Record Small Business Optimism As Investors Buy The Dip

This is an abridged version of our Daily Report.

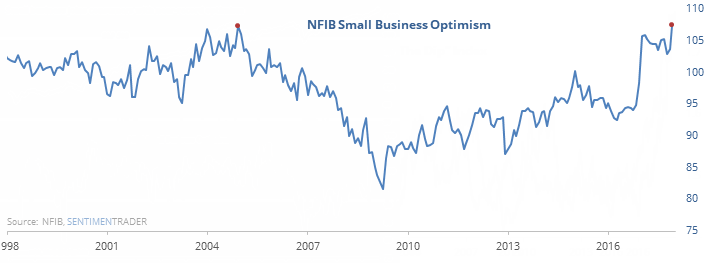

Near-record optimism (again)

Small business owners are showing nearly the highest optimism readings in 45 years, confirming other surveys that are showing somewhere between multi-year to multi-decade extremes in optimism.

High levels in the past led to mixed returns, with the Russell 2000 underperforming the S&P 500. Small value stocks performed the worst going forward, while large growth stocks did the best.

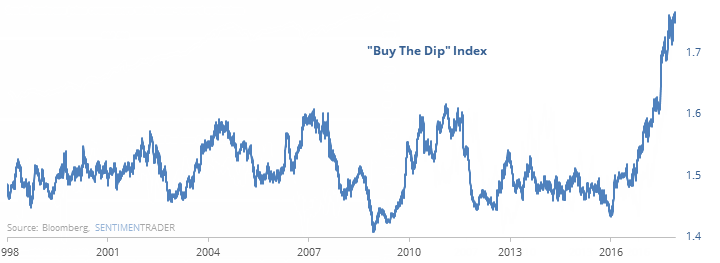

Buy the dip

Investors have been buying intraday dips in 2017 to a record degree. Since the inception of S&P 500 futures, there has never been a time that exceeded what we’ve seen this year, according to a comparison of intraday versus close-to-close changes in the futures.

The only real comparison is 1995, which has come up time and again in studies this year.

FOMC seasonality

The S&P 500 has closed at a 52-week high on the eve of a Federal Reserve decision on interest rates 10 times since the bottom in 2009. It added to its gains 5 times the days of the decision.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.