Risk Is Back, Baby

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

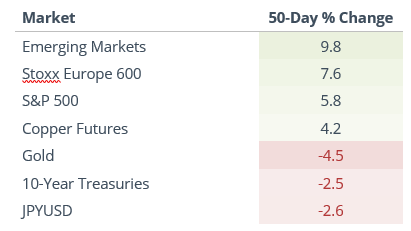

Risk on assets

Over the past 50 days, a handful of “risk on” assets have all returned more than 2.5%, while “risk off” assets have all lost more than -2.5%, showing a notable coordination in investor behavior.

Since 1990, when all the risk-on assets rose at least 2.5% over the past 50 sessions while all the risk-off ones lost at least -2.5%, for the S&P 500 (and copper), it was not a good short-term sign, and even three months later the S&P was negative more often than positive. After that, though, it was mostly good, with two big exceptions.

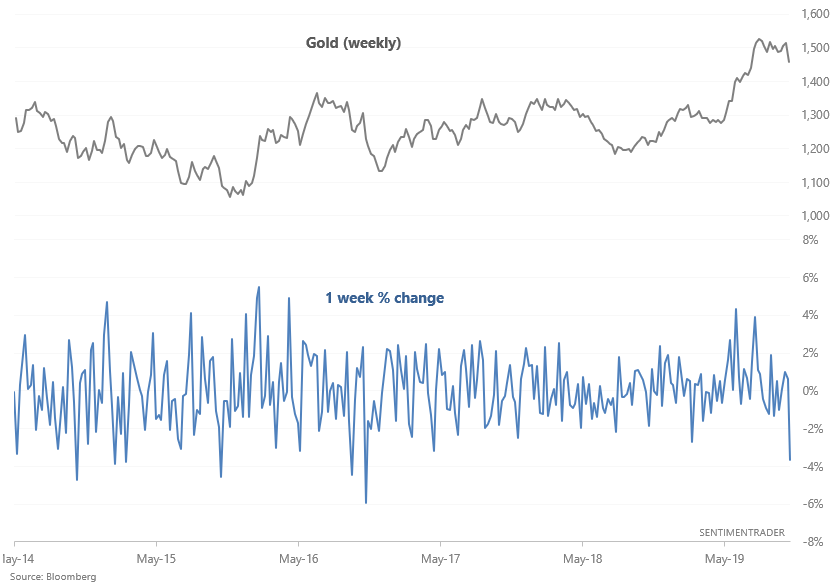

Dull metal

Meanwhile, gold tanked last week.

When gold fell more than -3.5% in one week while close to a multi-year high, its short term forward returns were mixed, but 3-12 month forward returns were mostly bullish.