Recovering global equities

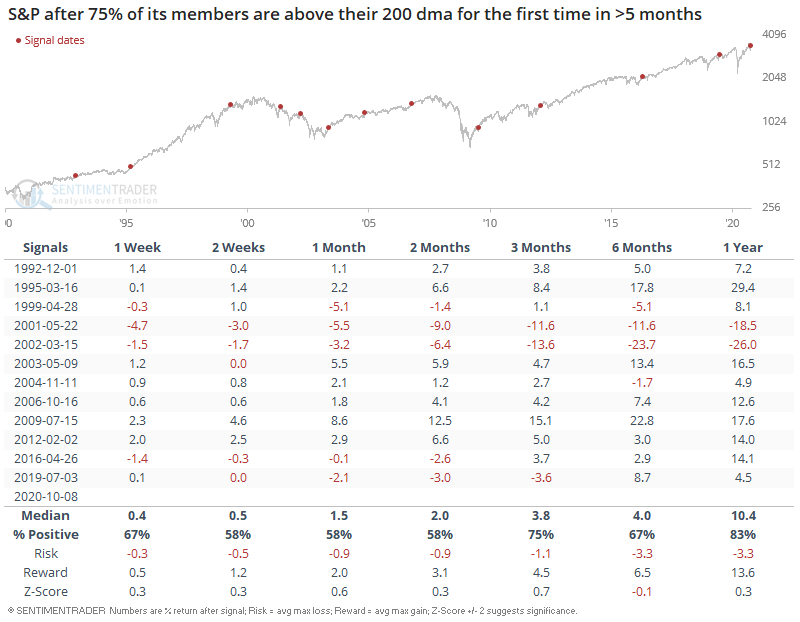

Global equity markets continue to recover as we approach earnings season. Despite the S&P 500 still being a few percentage points below its all-time high, the % of S&P 500 members above their 200 dma has reached the highest level since the March crash.

When this figure crossed above 75% for the first time in more than 5 months, the S&P 500 mostly rallied further over the next year. The 2 major bearish cases (2001 and 2002) occurred as bear market rallies fizzled out, luring unsuspecting investors into thinking that the bear market was over. Given that the S&P 500 is near an all-time high today (and not deep in a bear market), perhaps those 2 historical cases don't apply today.

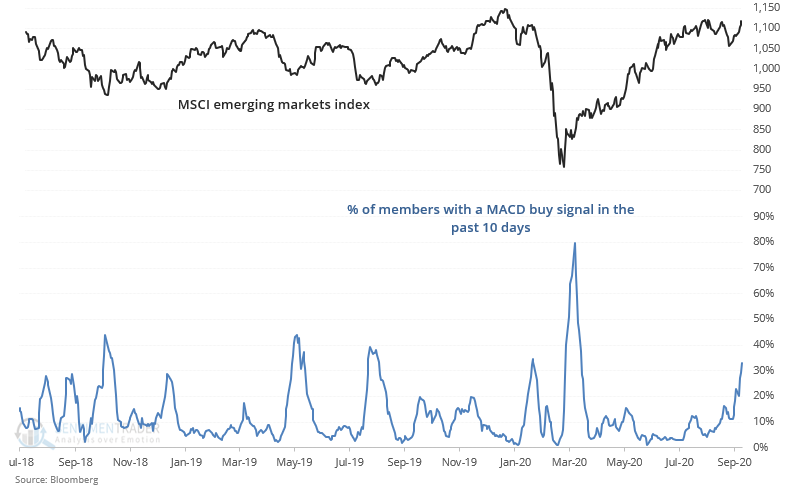

Meanwhile, emerging market stocks are starting to turn up as well. Almost a third of the MSCI Emerging Markets Index members' have triggered a MACD buy signal in the past 10 days:

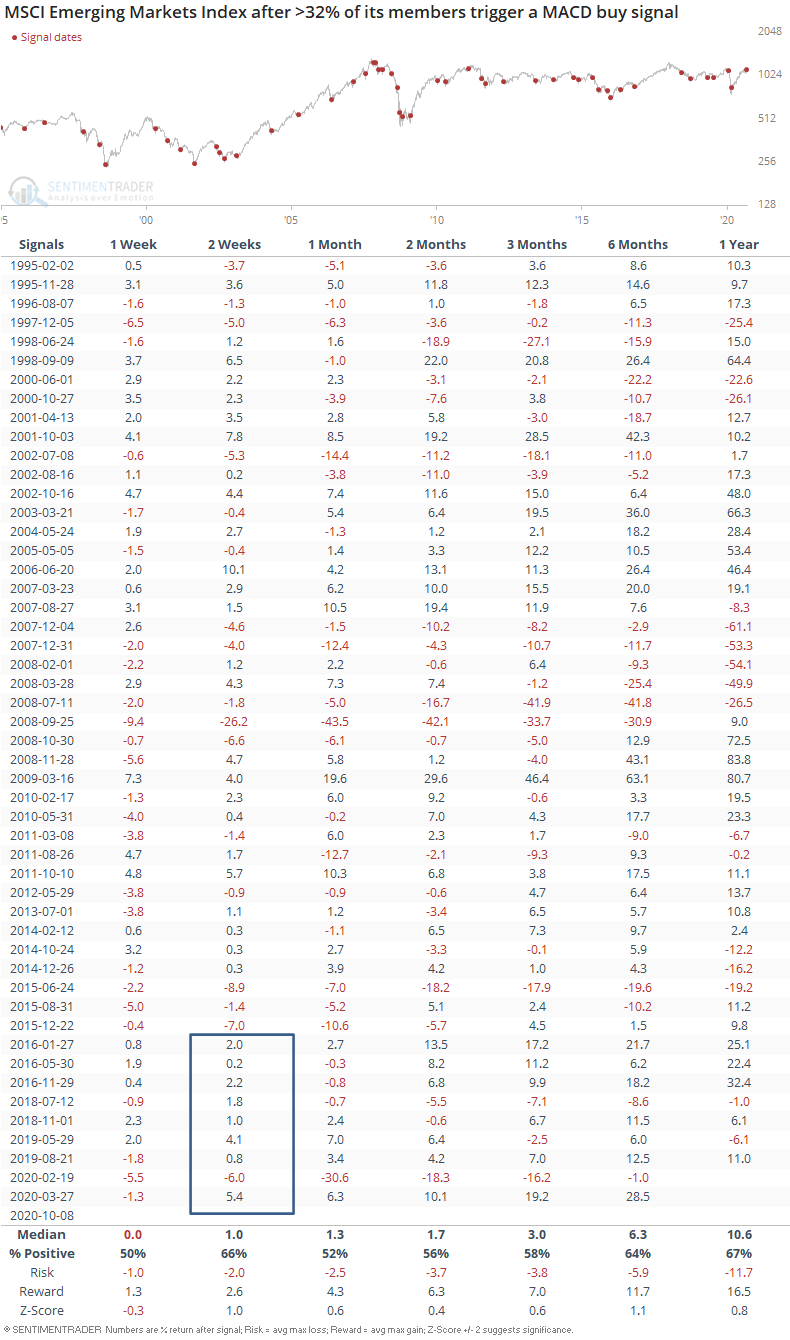

8 out of the 9 most recent cases led to more gains for emerging markets over the next 2 weeks:

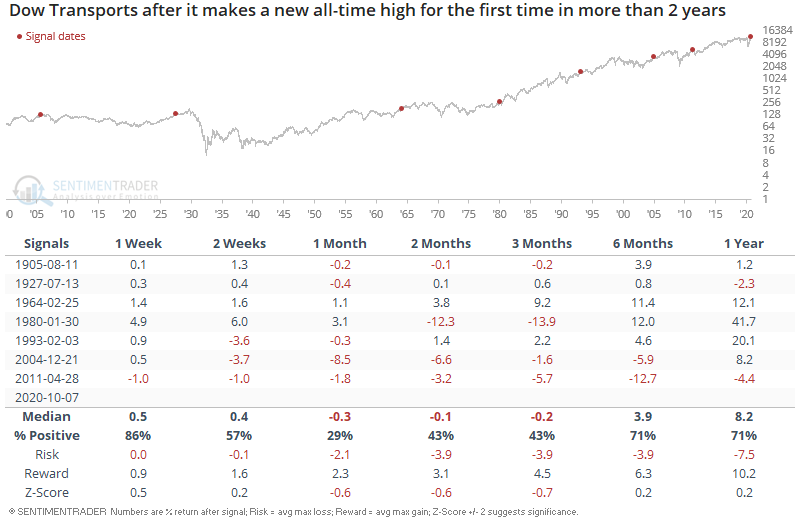

And lastly, Dow Transports made a new all-time high for the first time in more than 2 years. This was mostly random for Transports going forward, but led to above-average returns for the S&P 500 over the next year: