Ringing out the old with real estate

Key Points

- Of the 11 S&P 500 sectors, the real estate sector has been the top performer during the last five trading days of the year

- Consistency and downside risk are vital considerations that we will examine

- ETFs offer traders the potential to play this long-term year-end trend

Real Estate - Last five trading days of the year

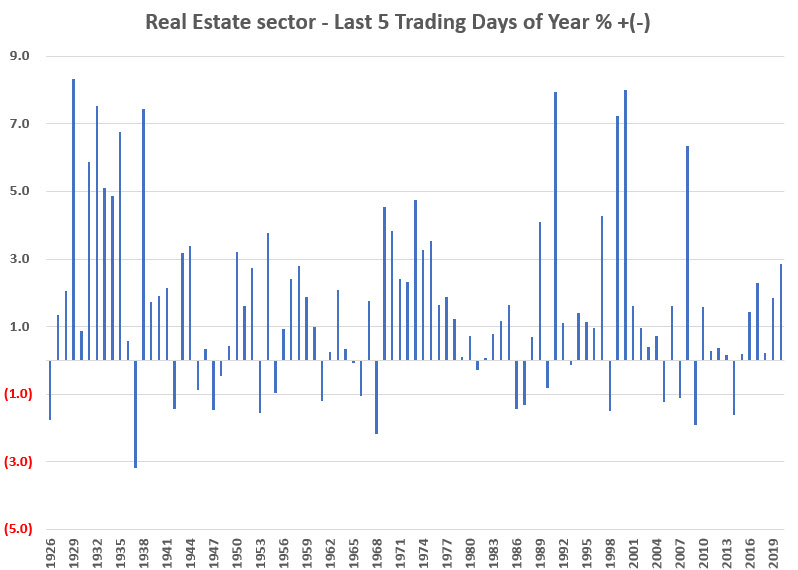

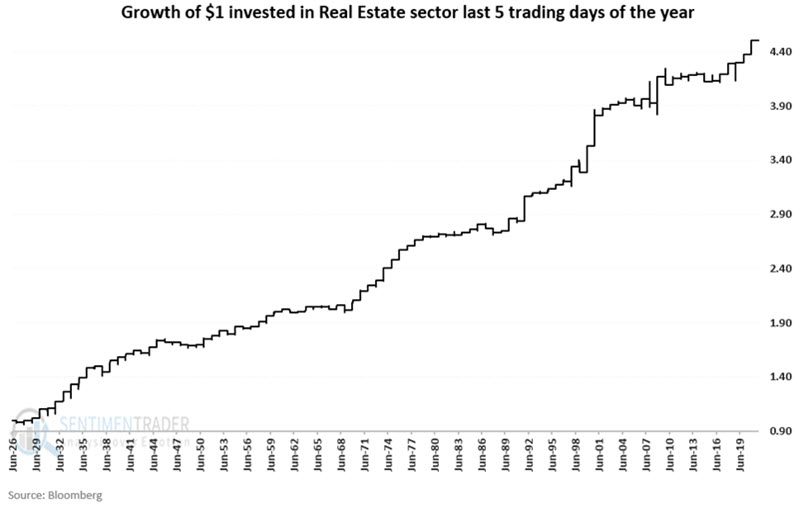

For our test, we will use index data going back to 1926. Before 1990, we used the Fama French real estate sector data series. Starting in 1990, we used the S&P 500 Real Estate sector data series.

The chart below displays the year-by-year % return for the index if held ONLY during each calendar year's final five trading days.

The chart below displays the cumulative growth of $1 if invested in the index ONLY during each calendar year's final five trading days.

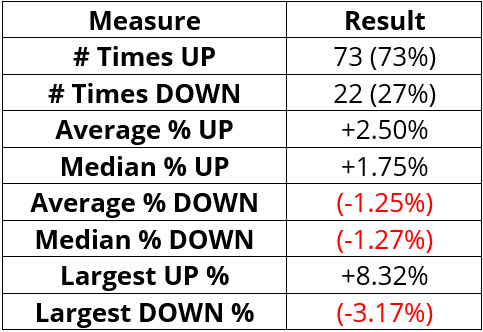

The summary of results shows that 73% of these windows were positive, with an average and maximum gain that were well above an average and maximum decline.

Actual trading considerations

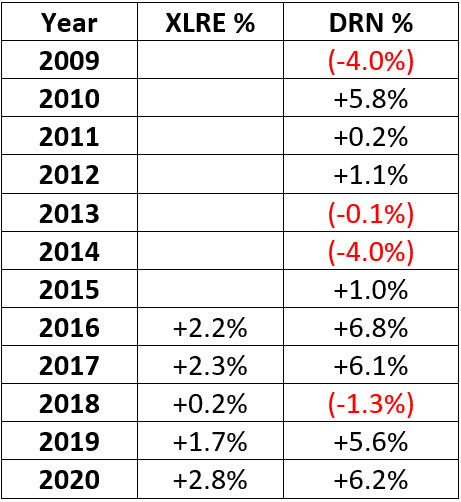

The most straightforward choice for exploiting this trend is via shares of an ETF. The Real Estate Select Sector SPDR Fund (XLRE) tracks the S&P 500 Real Estate Sector Index. While it has only been trading since 2015, it enjoys volume of almost 7 million shares a day.

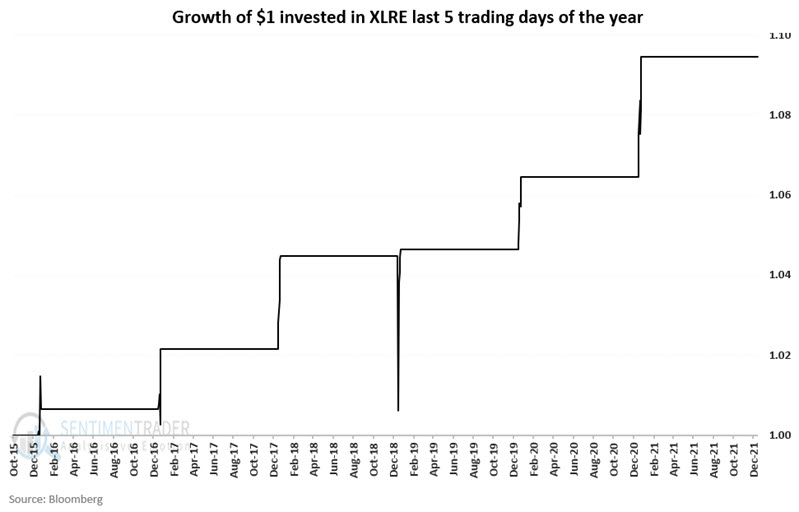

The chart below displays the cumulative growth of $1 if invested in XLRE ONLY during each calendar year's final five trading days starting in 2015.

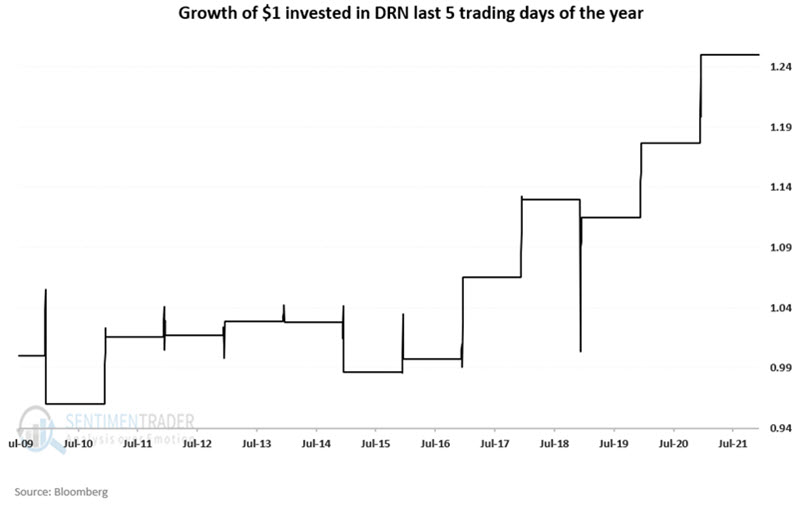

Another more aggressive approach involves ticker DRN, a 3x leveraged ETF that tracks the MSCI Investable Real Estate Index. The leverage means greater profit potential but also a greater risk of loss. Longer-term positions in 3x funds are fraught with peril. However, short-term trades such as the 5-day period we are discussing here can offer a trader who understands the risk the potential to magnify their gains if their strategy performs as expected.

The chart below displays the cumulative growth of $1 if invested in DRN ONLY during each calendar year's final five trading days starting in 2009.

The table below displays returns for XLRE and DRN during the last five trading days of the year since the inception of each ETF.

What the data tells us...

Of the 11 S&P 500 Index Sectors, Real Estate has been the best "last five trading days of the year" performer since 1926. The results for any given year can vary greatly. However, the Win Rate and average win-to-loss ratio have been relatively consistent over many decades. The ETF XLRE allows traders to emulate the returns of the S&P 500 Real Estate sector, and ETF DRN offers the potential for leveraged gains to traders willing to take on the risks associated with leveraged funds.