Seasonality, Utilities, and Junk

For those who don’t follow the premium Twitter account, which you have access to if you’re receiving this message, following are some of the studies and indicators that have been posted over the last couple of days. If you’d like to follow the Twitter account, please request to follow @SenTrader_Prem on Twitter then send an email to admin at sentimentrader dot com to let us know your Twitter account name.

These are posts from earlier today.

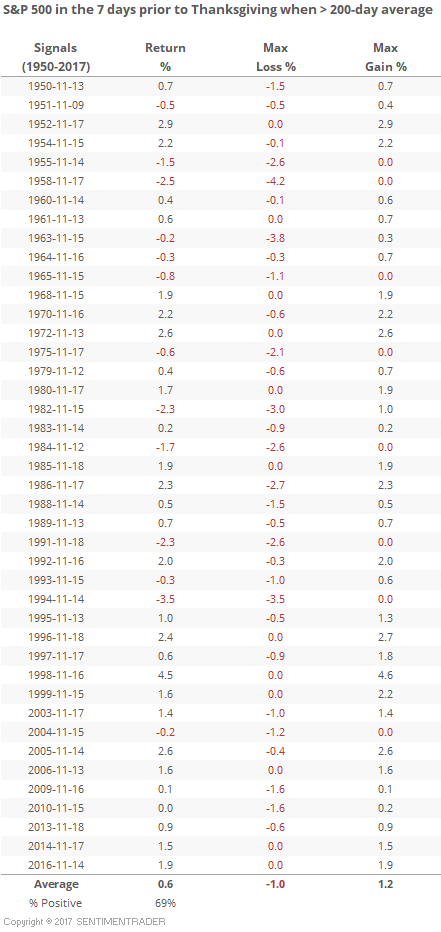

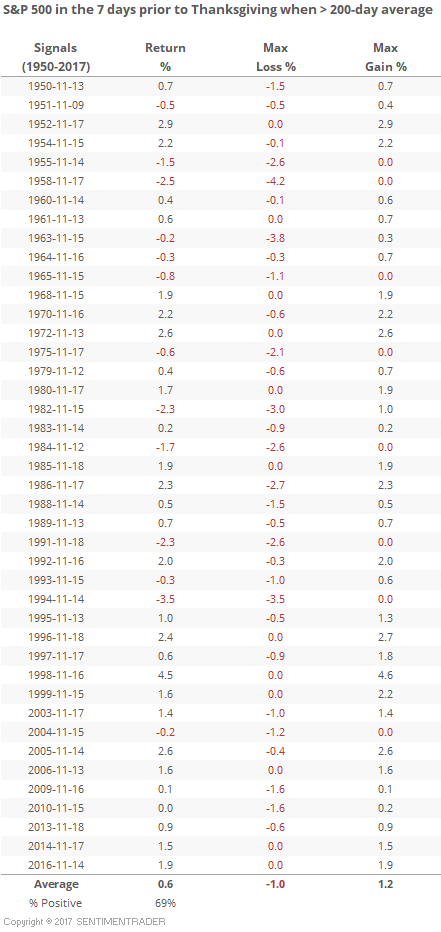

Biggest arguments against a selloff here is momentum and seasonality. Rarely see much of a pullback this time of year, especially in past 20 years. 1994 was last meaningful pullback.

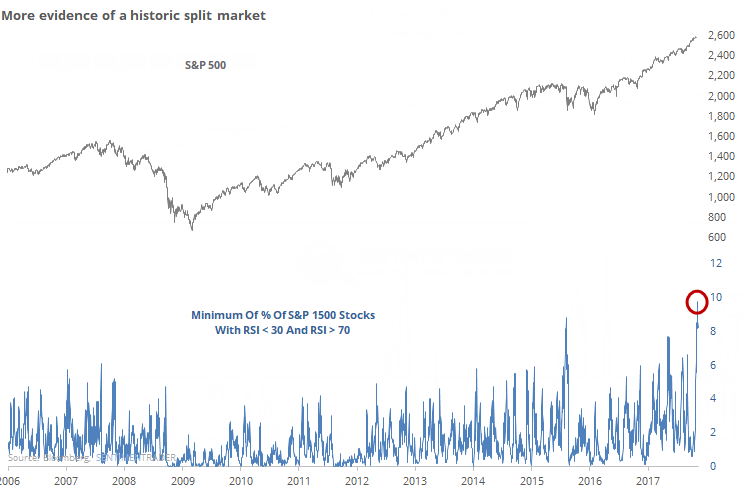

Just how split is this market? Among S&P 1500 stocks, more than 8% are oversold (RSI < 30) *AND* more than 8% are overbought. Most since '05. Closest was early Aug 2015.

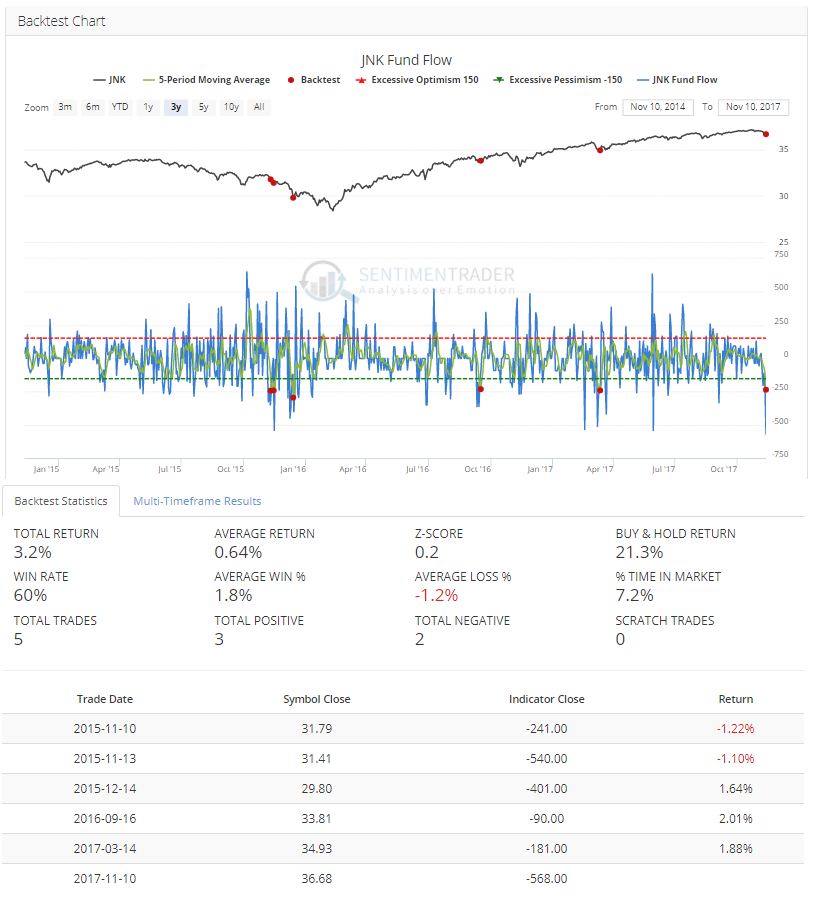

Okay, now the outflow in junk bond funds is hitting some extremes. 5-day avg on JNK at -235 mln is notable Next few weeks were good, but failed in 2008.

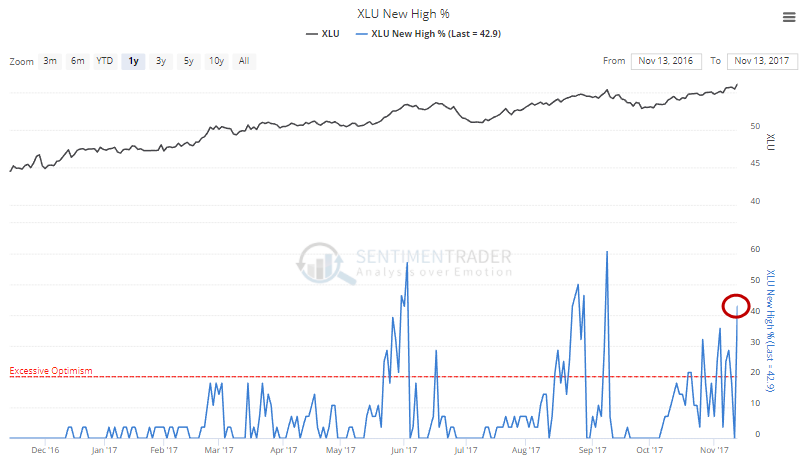

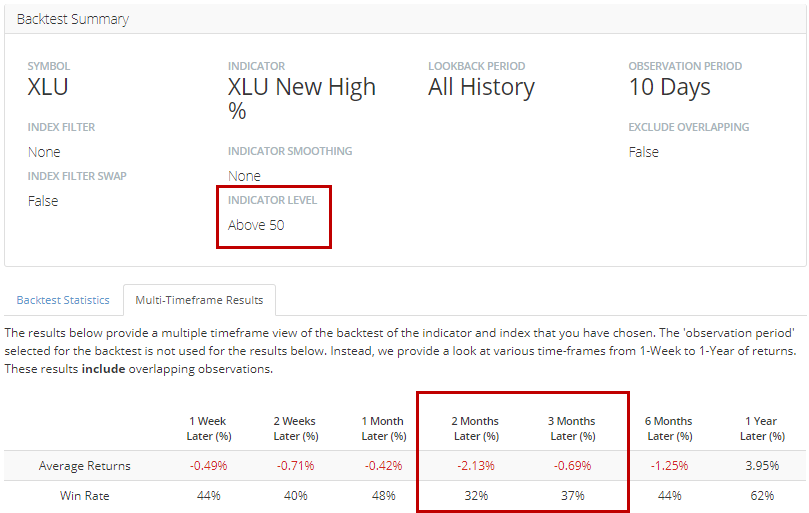

Big move in utilities pushed 40% of the stocks to new highs. Nearing extreme, but XLU hasn't had consistent trouble until more than half were at new highs.