Searching for The Summer Rally

The supposed "Summer Rally" in the stock market is one of those adages thrown around but rarely defined. This piece takes a closer look at the stock market's performance during the summer months of June, July, and August as a whole, and also at two specific "favorable" and "unfavorable" periods.

S&P 500 PERFORMANCE JUNE THROUGH AUGUST

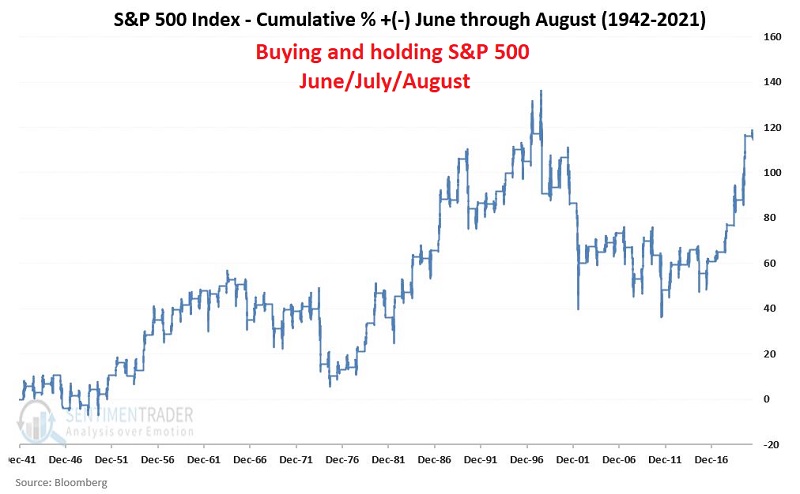

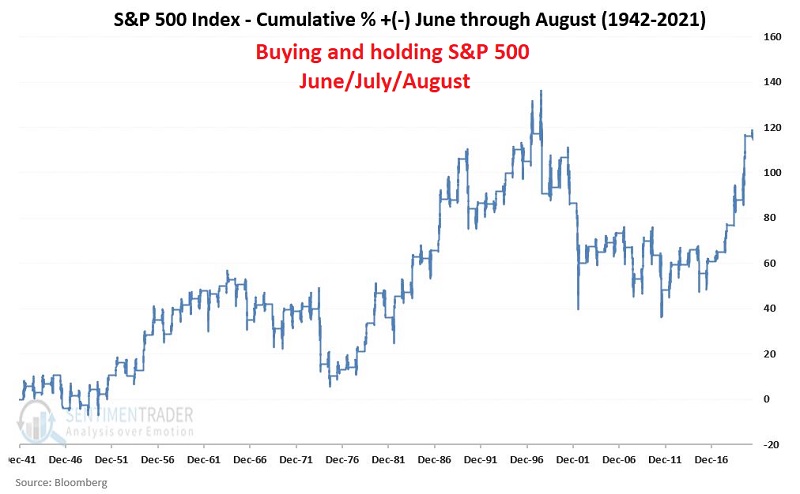

The chart below displays the cumulative price return for the S&P 500 Index if held long ONLY during June, July, and August, every year starting in 1942 through June 18, 2021.

For the record:

- June through August cumulative % +(-) = +114%

- All other months cumulative % +(-) = +22,275%

While the stock market has shown a positive overall performance during the summer months, clearly, these months have not been the most dynamic time of year for the stock market over the past eight decades.

Now let's focus on breaking the three summer months into two "favorable" and "unfavorable" periods.

THE SUMMER MONTH "FAVORABLE PERIODS"

Favorable Summer Periods:

- Favorable Period #1: June Trading Day #1 through June Trading Day #10

- Favorable Period #2: June Trading Day #19 through July Trading Day #9

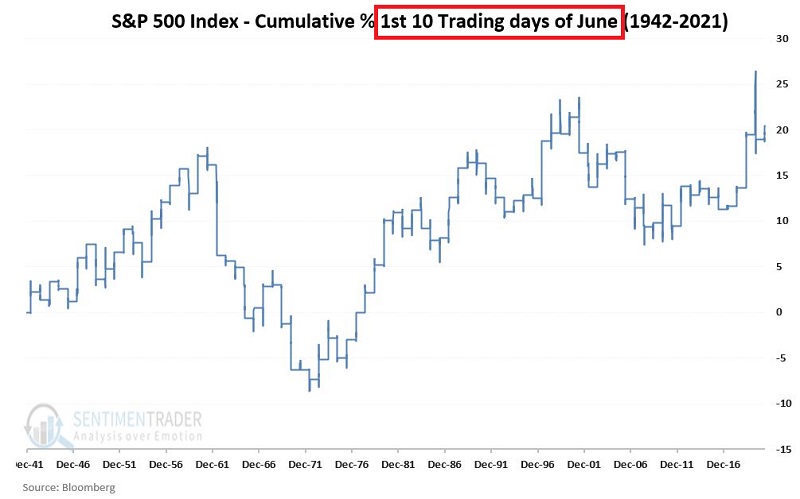

The chart below displays the cumulative % price change for the S&P 500 Index during Favorable Period #1 since 1941.

The cumulative price gain during Favorable Period #1 is +21%.

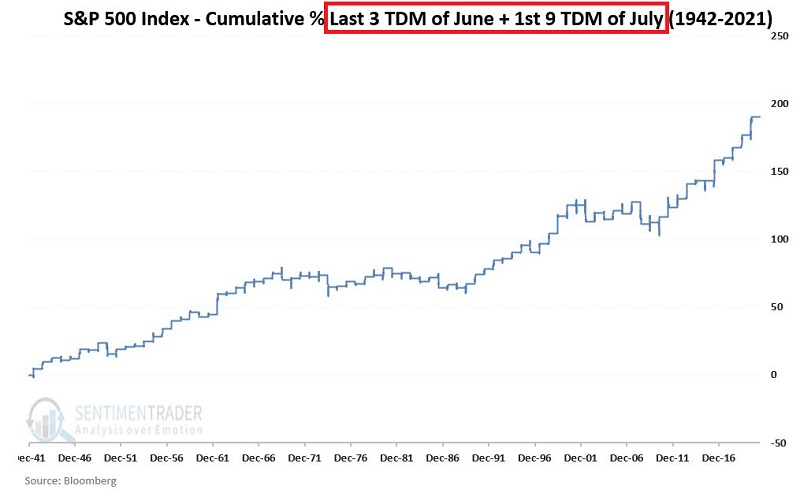

The chart below displays the cumulative % price change for the S&P 500 Index during Favorable Period #2 since 1941.

The cumulative price gain during Favorable Period #2 is +190%.

THE SUMMER MONTH "UNFAVORABLE PERIODS"

Unfavorable Summer Periods:

- Unfavorable Period #1: June Trading Day #11 through June Trading Day #18

- Unfavorable Period #2: July Trading Day #10 through the end of August

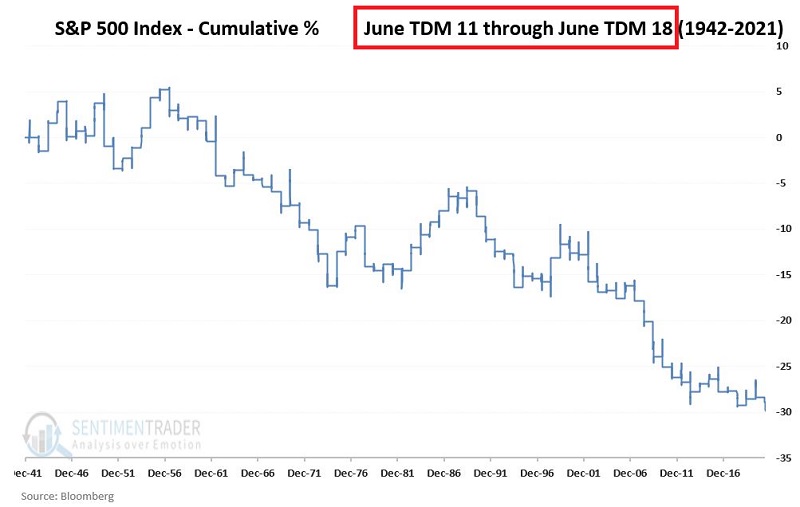

The chart below displays the cumulative % price change for the S&P 500 Index during Unfavorable Period #1 since 1941.

The cumulative price decline during Unfavorable Period #1 is -30%.

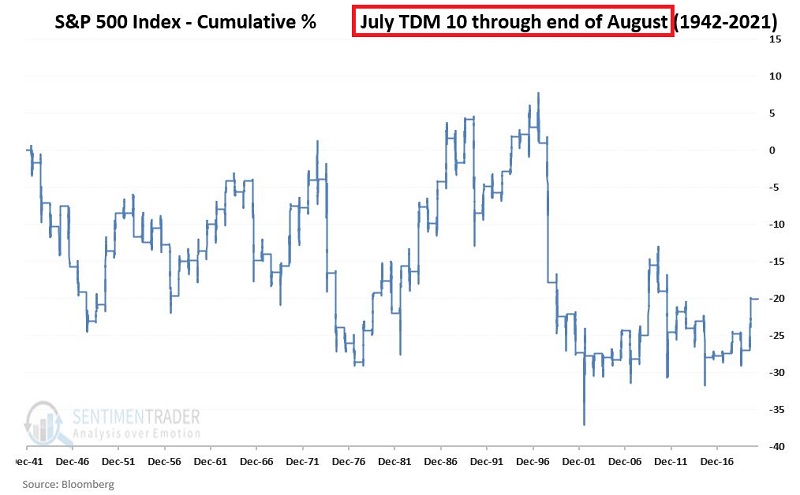

The chart below displays the cumulative % price change for the S&P 500 Index during Unfavorable Period #2 since 1941.

The cumulative price decline during Unfavorable Period #2 is -20%.

COMBINING PERIODS

Now we will make the following assumption:

- Trader A bought and held the S&P 500 Index ONLY during the two Favorable summer periods each year since 1942

- Trader B bought and held the S&P 500 Index ONLY during the two Unfavorable summer periods each year since 1942

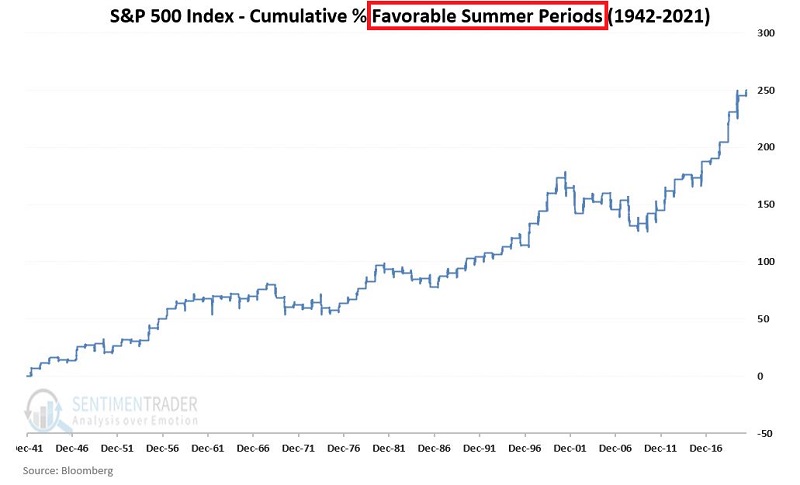

The cumulative hypothetical returns for Trader A appear in the chart below.

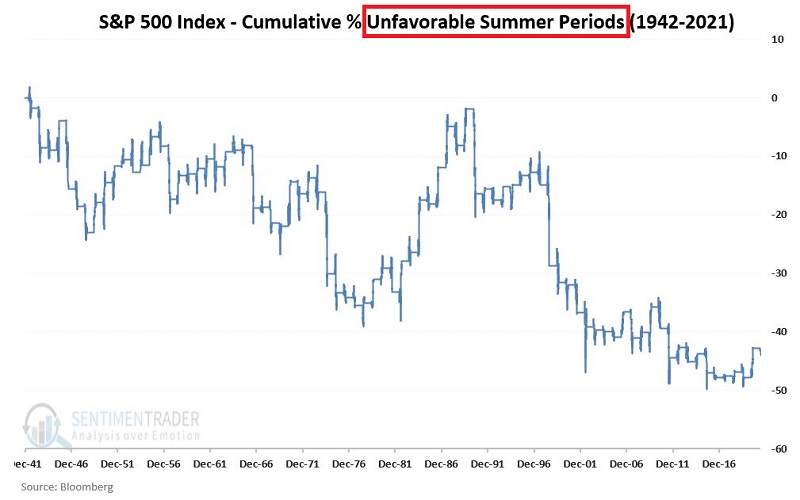

The cumulative hypothetical returns for Trader B appear in the chart below.

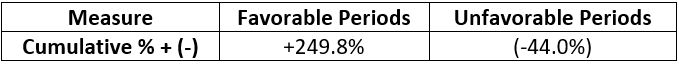

The comparison of cumulative returns appears in the table below.

SUMMARY

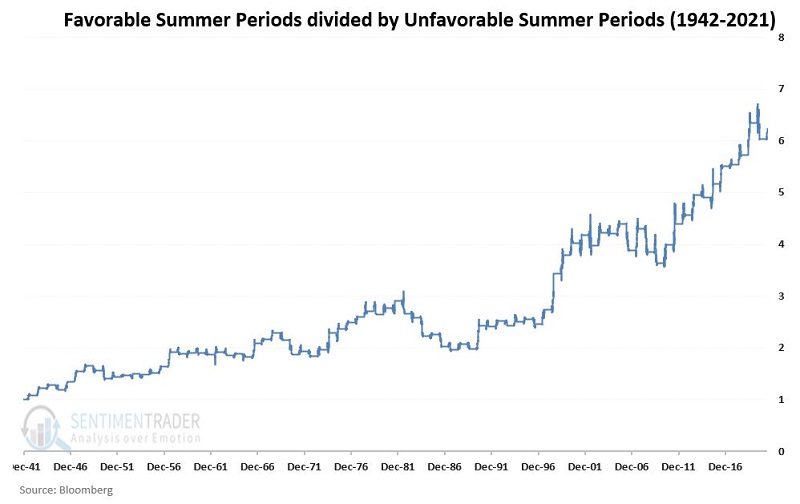

Nothing in the markets is ever perfect. The best we can hope for is long-term consistency. The chart below:

- Divides the growth of $1,000 invested in the S&P 500 ONLY during the two Favorable summer periods

- By the growth of $1,000 invested in the S&P 500 ONLY during the two Unfavorable summer periods

The chart above falls firmly into the "not perfect, but typically trending in the right direction" category over the past 80 years.

The table below displays the favorable and unfavorable periods for Summer 2021.