Russell 2000 - Percentage of Members Above the 50-Day MA Reset Signal

The Russell 2000 Index, a broad measure of small-cap stocks, has been moving sideways for the better part of the last three months. Consolidations allow lagging moving averages to catch up to price levels, and in doing so, market breadth measures under the surface of an index begin to erode. This erosion or reset can be a welcome development as it sets the stage for a potential continuation of the prior bullish trend.

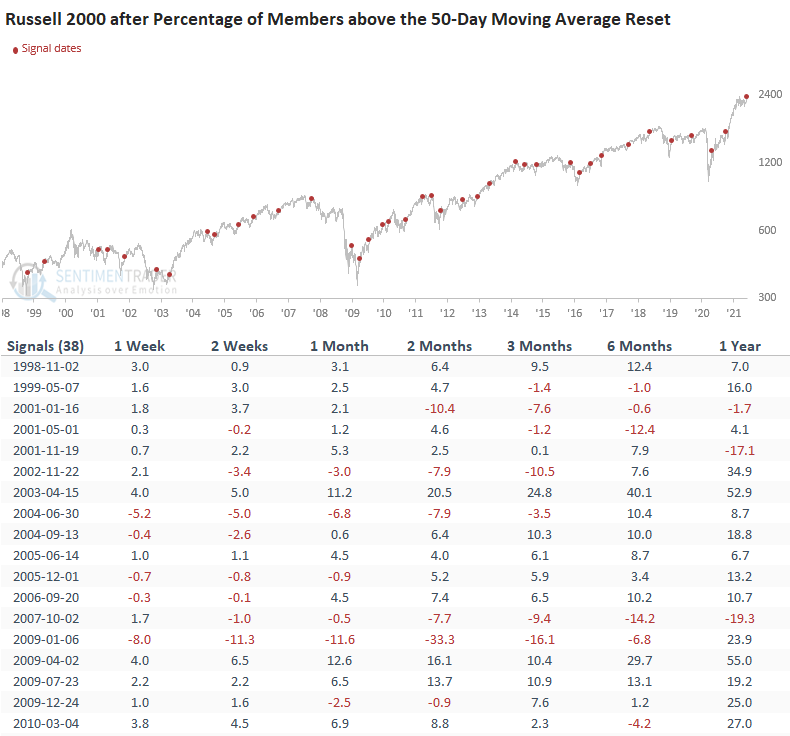

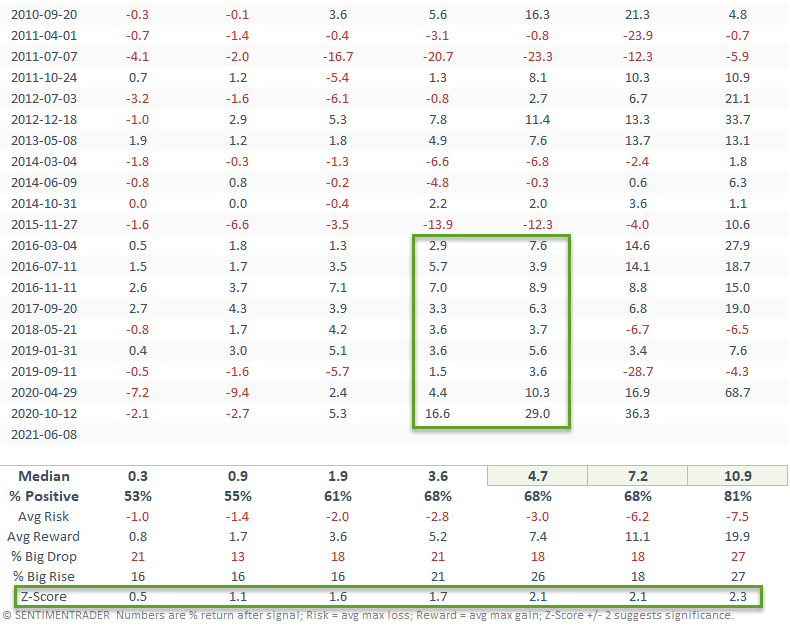

Let's assess the current consolidation reset for the percentage of Russell 2000 members above the 50-day moving average by examining instances when the indicator resets below 35% and then subsequently increases above 69%.

CURRENT DAY CHART

The fact that the percentage of members above the 50-day moving average never reset below an oversold level of 20% reflects the strong participation before the current consolidation.

HOW THE SIGNALS PERFORMED

Performance looks good in the 2-12 month window with a favorable risk/reward profile across several timeframes. I would also note that the 2-3 month timeframe has been profitable for nine consecutive signals.

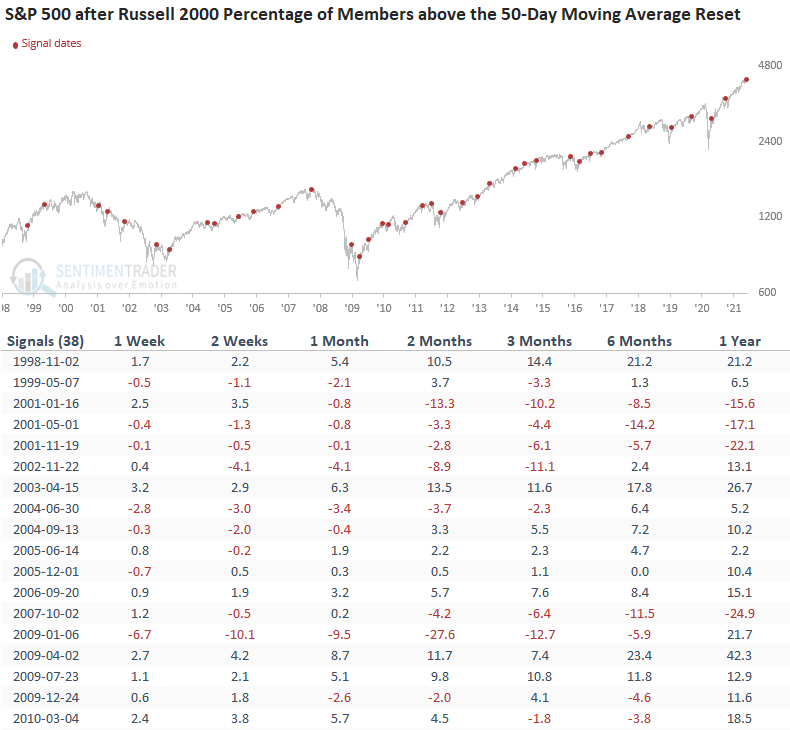

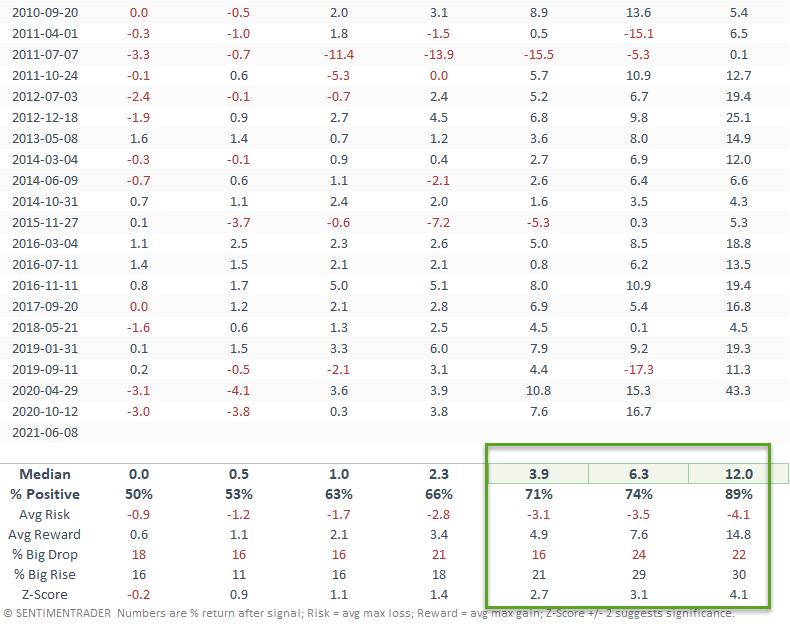

Let's apply the Russell 2000 signals to S&P 500 price data to see if the reset buy signal for the economically sensitive small-cap stocks provides an information edge for large-cap stocks.

HOW THE SIGNALS PERFORMED S&P 500

While short-term performance is somewhat mixed, the long-term results look fantastic. The small-cap reset is a welcome development for the broad market.