Risk Appetite Wanes As Small-Caps' Trend Ends And Funds See Outflows

This is an abridged version of our Daily Report.

Lack of risk appetite

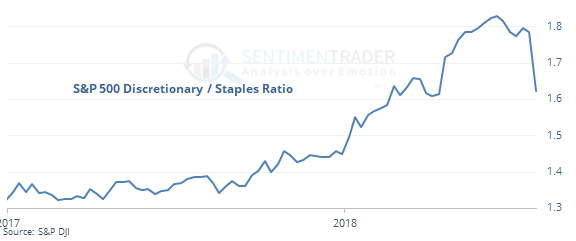

Discretionary stocks are at a multi-month low relative to defensive Staples.

That sign of risk-off behavior is unusual with the S&P near a high but has not been a good excuse to sell stocks.

Another trend ended

The small-cap Russell 2000 ended a long streak above its 50-day average. When recently setting a new high, the ends of similar streaks led to more weakness for small-cap stocks in particular, not necessarily the broader market.

Mass exodus

Investors have pulled more than $40 billion from equity funds in 8 weeks. That’s the most since 2016 and ranks near other extremes in the past 15 years.

The latest Commitments of Traders report was released, covering positions through Tuesday

The 3-Year Min/Max Screen shows basically the same extremes as last week, as “smart money” hedgers continue to build on multi-year or record long positions in coffee and the Swiss franc.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |