Risk-on behavior is nearing record levels

The new Risk-On / Risk-Off Spotlight page shows that most of the core indicators are still in risk-on mode. As long as that's the case, investors tend to be in buy-the-dip mode, which we saw again last week.

Like many other positive developments we've looked at over the last month or two, the biggest caveat is simply that the environment has been so positive for so long.

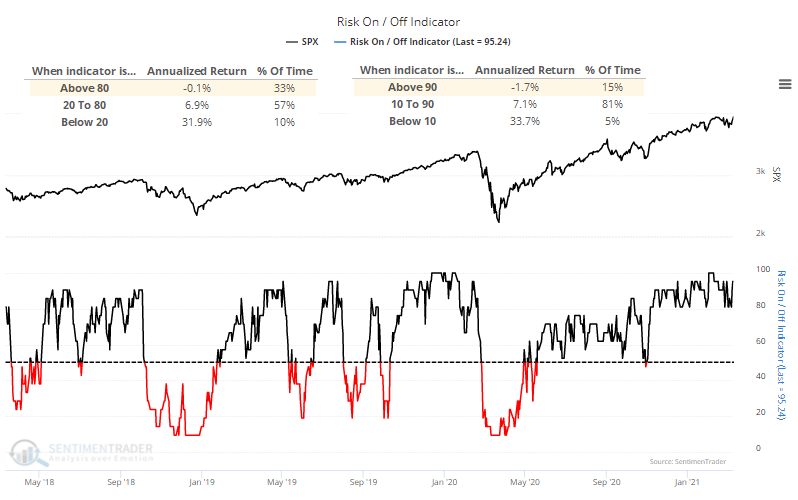

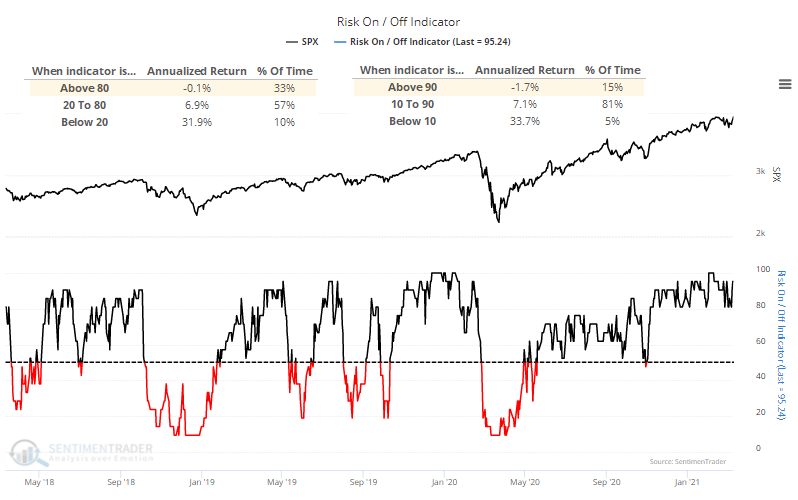

By the end of last week, nearly 100% of the indicators were in risk-on mode. That's so high that it has preceded weak returns. We should generally expect prices to rise when behavior is showing a risk-on mode. But when it gets above 80%, the S&P's annualized return was -0.1% and above 90% it was -1.7%.

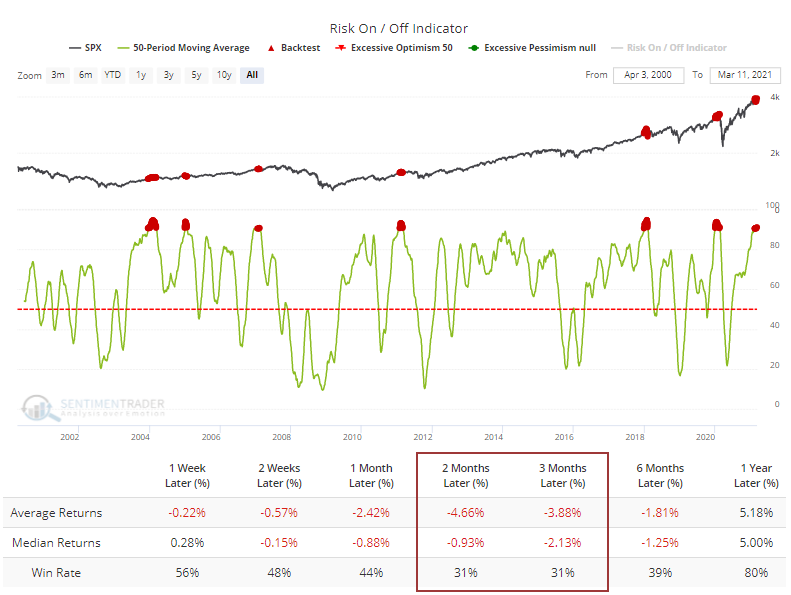

A risk-on mentality has been so prevalent for such a prolonged period that the 50-day average of the aggregate indicator has climbed above 90.5%, meaning that an average day over the past 50 sessions has seen more than 90% of the indicators displaying risk-on behavior.

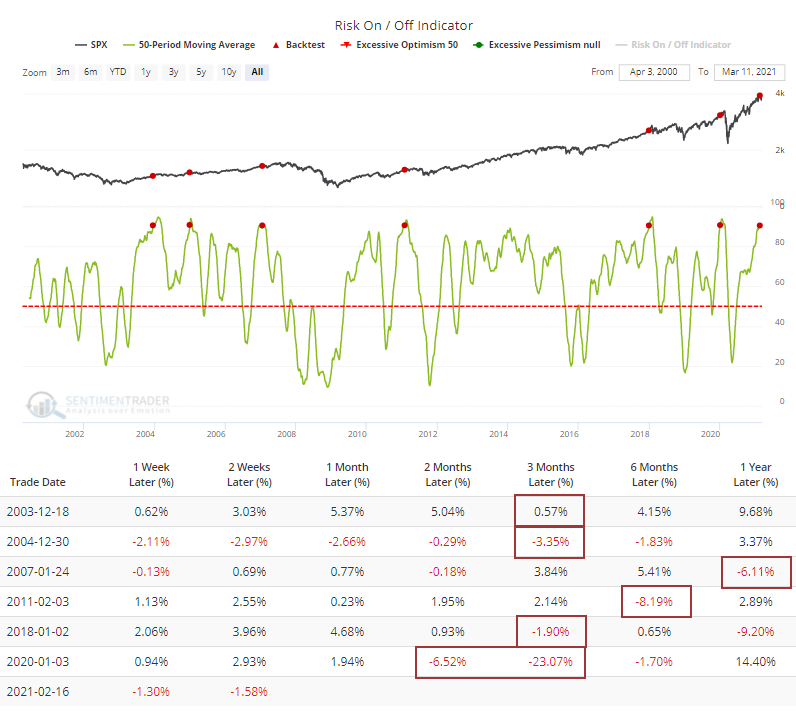

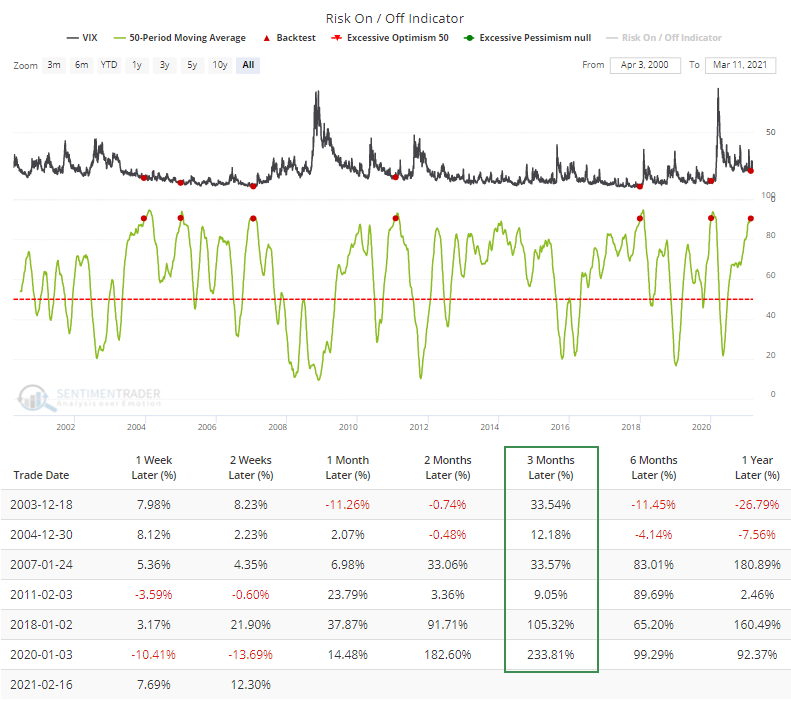

The Backtest Engine shows us that when the 50-day average has been this high, future returns were poor. Out of 162 days that met the criteria, only 50 of them showed a positive return 3 months later. To run this test, click here and then the Run Backtest button. Premium users will be able to test the full history, dating back to 2000.

Higher-beta indexes like the Nasdaq Composite fared even worse. Using that index in the Backtest Engine, the median 3-month return was -3.9% with only a 24% probability of seeing a positive return.

If we only look at the first signal in 3 months, then all of them saw any further short-term gains peter out or turn to an outright negative in the months ahead.

If we substitute the VIX for the S&P in the Backtest Engine, then we can see how much implied volatility or "fear" tended to spike over the next few months. It rose every time, and its average gain was substantial with a median gain of 34% and an average of 71%. This one is perhaps different in that it's triggering from a higher level.

We're still not seeing some of the divergent internal breadth deterioration that often triggers after true extremes in sentiment. For the most part, other than some odd days here and there, the indexes are still showing internal strength. It would be unusual, though not unprecedented, to see a sharp and prolonged downturn given those conditions.

The biggest problem is simply that things have been so good for so long, and investors have grown so comfortable, that forward returns have consistently been weak and extremely unlikely to be sustained.