Risk Appetite hasn't fully recovered

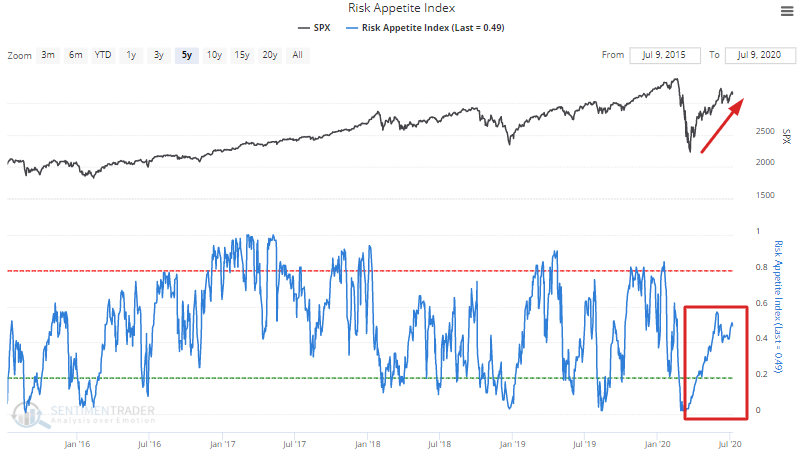

The majority of our sentiment indicators have recovered from the stock market's plunge in March. These indicators are either showing extreme optimism or almost-extreme readings. The Risk Appetite Index is one of the few indicators that isn't even close to registering an extreme despite the stock market's monster rally since late-March.

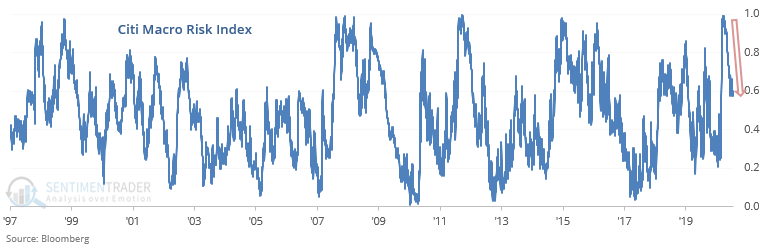

Taking a look under the hood, we can see that the Citigroup Macro Risk Index is still extremely elevated.

In a way this is to be expected, and is how all post-bear market rallies begin. For example, the 2009 rally was all about "green shoots". Bears were scratching their heads in amazement as the stock market seemingly disconnected from reality: how could stocks rally despite the ongoing recession? What matter in 2009 wasn't how "good" or "bad" the economy was - what matter was that the weak economy was getting better than before.

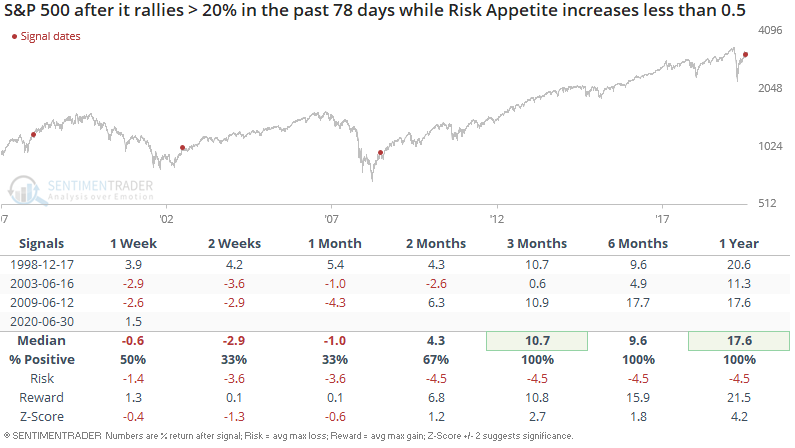

The following table demonstrates that post-bear market rallies in the past 22 years were accompanied by tepid increases in the Risk Appetite Index.