Recovering sentiment

As Jason noted, sentiment according to the CNN Fear & Greed Index is recovering from deep pessimism. It's not just sentiment in stocks that's climbing. Sentiment in corporate bonds is climbing as well, no doubt helped by the Fed's do-everything-we-can attitude.

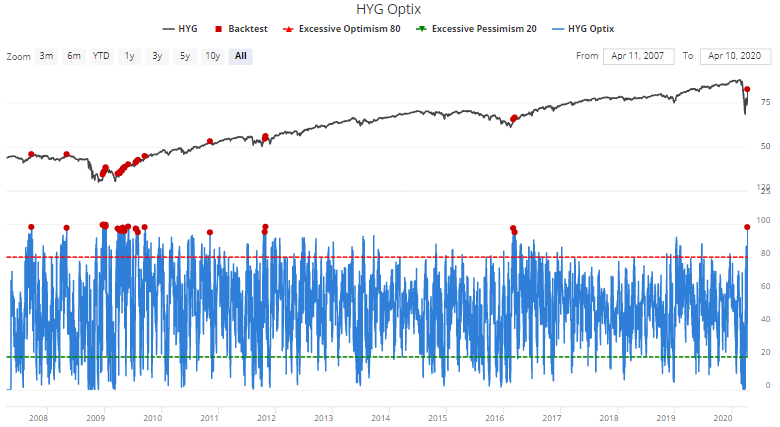

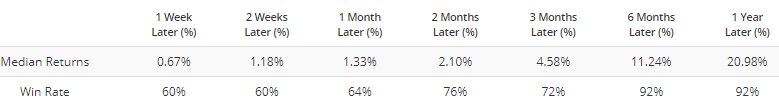

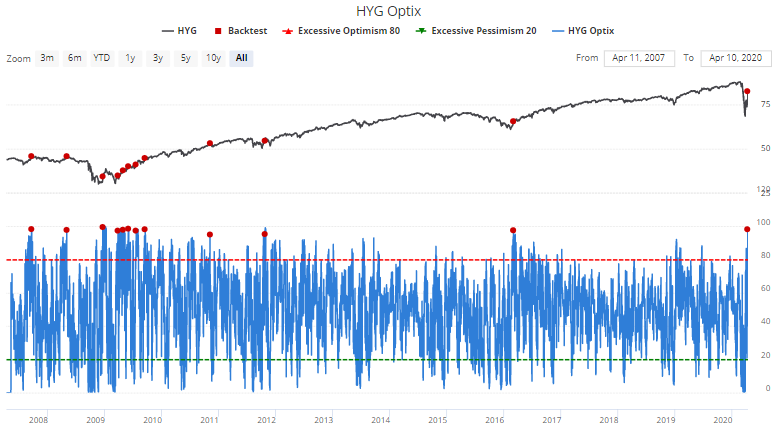

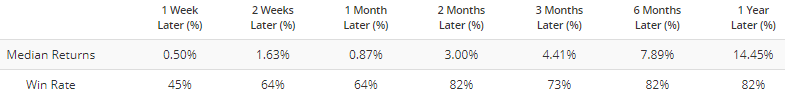

Our HYG Optix is currently at 98, one of the highest readings ever. Historical readings above 95 usually saw more gains for high yield bonds over the next 6-12 months:

Now granted, many of these historical cases were overlaps. But if we only look at the first case in 1 month, the results aren't very different. HYG usually continued to rally over the next 2+ months, even if it faced short term weakness:

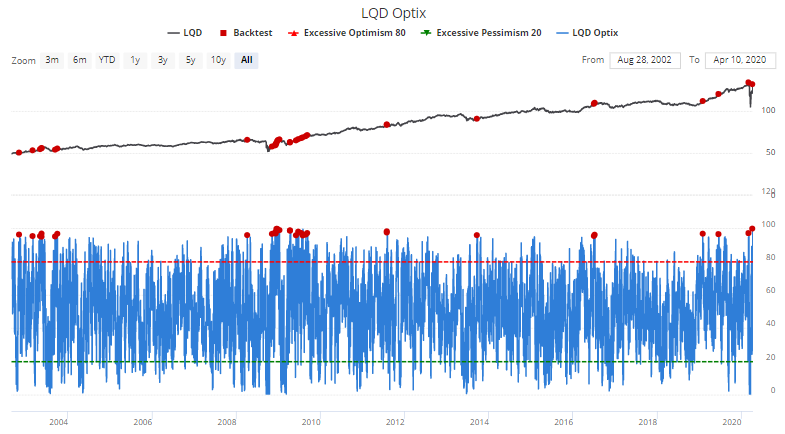

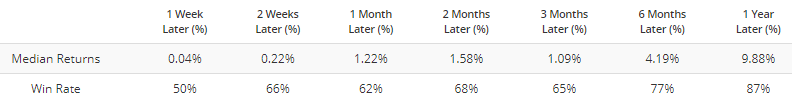

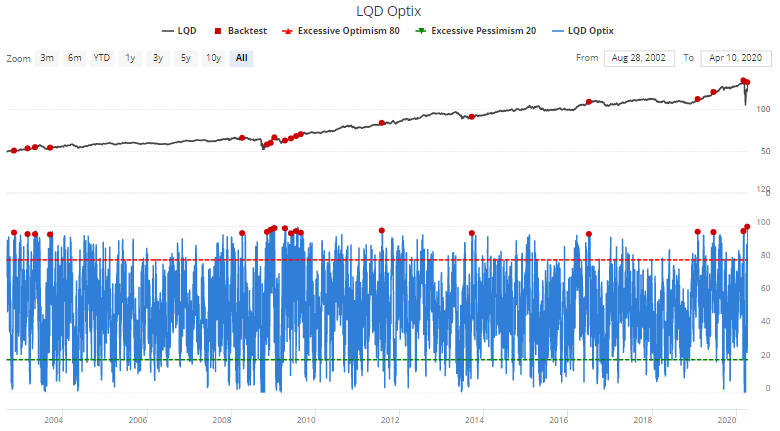

Similarly, LQD Optix is currently at 99. Historical readings above 95 usually led to more gains for investment grade corporate bonds over the next 6-12 months:

And once again, looking at the first case in 1 month to remove overlapping cases doesn't really make a difference:

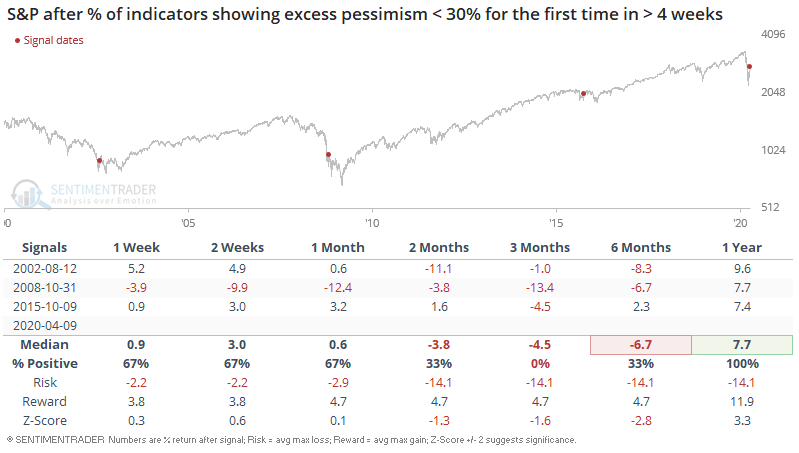

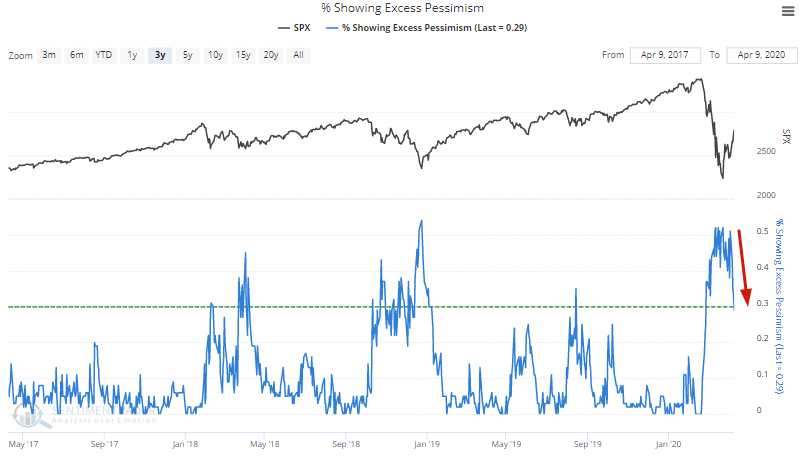

For equities, the % of indicators showing excessive pessimism has fallen below 30% for the first time in a long time:

When long streaks of excessive pessimism ended:

- Stocks were bullish over the long term (i.e. next 1+ year), however...

- Stocks often gave up gains over the short term.

This happened in August 2002, October 2008, and October 2015. While these weren't bad places to buy stocks from a long term perspective, stocks usually went lower over the next few months.