Russell Breaks Out But Suffers Buying Climax

This is an abridged version of our Daily Report.

Small-caps follow breadth to new highs

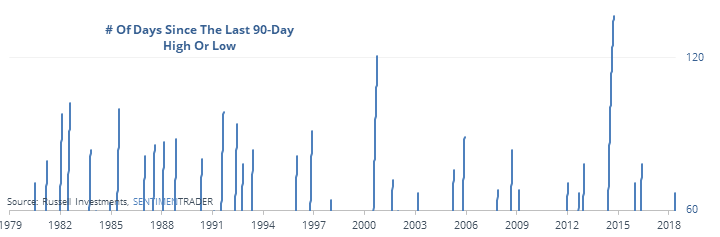

The Russell 2000 hit a new all-time high intraday on Monday. That’s the first 90-day extreme, high or low, for the index in more than three months.

A move to new highs after that long, and with such positive breadth, have been good for stocks.

It also suffered a buying climax

The intraday buying interest in the Russell 2000 did not persist and it reversed to close below its prior two closes. Similar reversals led to some very short-term weakness but wasn’t a major concern over the medium-term.

The Dow is no dud

This is the Dow’s 7th streak of 8 positive days since the 2009 bottom.

Negative spread

For the first time in more than three months, Dumb Money Confidence is higher than Smart Money Confidence. This usually happens when it takes a long time for an uptrend to take root and for trend-followers to recognize it.

Bullish options traders

The Options Speculation Index shows that across all U.S. exchanges, traders placed 24% more bullish trade strategies than bearish ones, the most since early February.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |