Recovery in 200-day average breadth shows long-term promise

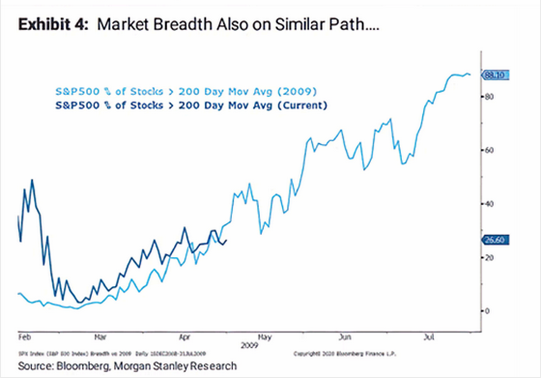

According to a major investment bank, stocks are trading just like they did during the recovery in 2009.

As noted on MarketWatch, Morgan Stanley shows that the percentage of stocks within the S&P 500 that are trading above their 200-day averages looks just like it did when they emerged out of the financial crisis.

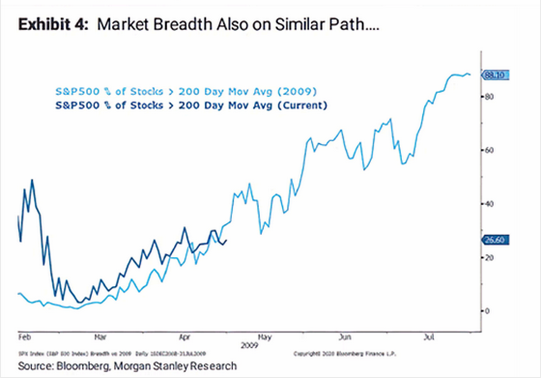

In the decades that we've been looking at price analogs (how highly correlated a current period is to the path during other periods), they've proven to be modestly useful. When there is a very high correlation, with a decent sample size, it has helped more than hurt as a guide.

The main problem is that it's way too easy to cherry-pick examples based on whatever outlook the analyst wants to convey. That's why we use a transparent methodology, going back as far as history allows, and show every occurrence. Sometimes it suggests an edge; often it does not. It's good to know what doesn't work just as much as it's good to know what does.

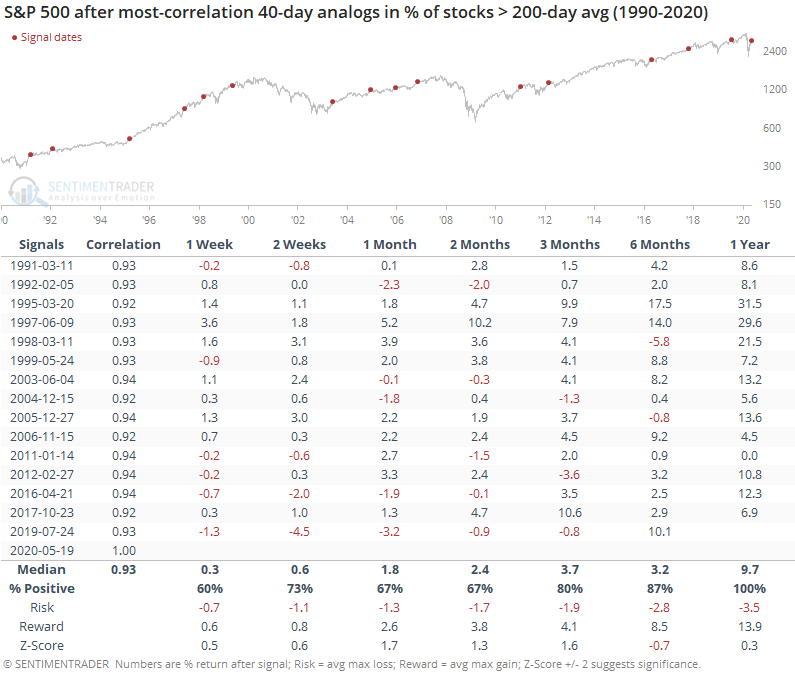

If we use the same methodology we always do, then we can see if Morgan Stanley has a useful point. We'll go back to 1990 and look for every 40-day period that had the highest correlation to how the past 40 days have unfolded in terms of the percentage of stocks in the S&P trading above their 200-day moving averages.

Interestingly, the initial recovery in 2009 doesn't even make the list - that's why we use a consistent methodology instead of trying to eyeball things. This is what we get:

The top 15 highest-correlated periods all had a correlation higher than 0.90, which is extremely high.

From their average path seen in the chart above, clearly it's very close to what we've seen since the March 23 low. The biggest worry is that many of those also peaked right about now - that doesn't mean that the S&P 500 itself peaked, only that the percentage of stocks above their long-term averages did.

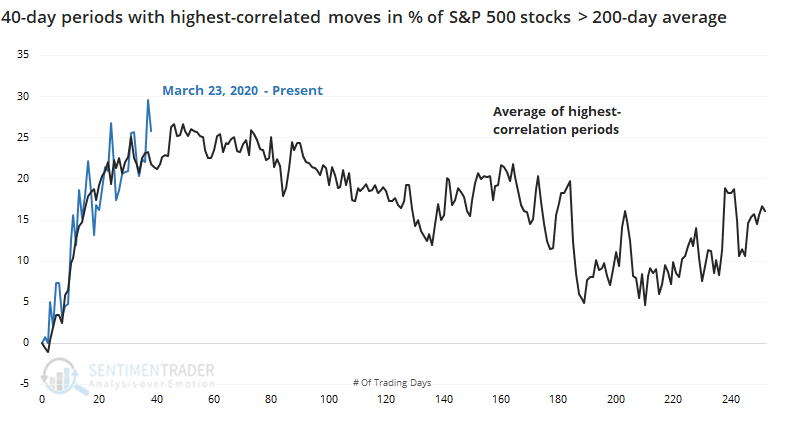

Here are the 10 most recent instances. Again, that's not the S&P 500 we're looking at, it's the percentage of stocks above their 200-day averages.

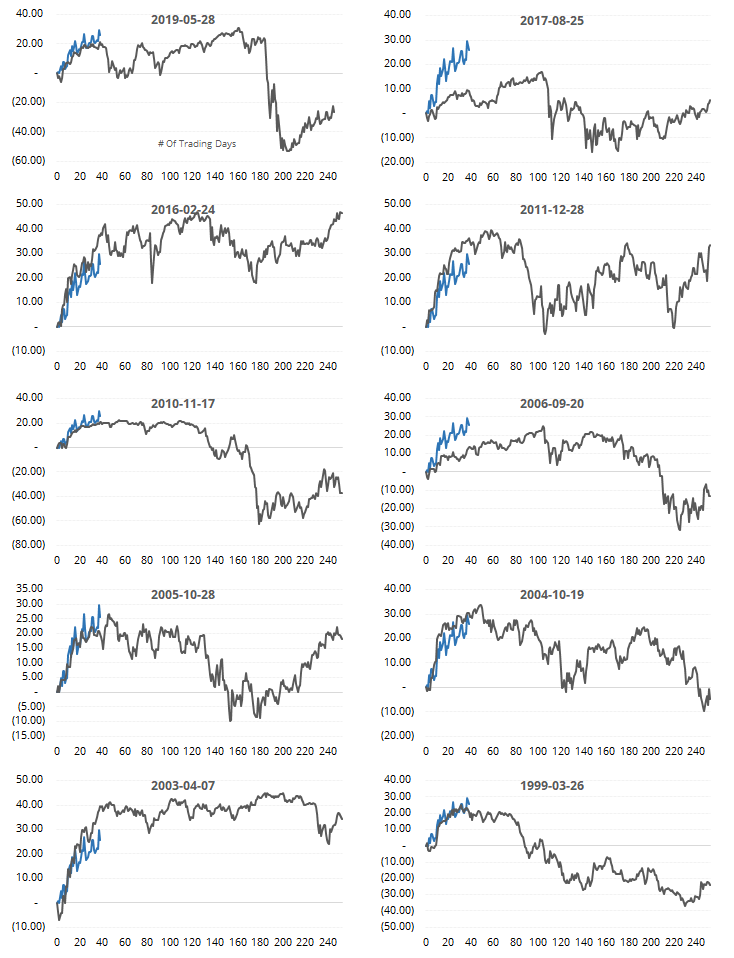

Okay, so what? Let's see what kind of impact that had on returns for the S&P going forward. These returns are from day 40 on onward, for the highest-correlated periods.

It was a decent sign, especially longer-term. The next 1-2 months were mostly positive, but not exceptionally so. There was a higher probability of seeing a positive return from 3-12 months later, with a perfect record a year later. The average return wasn't that great, about in line with random, but the risk/reward skew was healthy.

While it might not be the slam-dunk positive it was if we rely on the 2009 template, it does suggest a modest upside bias long-term.