ROKU Yes, ROKU No

Trading opportunities - like beauty - are in the eye of the beholder. Take ROKU (Roku, Inc.), for instance.

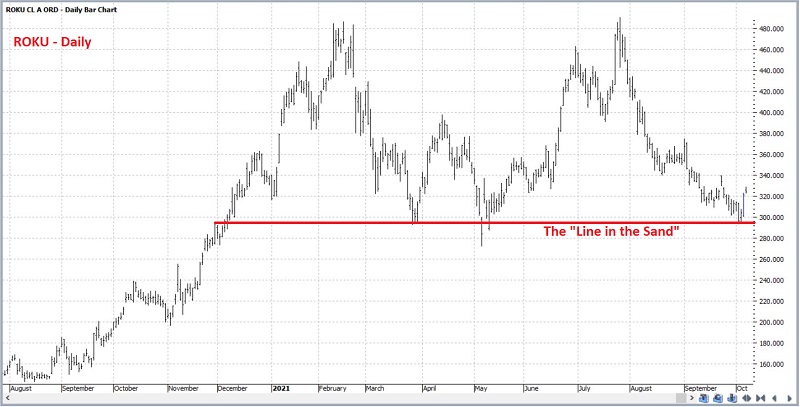

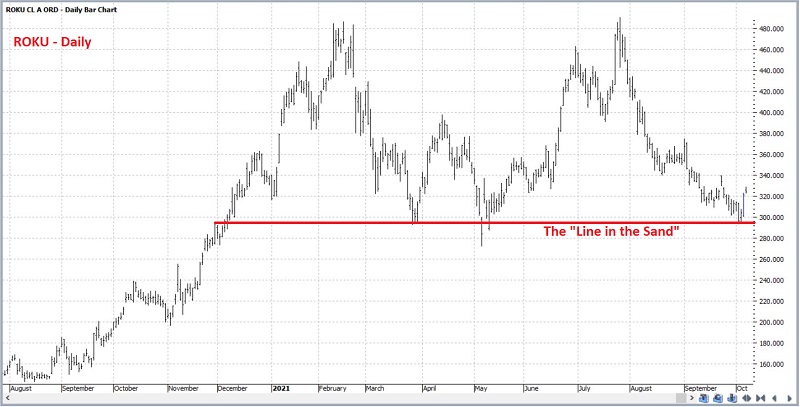

One trader will look at the daily chart below (courtesy of ProfitSource) and see a stock that has just "successfully tested support and is ready for the next leg up."

Another trader will look at the weekly chart of Roku below and see a stock that "is in the early stages of a long, hard fall."

Another trader will look at the weekly chart of Roku below and see a stock that "is in the early stages of a long, hard fall." Who will be right, and who will be wrong? It beats me. But whatever happens, there is an opportunity at the moment.

Who will be right, and who will be wrong? It beats me. But whatever happens, there is an opportunity at the moment.

At the same time, the problem for many traders is that ROKU is trading at around $325 a share. So, to buy 100 shares of stock requires a commitment of roughly $32,500. Likewise, selling short 100 shares of ROKU would involve a hefty sum of margin (not to mention the assumption of unlimited risk). So, let's consider alternatives for both scenarios.

As always, the examples that follow are just that - examples - and NOT "recommendations."

ROKU "YES"

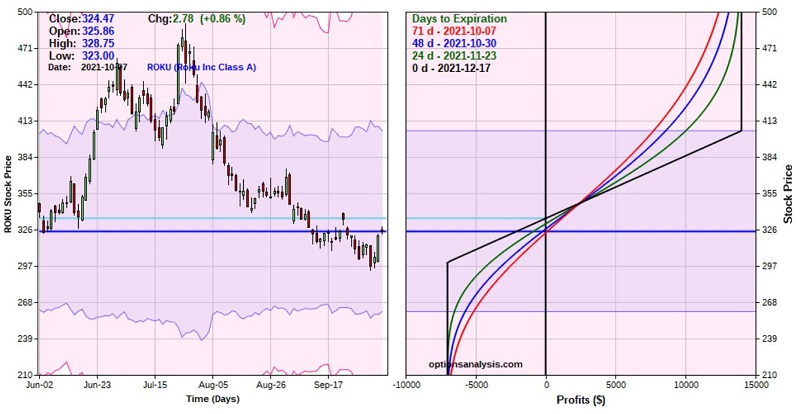

Our example bullish trade involves:

- Buying 2 ROKU Dec17 300 calls @ $41.10

- Selling 2 ROKU Dec17 405 calls @ $6.05

The particulars and risk curves appear in the screenshots below (courtesy of Optionsanalysis)

Things to note:

Things to note:

- This trade has 71 days left until expiration at the time of entry, so a trader MUST expect ROKU to move higher in the next 2+ months.

- Buying a 2 lot gives this trade a delta of 100. This means that (for now) this position will behave like a position holding 100 shares of ROKU, however...

- ...The cost to enter this trade is $7,010 versus $32,447 to buy 100 shares of ROKU stock.

- The maximum profit potential is $13,990 (if ROKU is above $405 a share at December option expiration).

- The maximum risk is $7,010 (if ROKU is below $300 a share at December option expiration). HOWEVER, if a trader resolves to cut their loss if the recent low of near $293 a share is taken out, the loss would be somewhere between -$3,000 and -$5,200 (depending on whether that price is taken out sooner or later).

ROKU "NO"

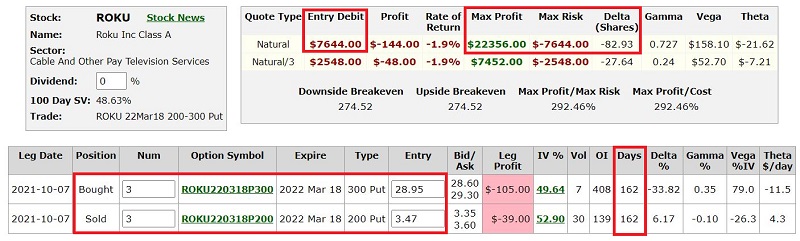

Our example bearish trade involves:

- Buying 3 ROKU Mar18 300 puts @ $28.95

- Selling 3 ROKU Mar18 200 puts @ $3.47

The particulars and risk curves appear in the screenshots below (courtesy of Optionsanalysis)

Things to note:

Things to note:

- This trade has 162 days left until expiration at the time of entry - so the trader has almost 5 months for ROKU to make a move

- Buying a 3 lot gives this trade a delta of -82.93. This means that (for now) this position will behave like a position holding short 83 shares of ROKU. The cost to enter this trade with a 3-lot is $7,644.

- The maximum profit potential is $22,356 (if ROKU is below $200 a share at March 2022 option expiration).

- The maximum risk is $7,644 (if ROKU is above $300 a share at December option expiration). HOWEVER, if a trader resolves to cut their loss if the recent high of near $375 a share is taken out, the loss would be somewhere between -$3,500 and -$6,600 (depending on whether that price is taken out sooner or later).

SUMMARY

Will either of these trades make money? I can't say. They are not presented as "hot trades" of the "you can't lose trading options" variety (as if there was such a thing). But each trade represents a potential opportunity for a trader:

- With a specific outlook for ROKU (bullish or bearish)

- Who does not want to or cannot afford to commit the capital to trade 100 shares of stock

- Desires limited, predefined risk