Seasonal Overview

As we head into a new month, it's always interesting to take a look to see if there are any consistent tendencies among the markets and sectors we watch. Outside of commodity contracts, the concept of seasonality is iffy, especially in recent decades. So for many stock indexes and even sectors, it should be taken with a grain of salt.

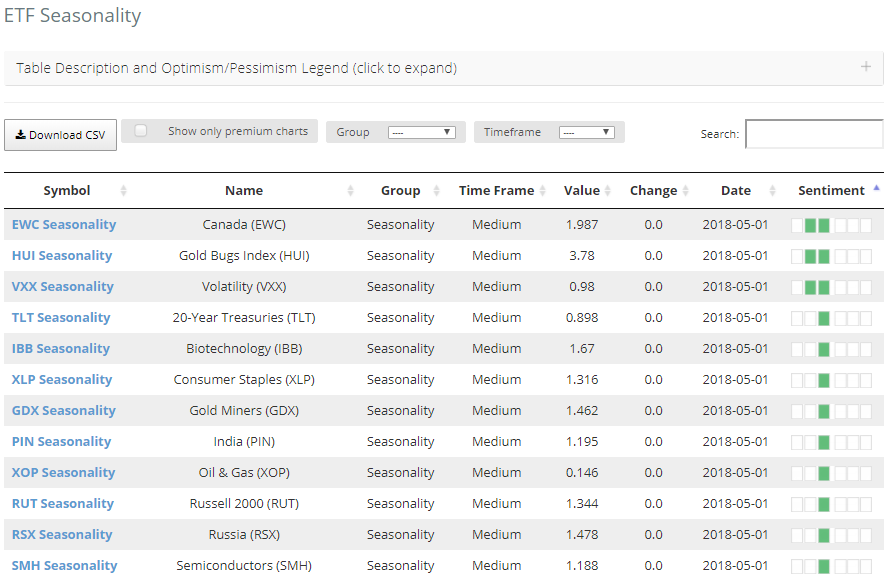

Among the most popular ETFs, here are the best performers for May. Note that the table is sorted by May's average return relative to that particular fund's returns during other months of the year. The VXX volatility fund, for example, only averages a gain of 0.98% for May, but it usually loses money, so relatively, it's ranked high on the list.

Among the best performers are the TLT bond fund and a couple of gold funds.

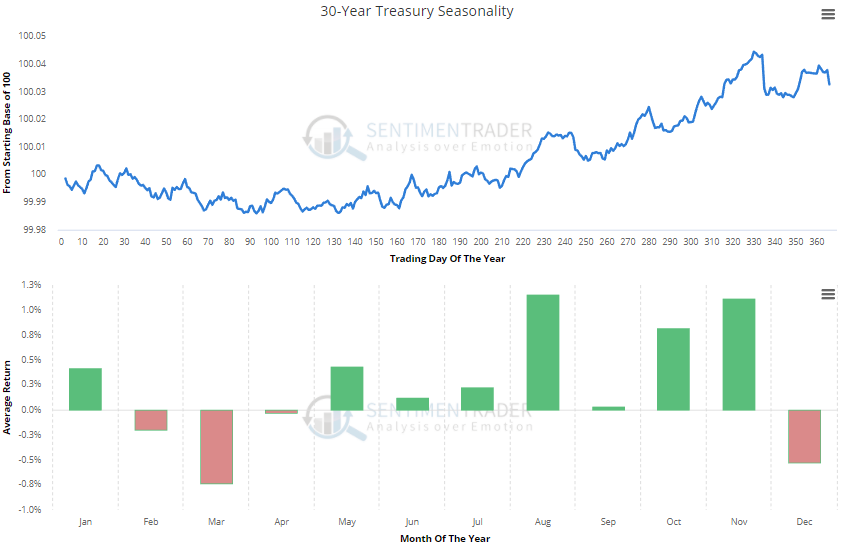

Speaking of bonds, the 30-year Treasury futures contract has usually bottomed around this time of year (suggesting bond prices would rise and yields decline).

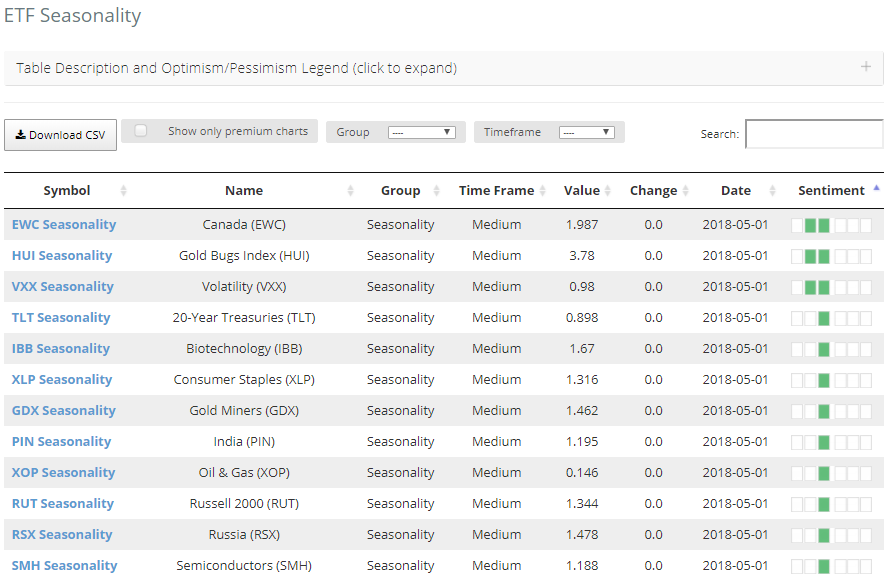

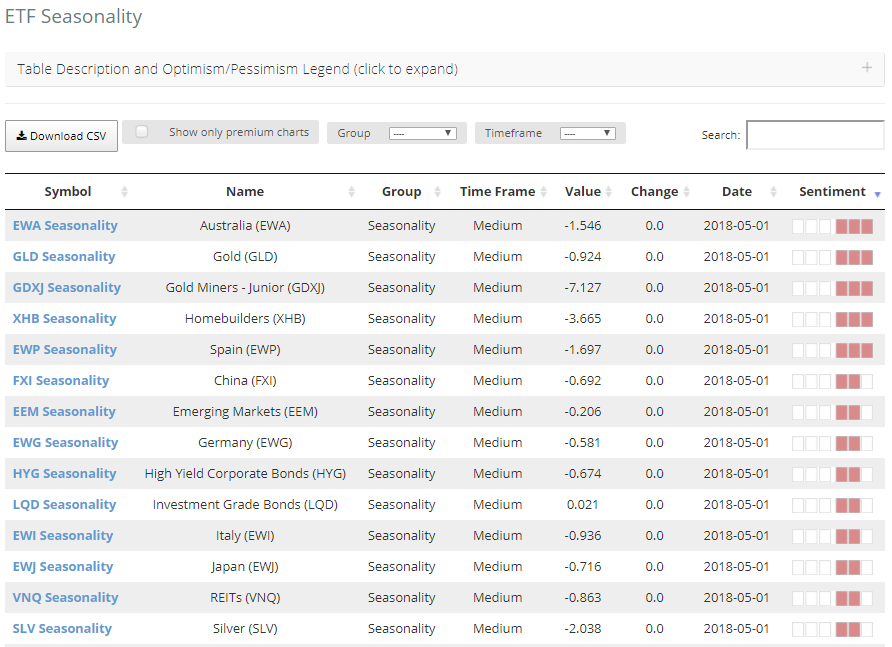

Here are the worst performers. Oddly, the Junior Gold Miners is on the list, along with the GLD gold fund itself. The corporate bond funds also didn't do too well.

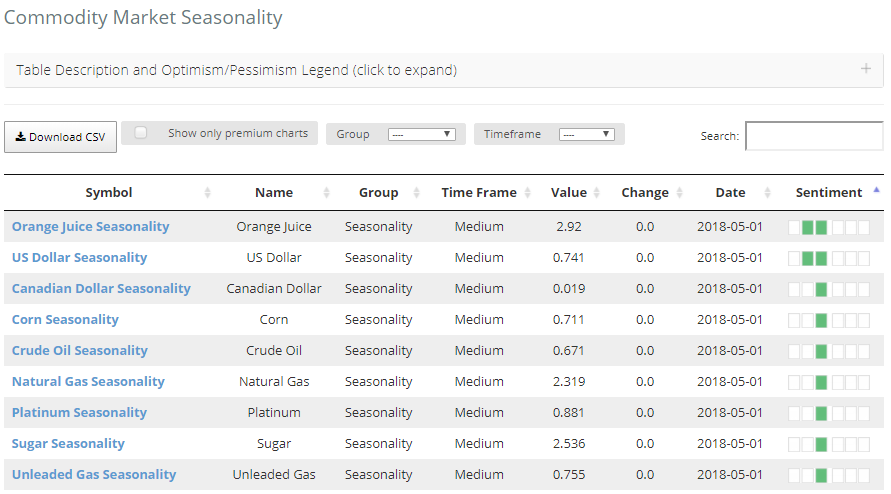

Among commodities, OJ did well, along with the U.S. dollar. The others had lesser positive biases.

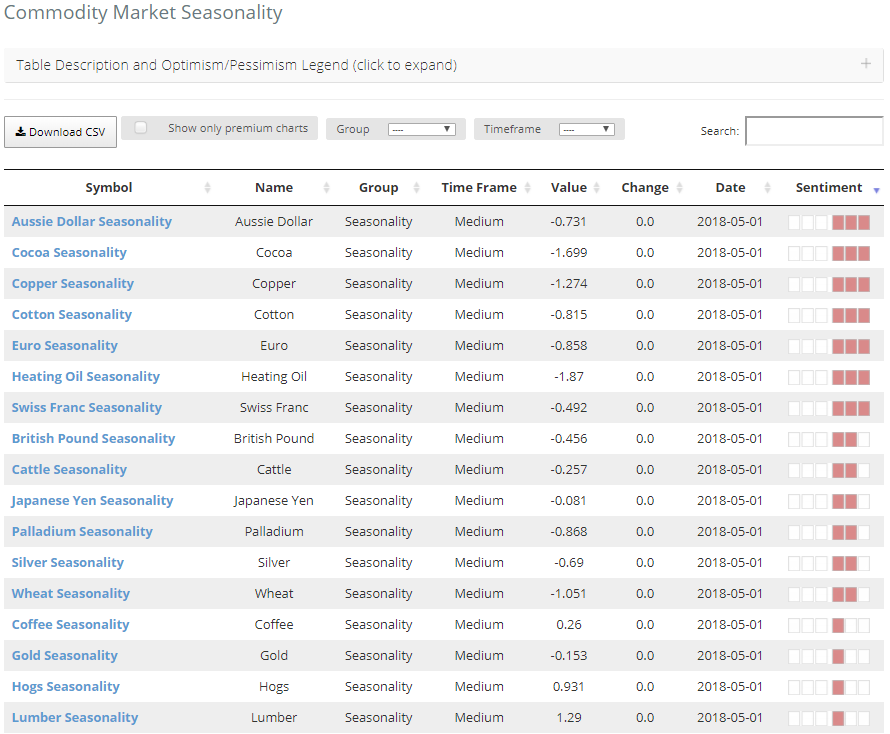

The worst performers included other currencies, which is not surprising since the U.S. dollar's bias was positive for May. The tendency for a rising dollar also hurt other contracts. Gold futures are on this list, since there is a longer history than the GLD fund noted above. It wasn't especially strong, though.

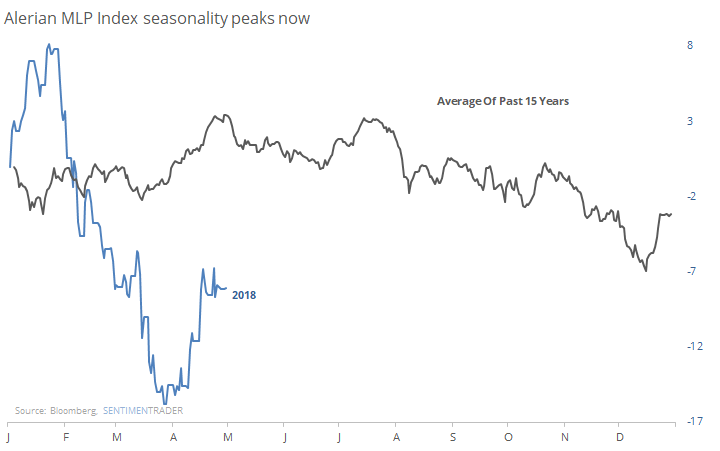

Energy contracts make both lists. Crude oil shows a modest positive bias, which lasts through the summer. Rising crude would help MLPs, which have flattened in recent days. The past 15 years have seen a seasonal peak right now in the sector, so if it can shrug off that headwind, it would suggest even higher prices ahead.