Sectors and factors depending on the election outcome

A couple of days ago, we looked at what the summer might look like depending on how the odds change for President Trump to hold onto the White House. Essentially, it was better for stocks if an incumbent Republican managed to hold onto the office or lose to another Republican.

We got quite a few questions asking if there were any specific sectors or factors that did better or worse depending on the outcome.

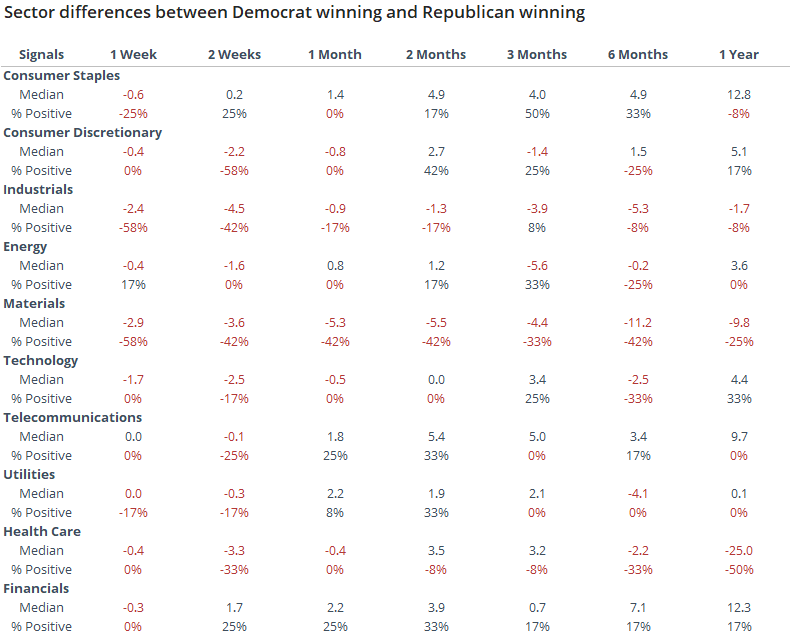

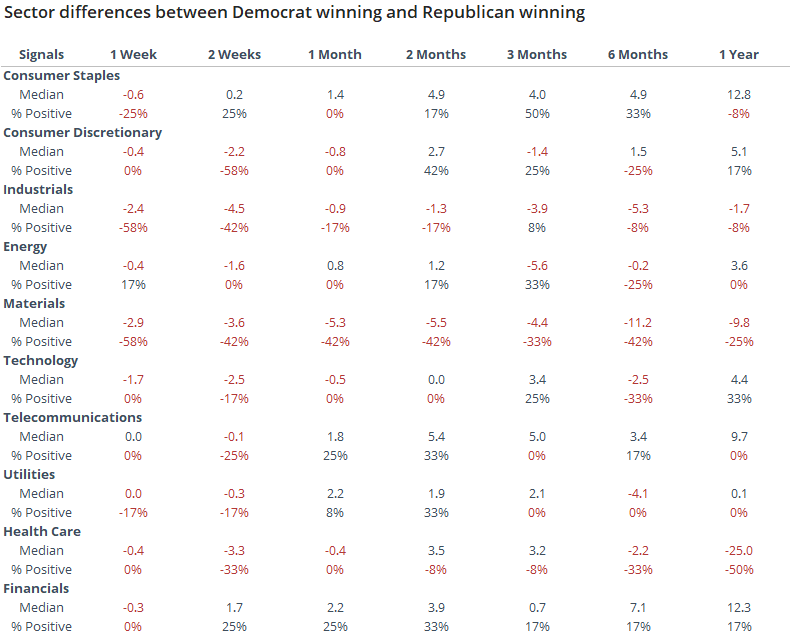

The table below shows the difference in returns and percentage of the time the sector was positive between those years when a Democrat won versus a Republican. If the number is positive, then that sector did better when a Democrat ended up winning the election.

The largest positive differences over the next 6 months were in staples, followed by financials and communications. The biggest negatives were in materials, health care, and technology. Again, it's hard to assign cause and effect, but we might see some of these sector differences become pronounced depending on how the election odds play out in the coming months.

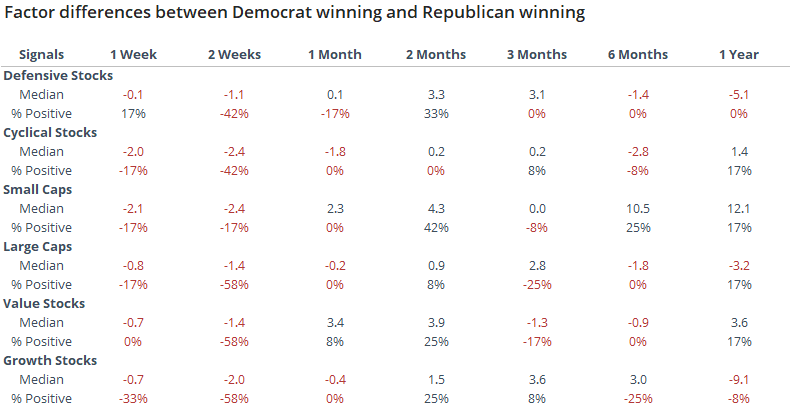

Here is the same table for factors.

Small-cap stocks showed the only positive factor if a Democrat ended up taking the White House vs a Republican. Cyclical and growth stocks were among the most consistent losers, but the edges were not large.

It's a little iffy to base a conclusion on this data because we don't know what the election outcome will be ahead of time. It does suggest, though, that given the historic performance and optimism currently baked into growth (especially tech) shares, the high and rising probability of an incumbent Republican loss should be a headwind for sustained further gains.