Regarding S&P 500 seasonal weakness

Key points

- The stock market tends to experience weakness during the August-October period

- Results can vary widely on a year-to-year basis

- "Hope for the best, prepare for the worst" appears to be a reasonable approach

Defining a period of seasonal weakness

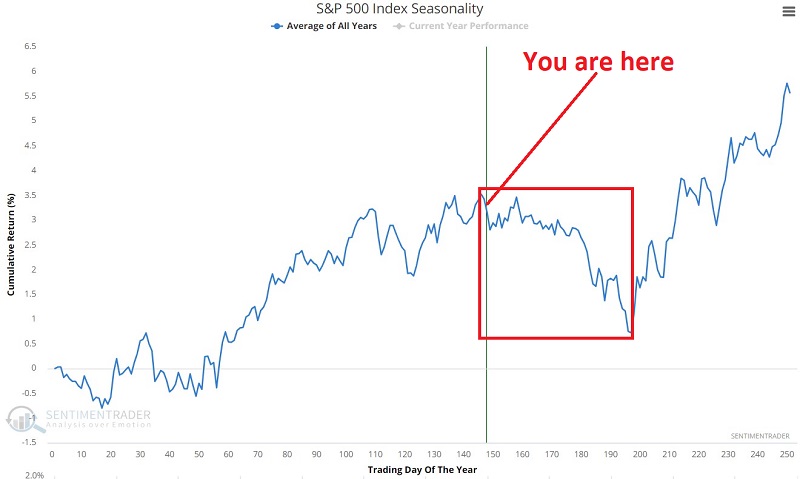

The chart below displays the annual seasonal trend for the S&P 500 Index. A period of typical seasonal weakness is highlighted in red.

There are two key things to note. First, the chart above is not a roadmap. In any given year, the market may follow the trends above closely - or not much all. Second, the period of seasonal weakness highlighted in red has witnessed a lot of market choppiness and volatility over the years.

The Test

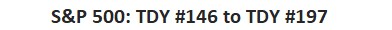

Our test will look at S&P 500 performance between Trading Day of the Year (TDY) #146 and #197 since 1953. Before that time, the market was open on Saturday for part of the day (shhh, don't give anyone any ideas), and the number of trading days in a year was higher. Since 1953 TDY #146 to #197 started roughly in early August and ended in mid-October.

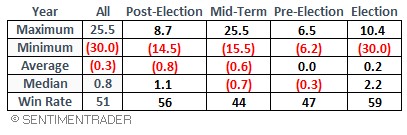

We will also break out performance by the year in the election cycle (post-election, mid-term, pre-election, election).

The market's period of seasonal weakness

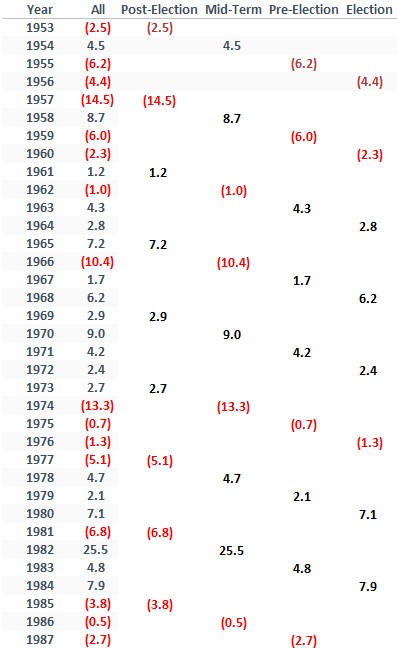

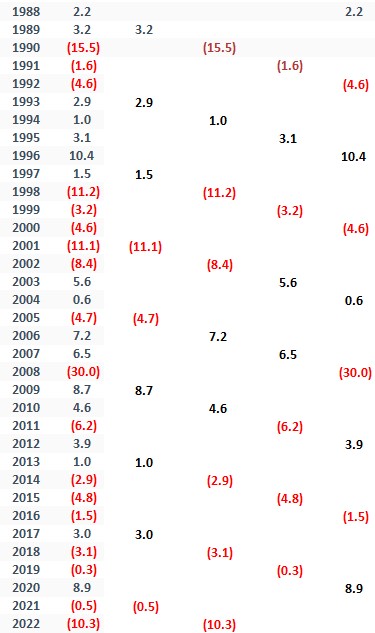

The table below displays S&P 500 performance from the close of TDY #146 through TDY #197. For 2023, this period began at the close on 2023-08-02 and extends through 2023-10-13.

The table below summarizes performance.

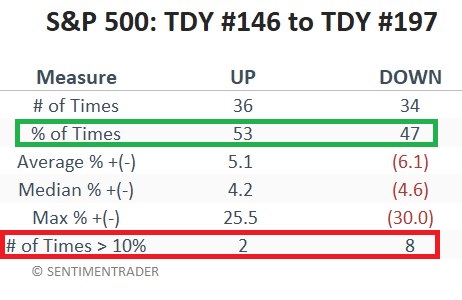

The table below takes a closer look at performance across all years.

The good news is that this period has actually shown a gain more often than a loss (36 times up, 34 times down). The bad news is that the average and median losses are more significant than the average and median gains. Likewise, if we look at the best and worst performances, the S&P has shown a gain of over +10% two times (1982 and 1996) but also a loss of over -10% eight times. Essentially, "When it's good, it's pretty good, but when it's bad, it's very bad."

What the research tells us…

To repeat, seasonality is not a roadmap. The fact that the first chart above shows a decline from early August into mid-October does not mean that the market is doomed to decline in the months ahead. The results imply that long-term investors may do well to temper their enthusiasm (particularly after the giddy emotional heights of five consecutive up months) and that short-term traders should be looking for opportunities in either direction.