Russell's Failed Rally With A Yield Curve Warning

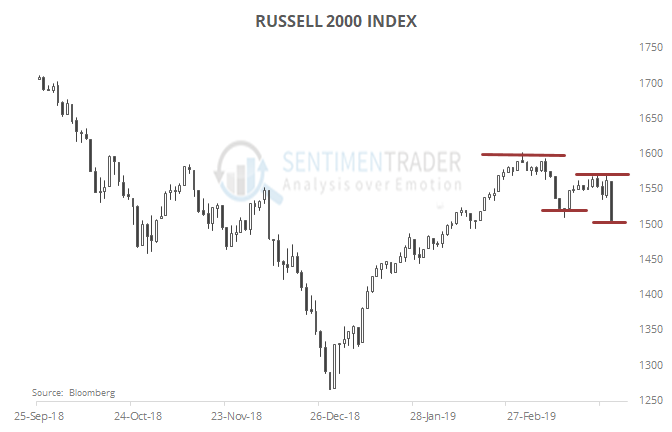

Bear pattern

The Russell 2000 rallied for almost two weeks, then failed on Friday and set a lower low. That triggered a classic failed bear market rally attempt.

Historically, that hasn’t meant much in the shorter-term, but over the medium- to long-term, risk tended to be higher than reward. These were not slam-dunk sell signals, especially in the shorter-term. Up to a month later, the Russell’s average return was higher than a random return. But by two months later, it turned sour.

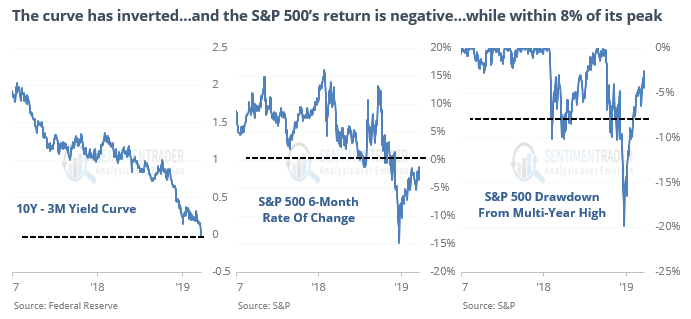

Curve worries

There is no shortage of warnings following the inversion of the yield curve last week. One of the direst is from Dr. John Hussman, with a signal suggesting an imminent decline.

Using his conditions, the signals were highly negative for stocks over the next 9-12 months, but the signal was not robust. Even a slight modification of the rules drastically changed some of the outcomes.

Confident traders

The smallest of options traders spent 39% of their volume buying speculative call options last week. According to the Backtest Engine, a reading that high since the financial crisis led to an average return of -2.3% in the S&P 500 over the next three months.

Lotsa bears

Nearly a third of S&P 500 stocks are still at least 20% below their peaks. There have been two other times since the financial crisis when more than 50% of them hit that bear market threshold. By the time the S&P rallied 20% off its low in 2012, only 18% of stocks were in bear markets. In 2016, only 12% were.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.