Risk Appetite Index Buy Signal Concept

In a note last week, I discussed how I created a risk-off signal using the Sentimentrader.com Risk Appetite Index. I want to share how I used the same Index to develop a risk-on signal in today's article.

Buy Signal Concept

When I design a buy signal, I like to use two basic techniques to ensure that I never catch a falling knife. The first is a momentum condition for the Index. I accomplish this by incorporating a positive rate of change or a range rank cross above condition. The second method requires an improvement in the model indicator. I use an increment amount condition to accomplish this task. The risk appetite signal in today's report utilizes the increment amount technique.

Risk Appetite Index Risk-On Buy Signal

The risk-on signal seeks to identify instances in history when the risk appetite Index has fallen below a user-defined threshold and increases from the subsequent low by an increment amount. The model will issue an alert based upon the following conditions.

Signal Criteria

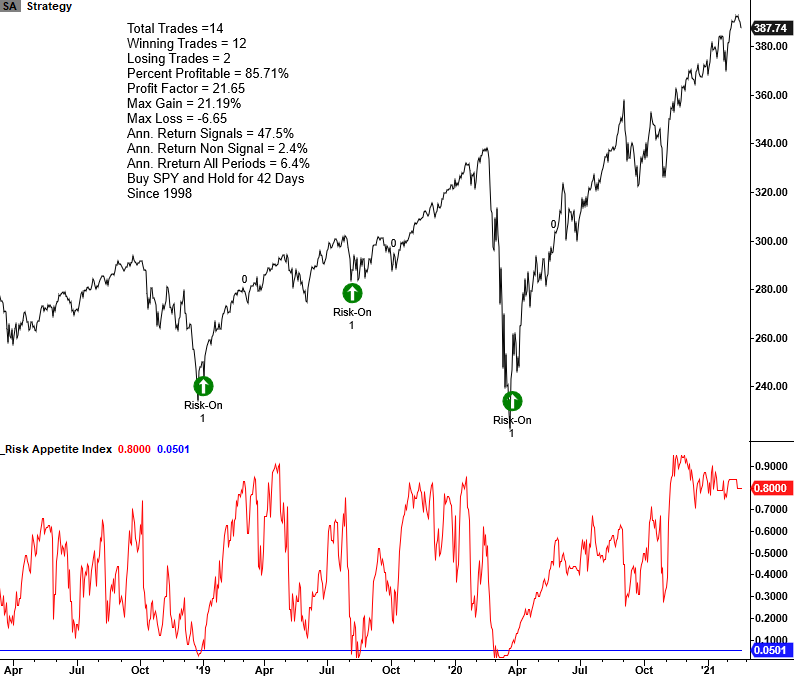

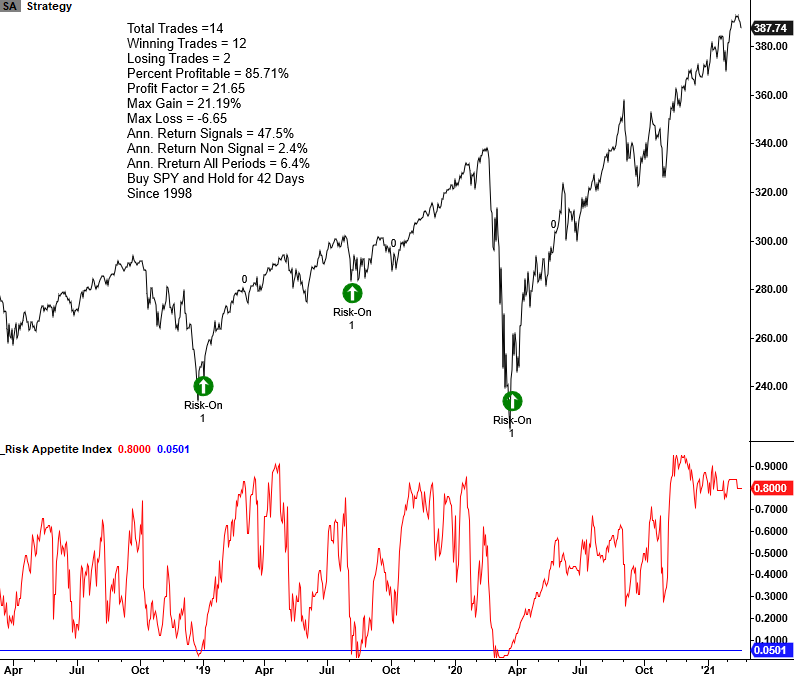

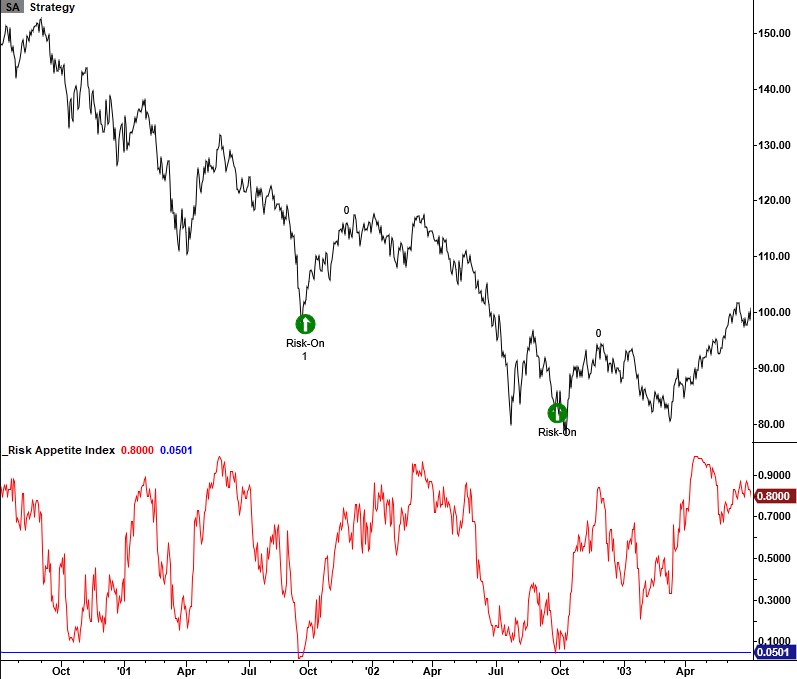

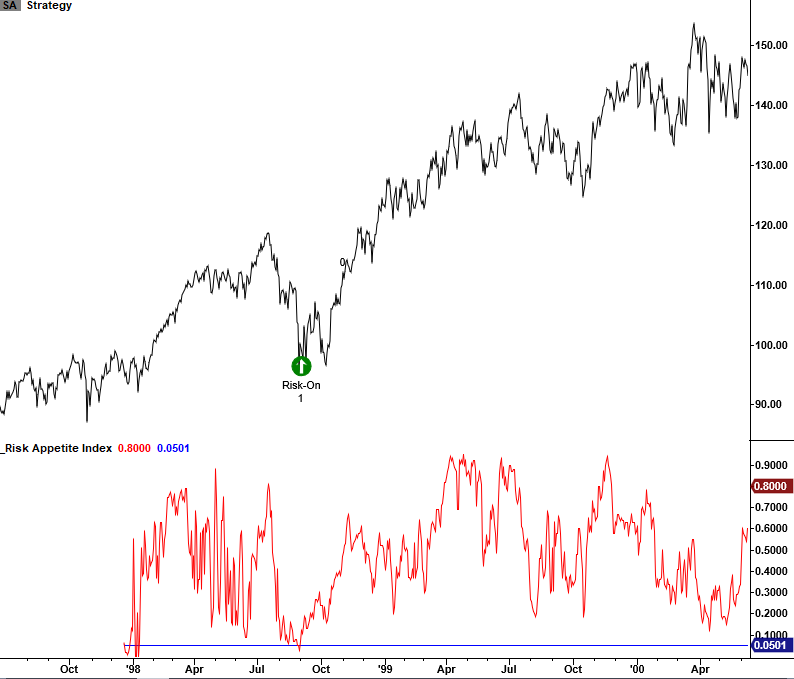

Condition1 = Risk Appetite Index crosses below 0.0501

Condition2 = Risk Appetite Index increases by 0.05 from the subsequent low below the threshold level.

Let's take a look at some historical chart examples and the signal performance.

Please note the blue horizontal line in the risk appetite index sub-graph as you review the historical chart examples. The line represents the signal threshold level.

Risk Appetite Signal Example

Risk Appetite Signal Example

Risk Appetite Signal Example

Risk Appetite Signal Example

Risk Appetite Signal Example

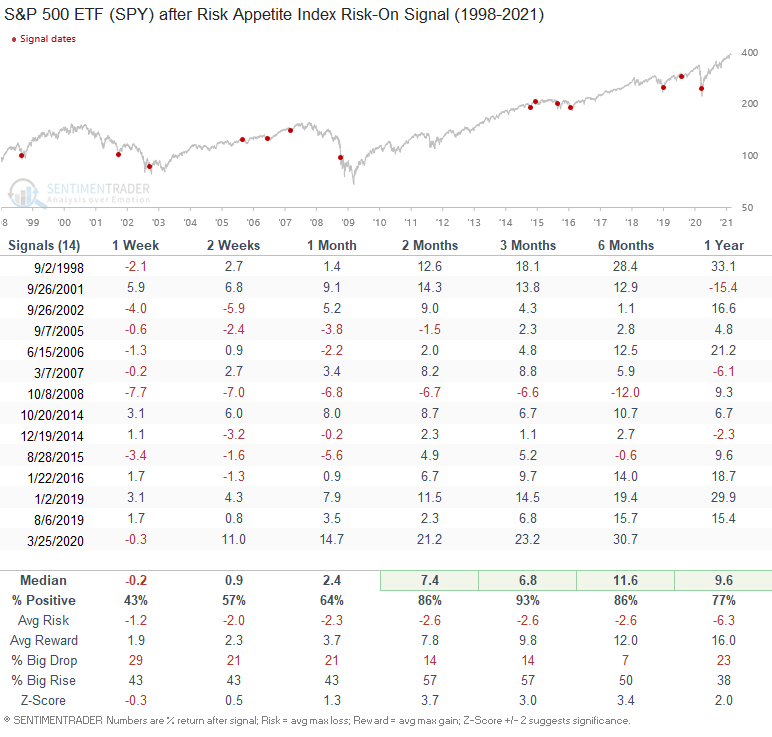

Risk Appetite Signal Performance

The risk appetite risk-on buy signal exhibits strong results in the 8-52 week timeframe.

Conclusion: The Risk Appetite Index signal provides an excellent risk/reward profile. However, because the index history is limited and the data updates are not timely, I would use the model to confirm other bullish for the market signals.