Sectors and the Month of June

There are no "sure things" in the financial markets. But there sure are "things." Two of those "things" are:

- Except for the Nasdaq Index (for whatever reason), the month of June is often (though not always) unkind to the stock market.

- Specific sectors have shown a definite tendency to outperform during the sixth month of the year, while others have shown a definite tendency to underperform.

So, let's take a closer look at sector investing in June

For testing purposes, we will use the 11 S&P 500 Sector Indexes starting in 1950.

TOP AND BOTTOM JUNE SECTORS

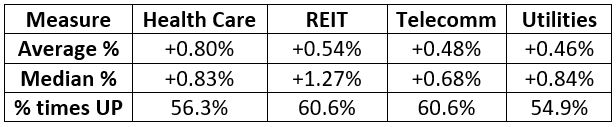

The table below shows the Top 4 performing sectors for June

The table below shows the Bottom 4 performing sectors for June

COMBINED PERFORMANCE

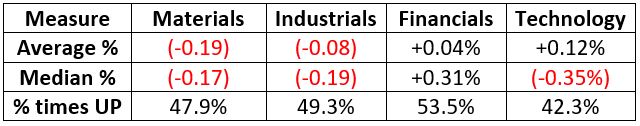

Next, we will test the top and bottom sectors as follows:

- Each June, we divide one portfolio by four and allocate 25% to each of the Top 4 sectors listed above

- Each June, we divide another portfolio by four and allocate 25% to each of the Bottom 4 sectors listed above

The chart below displays the cumulative growth for both the Top 4 and Bottom 4.

Two quick takeaways:

- The overall performance of the Top 4 is not exactly "eye-popping" (I warned you earlier about the "so-so" nature of stock performance during June)

- Nevertheless, the Top 4 clearly outperformed the Bottom 4

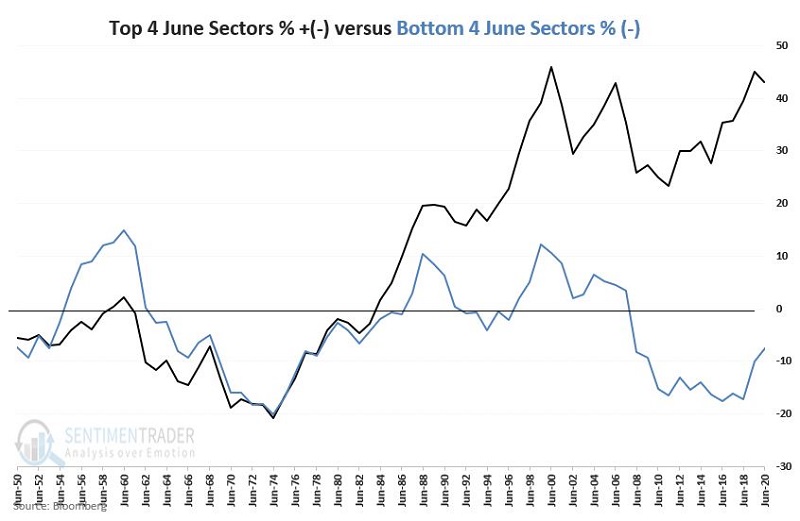

The chart below divides the growth of the Top 4 by the growth of the Bottom 4. When the line is rising, it means the Top 4 sectors are outperforming and vice versa.

Quick takeaway:

- The Top 4 underperformed during the first seven years and last two years of the 1950-2020 test period

- However, the Top 4 consistently outperformed the Bottom 4 for the intervening 61 years

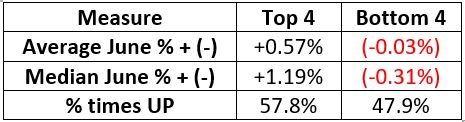

The table below displays the relevant comparative performance figures between the two groups from 1950-2020.

SEASONALITY ILLUSTRATED

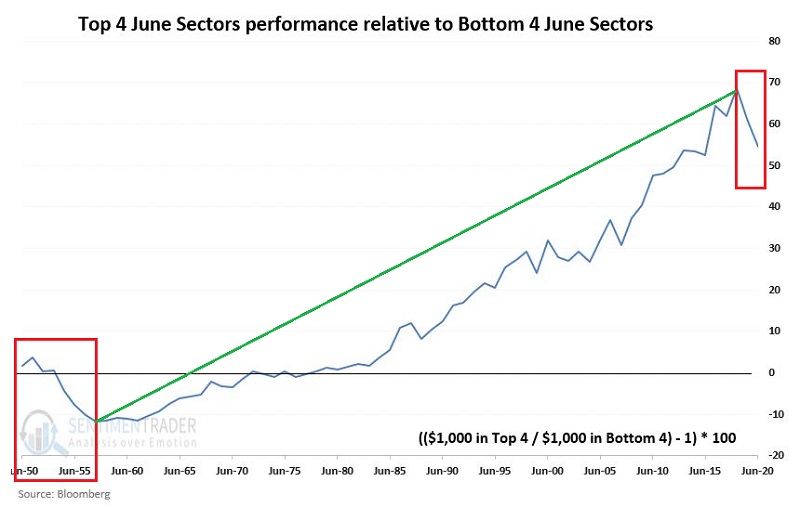

The two charts below display the annual seasonal trend for ETFs covering the top 2 June sectors - Health Care (XLV) and REITs (IYR).

The two charts below display the annual seasonal trend for ETFs covering the bottom 2 June sectors - Material (XLB) and Industrials (XLI).

SUMMARY

As always, seasonal trends come with the standard caveat that "there is no guarantee regarding what will happen this time around." But if a trader is looking for an "edge," certain sectors appear to be a better bet than others in the month ahead.