Rising sector sentiment

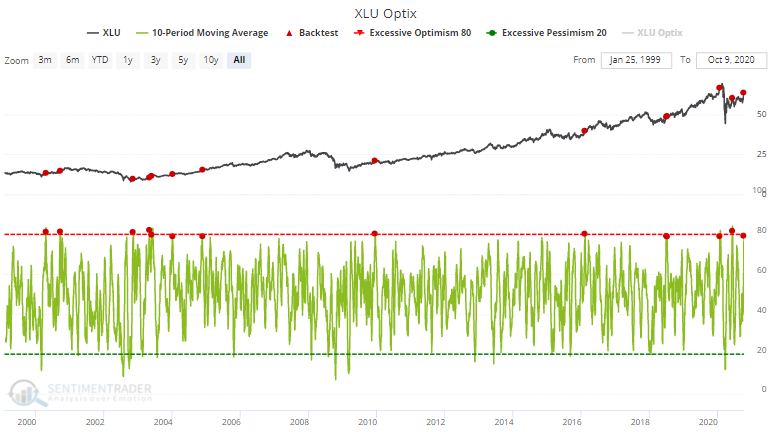

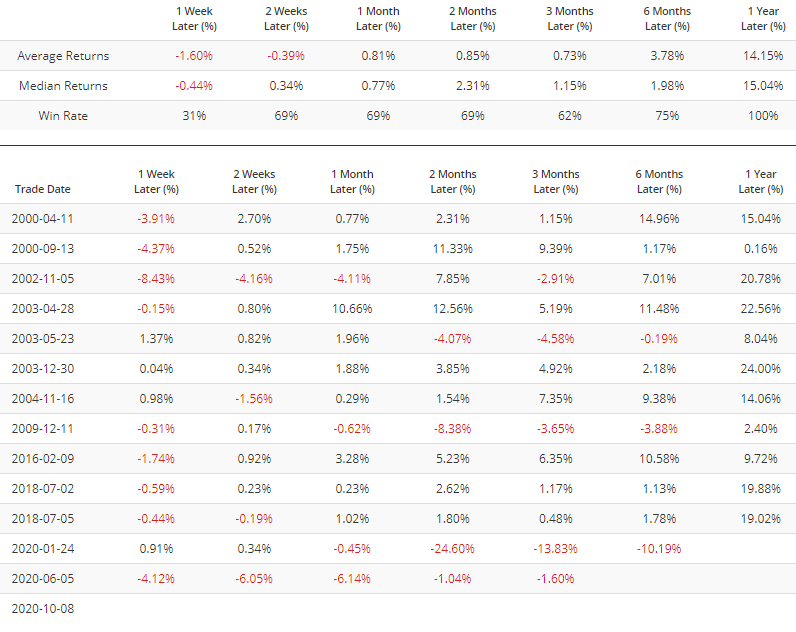

Sentiment is rising across various sectors as the broad U.S. stock market rebounds. The rally in utilities pushed XLU Optix's 10 dma to one of the highest readings ever (79):

When utilities sentiment was this high in the past, XLU often retreated over the next week. But as is typically the case with high sentiment, this consistently led to more gains over the next year:

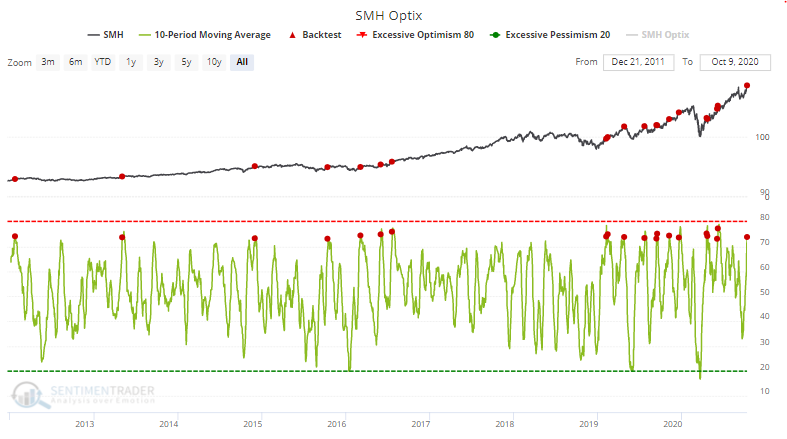

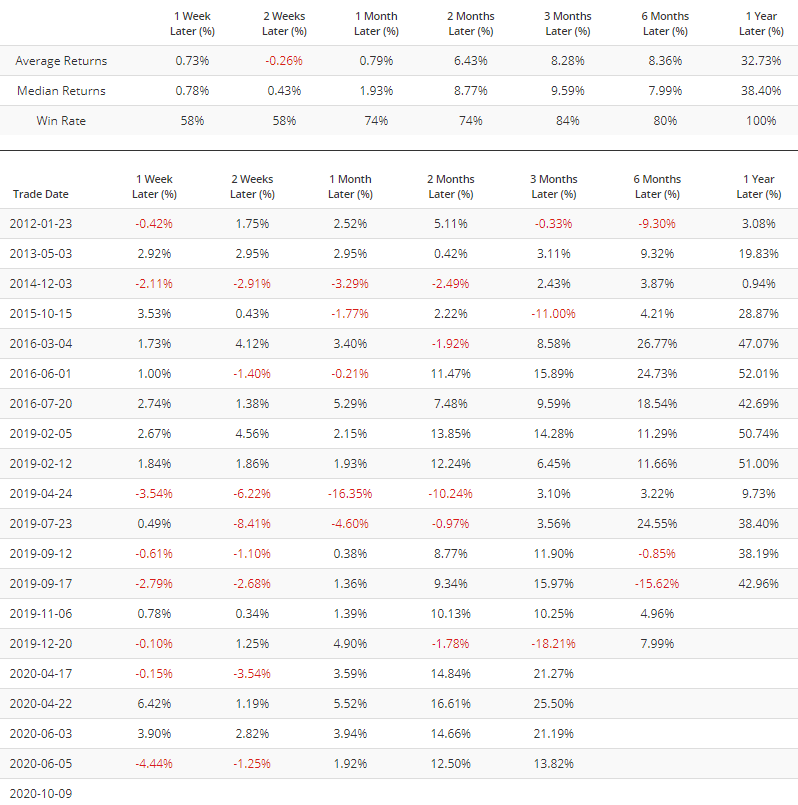

Strength in tech stocks doesn't seem to let up. Semiconductor stocks continue to surge, with SMH Optix's 10 dma at 73:

In the past, strong semiconductor sentiment led to slightly below average returns over the next 2 weeks. But once again, such high sentiment is usually a bullish sign for the next 6-12 months:

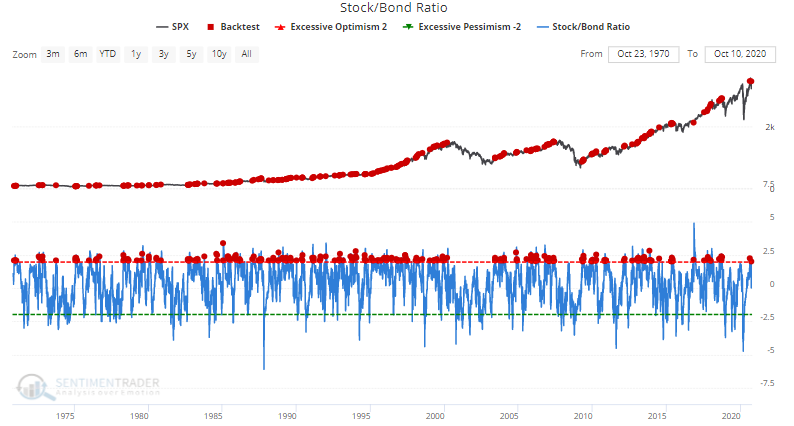

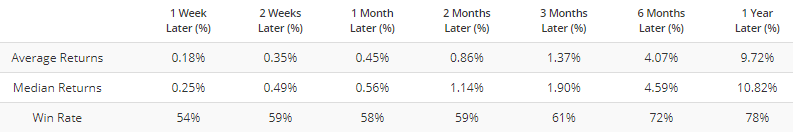

Looking at the broader market, the Stock/Bond ratio is above 2, a level which in the past led to worse-than-random returns over the next 2 months:

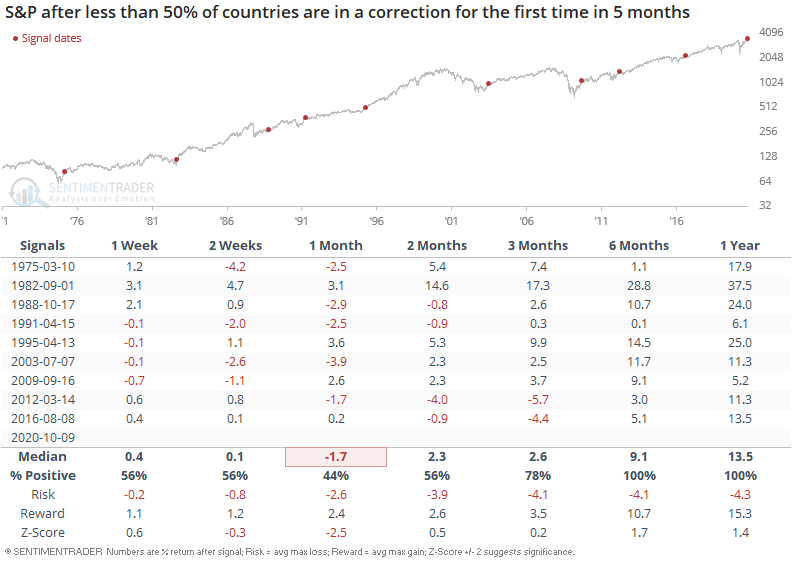

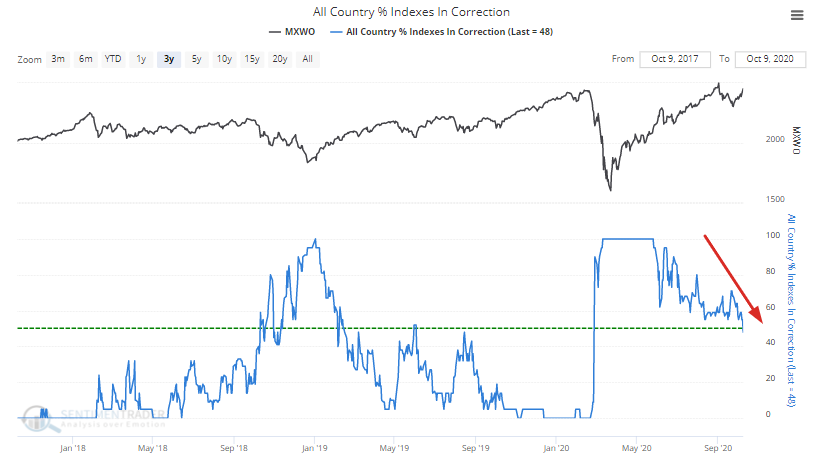

The recent bounce in equities is evident outside of the U.S. as well. Fewer than half of countries are in a correction for the first time since the March crash:

This usually happened after a major bear market and recession, which is why the S&P's returns over the next 6-12 months were uniformly bullish: