Risk Appetite Index suggests higher stock prices

Key Points

- Our Risk Appetite Index fell to a deeply oversold level in late November

- It has since reversed back to the upside

- Both of these occurrences suggest higher stock prices in the months ahead

The Risk Appetite Index

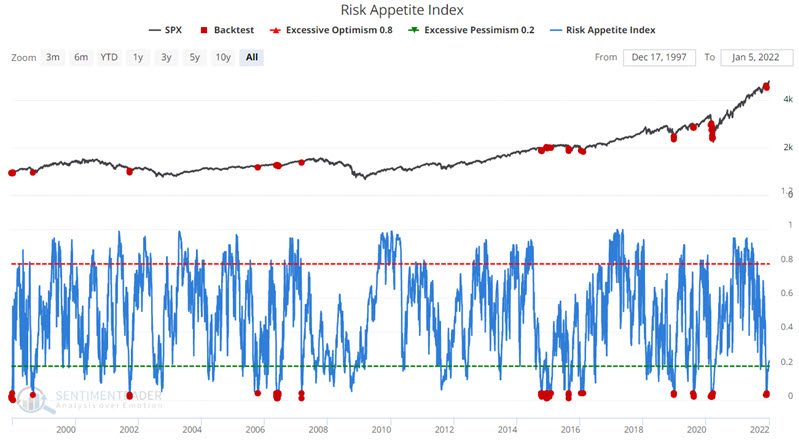

A handful of firms have introduced various measures of investors' risk appetite. We combined three of them and normalized them into a single index called the Risk Appetite Index. As the index rises, investors are becoming more and more risk-seeking. As the index falls, investors are becoming more and more risk-averse.

The Risk Appetite Index is a contrarian indicator, i.e., excessive optimism should lead to poorer-than-average future market returns. Conversely, extreme pessimism should lead to better-than-average future market performance.

There are various ways that the Risk Appetite Index can alert investors to favorable market conditions. Let's look at three.

#1. An early alert signal

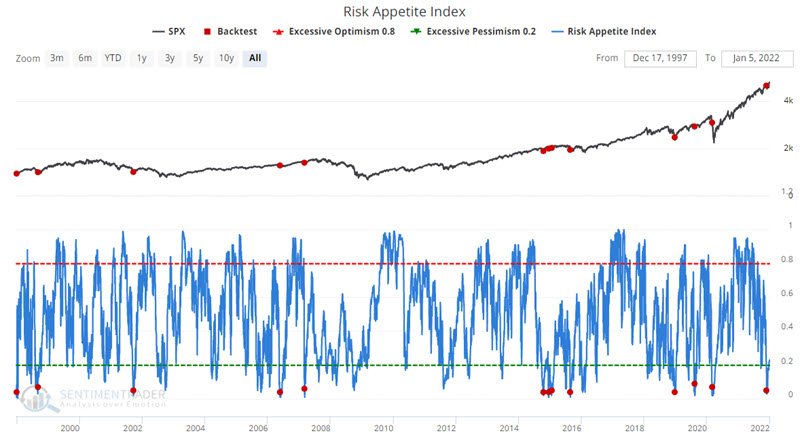

Our first look identifies when the Risk Appetite Index is below 0.05. This can be tested in the Backtest Engine. The chart below displays the signal dates.

The table below displays performance results.

Results have been solidly bullish, with three months showing a 100% Win Rate.

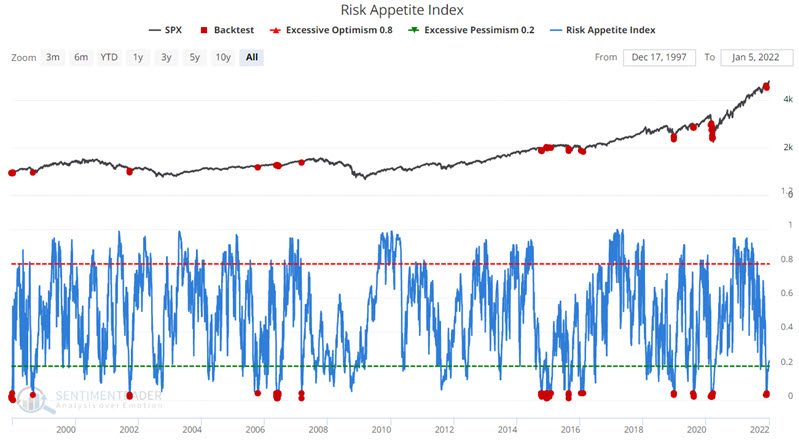

#2. An even more extreme alert signal

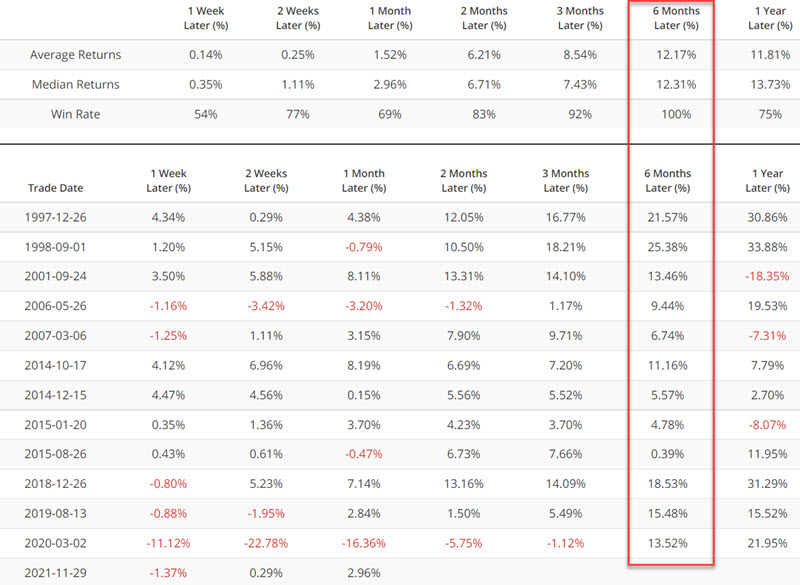

Our second look identifies when the Risk Appetite Index drops below and then crosses back above an even more extreme level of 0.03 for the first time in a month. This can be tested in the Backtest Engine. The chart below displays the signal dates.

The table below displays performance results.

The 6-month time frame has seen the S&P 500 Index gain ground in all 12 prior instances.

The latest signal was generated just over a month ago, on 11/29/2021). The table below shows that the S&P 500 gained ground between the end of the first month and the end of the 6th month in all previous cases. The median return for this five-month period has been +8.0%. While some of the gains were small, the main point is that there were no major selloffs. This suggests continuing to give the bullish case the benefit of the doubt.

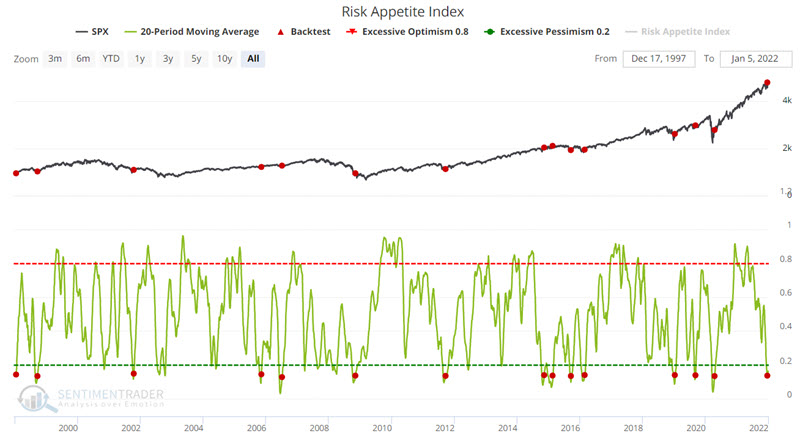

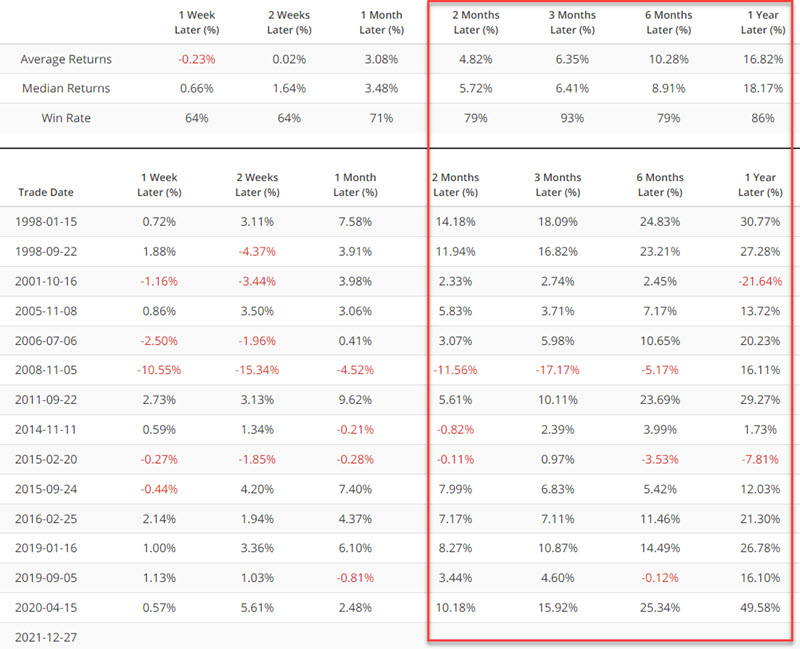

#3. A confirmation signal

Our third look uses one of Jason's backtests and identifies when the 20-day moving average for the Risk Appetite Index crosses back above 0.13. This can be tested in the Backtest Engine. The chart below displays the signal dates.

The table below displays performance results.

What the research tells us:

Robust indicators can often be used in more than one way. This piece highlighted that the Risk Appetite Index can be useful as an early warning system, a timely trade trigger, and a solid confirming indicator. The oversold level reached in late November, the reversal in early December, and the confirmation signal in late December all lend weight to the bullish case for stocks in the months directly ahead.