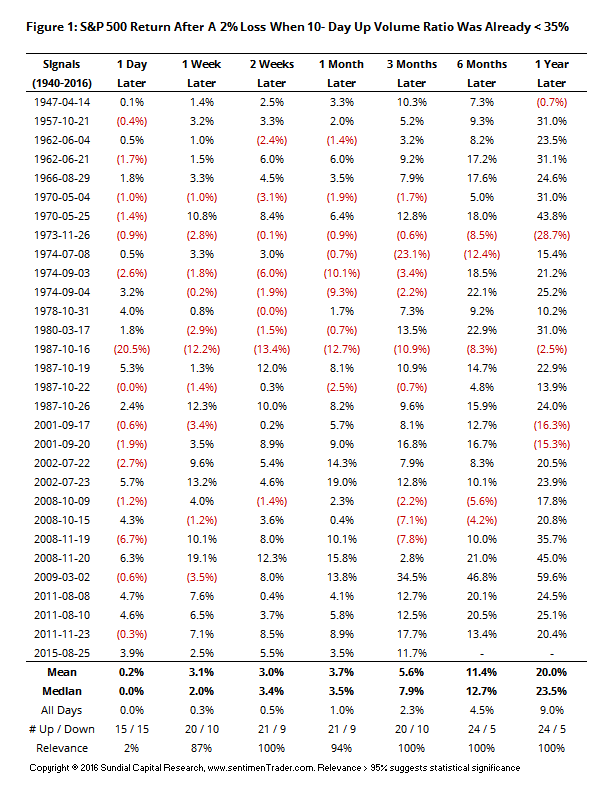

As we can see from Figure 2, 1987 was the exception (no surprise there). In fact, out of 30 occurrences, only 9 of them led to lower prices over the next month. And only four of those were larger than a 2% loss. In the past 40 years, there was only that loss from Black Monday and then another minor loss from later that October.

It's never good to be cavalier about markets. We could drop 10% tomorrow. But counting on the idea that we might crash because we're already oversold is an idea anchored on one horrific incident, ignoring the many times it not only didn't lead to a crash, but to significant gains.