Ringing in the new with SLV

Key Points

- Silver has demonstrated a tendency to rally early in the new year

- This trend has been especially strong since 2004

- Traders still need to focus first on risk management

Silver into the new year

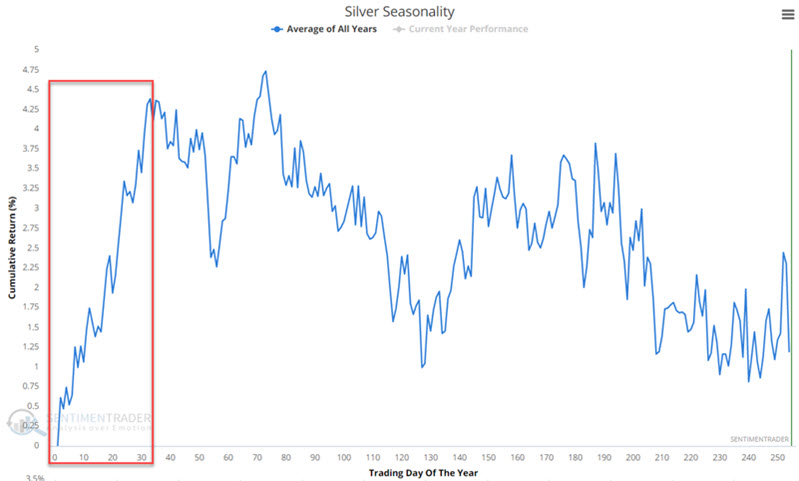

The chart below displays the annual seasonal trend for silver futures.

Our seasonally favorable period extends from the close on Trading Day of Year (TDY) #249 through Trading Day of Year #33 in the new year. In 2021-22 this period extends from the close on 12/28/2021 through 2/17/2022.

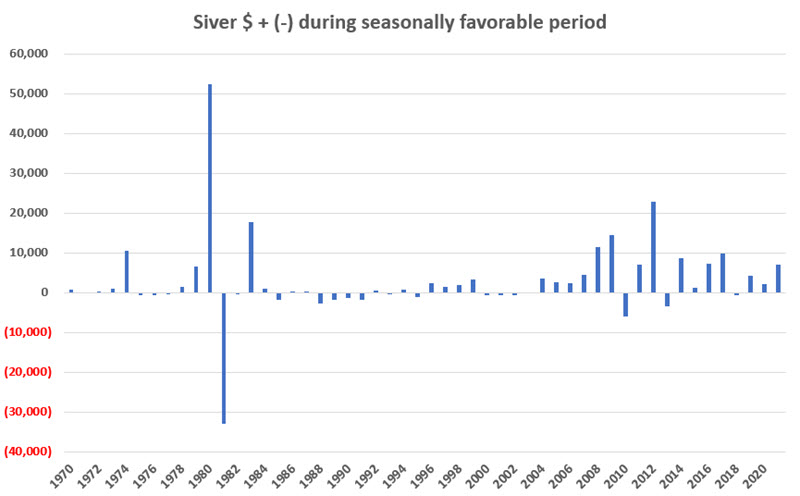

The chart below displays the annual $ return for silver futures during this seasonally favorable period.

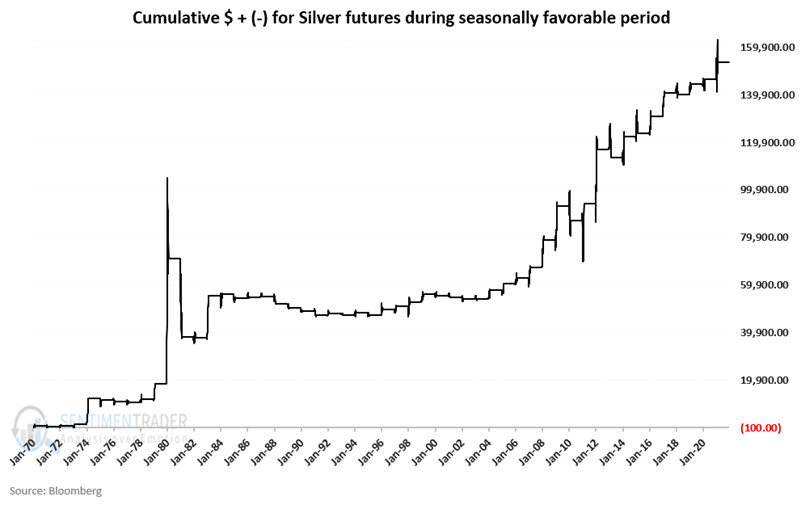

The chart below displays the cumulative $ return for silver futures during this seasonally favorable period.

There are two key things to note:

- This trend is by no means a "sure thing" from year-to-year

- Significant declines are possible, and a trader must have a plan for mitigating risk

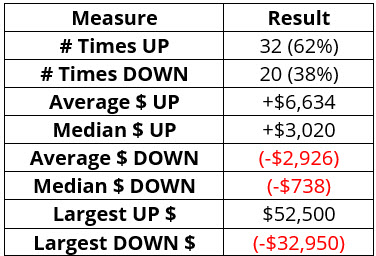

The table below displays the relevant performance numbers.

Note that the median loss was only -$738. That's the good news. The bad news is that the largest loss was -$32,950 (1981).

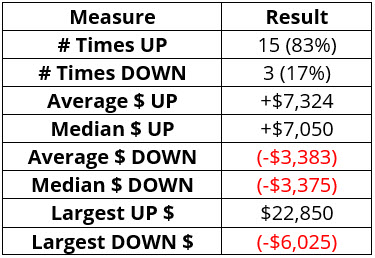

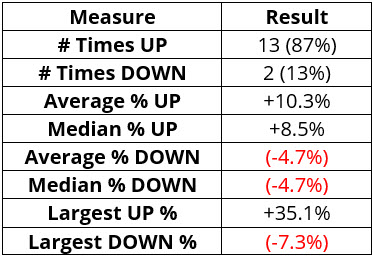

The table below displays results since 2004.

The one glaring problem with all of this is that most individuals are not well suited to trade silver futures. So, let's consider an alternative.

SLV ETF

SLV (iShares Silver Trust) is an ETF intended to track the price of silver futures. Traders can buy and sell shares of SLV just as they would shares of stock. While this approach lacks the leverage of futures trading, it makes an investment in silver more accessible to many individual traders.

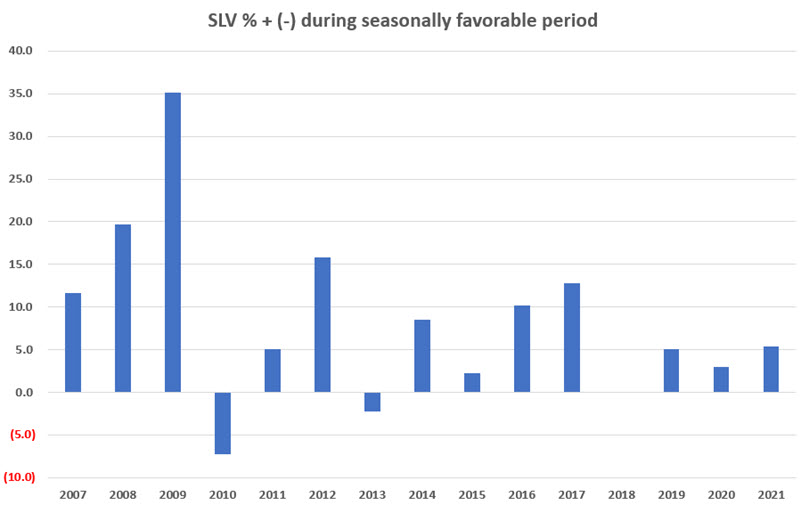

The chart below displays the year-by-year % return for SLV ONLY during our seasonally favorable period.

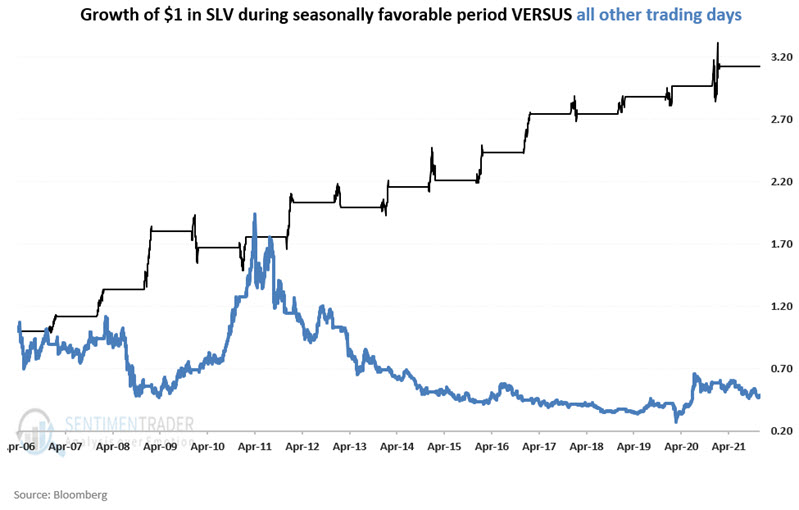

The chart below displays the growth of $1 invested in SLV ONLY during our seasonally favorable period.

The table below displays SLV results during our seasonally favorable period since SLV started trading in 2006.

To fully appreciate silver's performance during the seasonally favorable period, the chart below displays:

- The growth of $1 only during the seasonally favorable period

- Versus the growth of $1 during all other trading days

Since SLV started trading, SLV has:

- Gained +213% during seasonally favorable periods

- Lost -51% during all other trading days

What the research tells us…

Silver tends to rally early in the year; however, results can vary widely from year to year. While results have been consistently favorable in the past roughly 18 years, there is no guarantee that this degree of favorability will continue. Silver futures offer the potential for significant gains but also catastrophic loss for the unprepared and/or under-capitalized trader. The SLV ETF offers traders an unleveraged way to play the long side of silver.