Risk Appetite Index - Risk-Off Signal Concept and Update

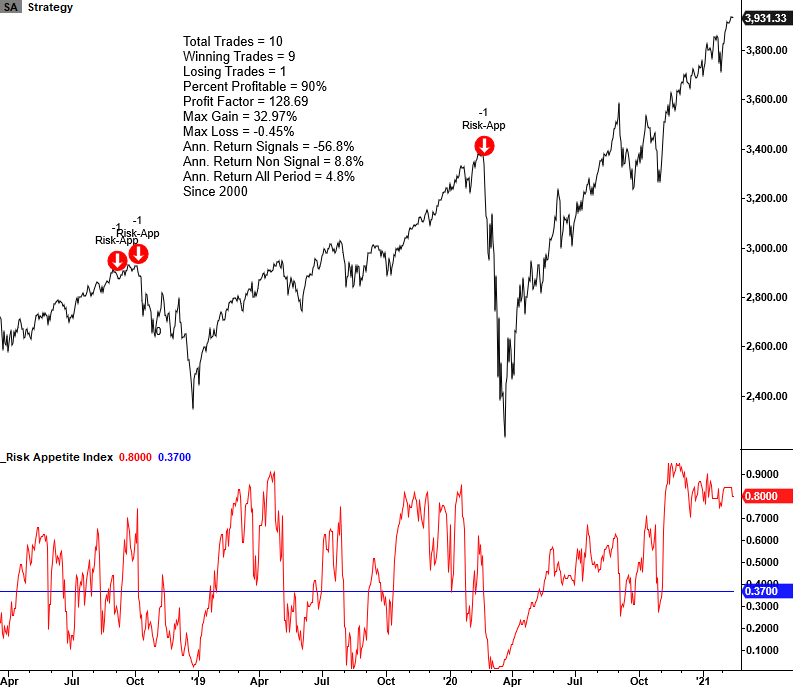

As we all know, extreme sentiment readings can often become more extreme. The best risk-off signals occur when sentiment reverses from an optimistic extreme. Some time ago, Jason created a risk appetite index that combines measures from three banks. For more information on the risk appetite index, please visit the website. I want to provide an update and share how I created a risk-off signal using the Risk Appetite Index from Sentimentrader.com in today's note.

Risk Appetite Index Risk-Off Signal

The risk-off signal seeks to identify instances in history when the risk appetite Index has fallen below a user-defined threshold, and the S&P 500 is hovering near a 252-day high. The model will issue an alert based upon the following conditions.

Signal Criteria

Condition1 = Risk Appetite Index <= 0.37

Condition2 = S&P 500 Index <= 1% from a 252-day high

Condition3 = If Condition 1 & 2, start days since signal count

Condition4 = If days since signal count <= 5 and SPX range rank crosses below 87%, signal risk-off

Note: The signal contains a reset threshold above a user-defined level to identify instances when the RA Index is declining from a high level.

Let's take a look at some historical examples and signal performance.

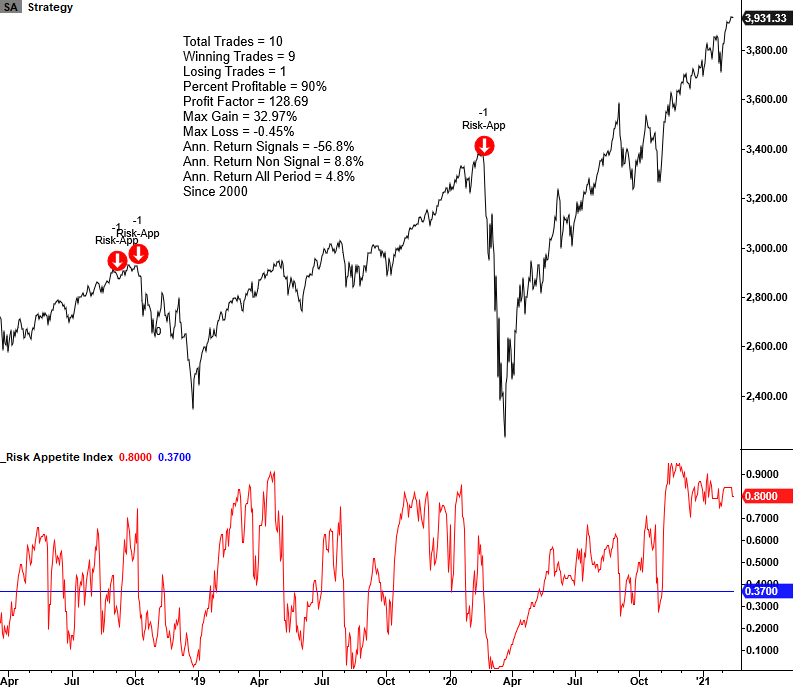

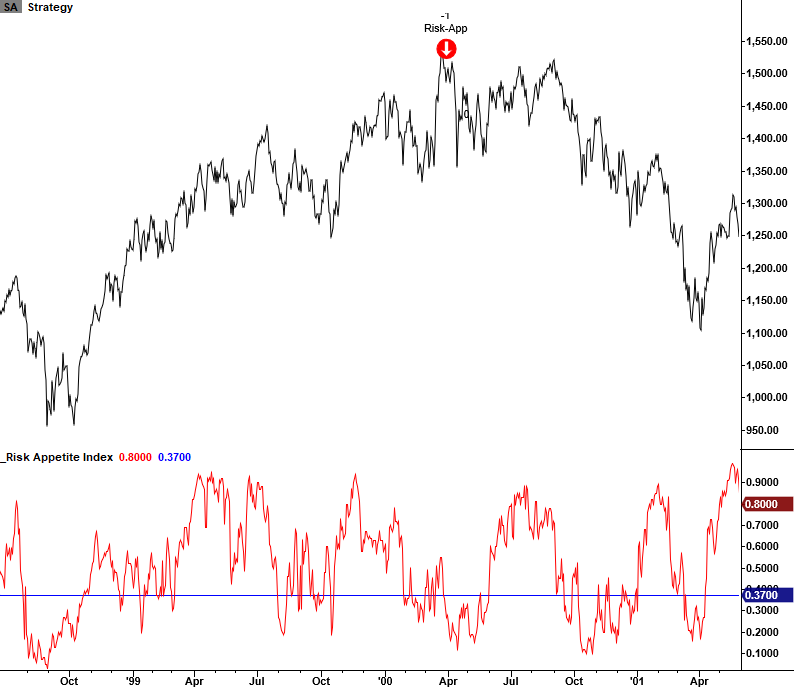

Please note the blue horizontal line in the risk appetite index sub-graph as you review the historical chart examples. The line represents the signal threshold level. As you can see, once risk appetite begins to deteriorate from a high level and falls below the threshold level, the market is vulnerable. The risk appetite index provides an excellent example of the "reverse from an extreme" sentiment concept.

Risk Appetite Index Current Day

While the risk appetite index has seen some deterioration from a high level of late, it remains firmly above the signal threshold level. Interestingly, it took some time for the index to surge to a high level after the pandemic market low.

Risk Appetite Index 2014-16

Risk Appetite Index 2006-07

Risk Appetite Index 2000

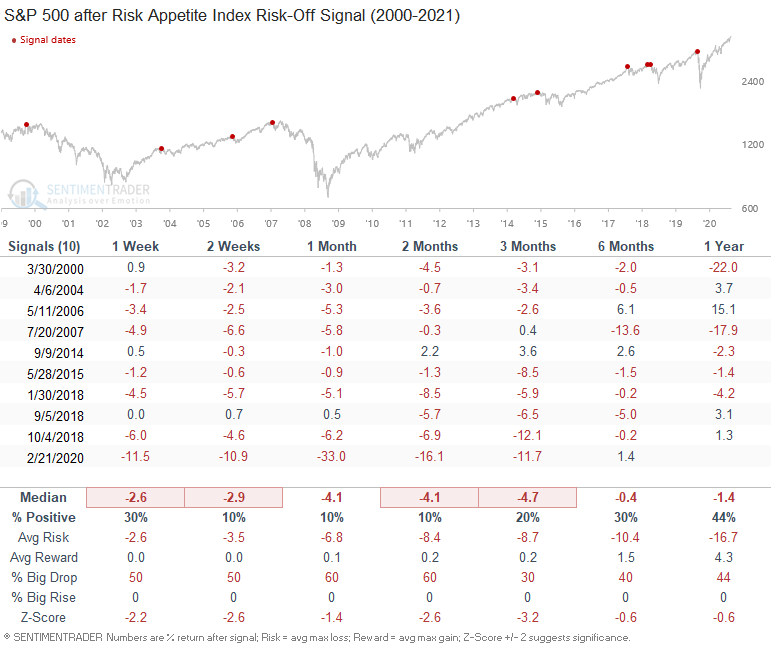

Risk Appetite Index Signal Performance

While the sample size is small, returns are weak across all timeframes.

Conclusion: The risk appetite index provides an excellent example of the "reverse from an extreme" sentiment concept. Given the current risk appetite index level, it's unlikely that a risk-off signal will trigger in the short-term. I will be monitoring this model along with several other ones that I have shared in recent notes for any deterioration. For now, risk appetite remains intact.